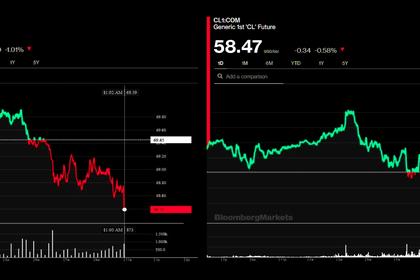

OIL PRICE: NEAR $65

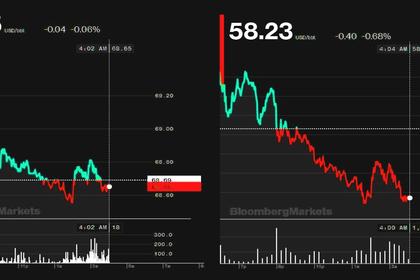

REUTERS - Oil fell on Friday and held on track for its biggest monthly drop in six months as comments from U.S. President Donald Trump ramped up trade tensions, weighing on the demand outlook.

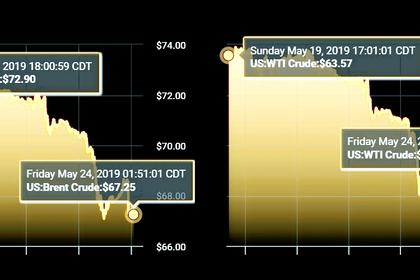

Brent futures are heading for a 10 percent slide in May and WTI for a 13 percent drop, their biggest monthly losses since last November.

Front-month Brent crude futures, the international benchmark for oil prices, were at $65.72 at 0844 GMT, down $1.15 from last session's close.

U.S. West Texas Intermediate (WTI) crude futures were at $55.85 per barrel, down 74 cents from their last settlement.

Both grades earlier hit their lowest since March 8.

U.S. President Donald Trump vowed on Thursday to slap tariffs on all goods from Mexico unless it stops illegal immigration, firing up fears over economic growth and appetite for oil.

The Mexico trade dispute adds to a trade war between the United States and China, which many analysts expect to trigger a recession..

China's factory activity shrank more than expected in May, an official survey showed on Friday.

U.S. OUTPUT BACK TO RECORD

Crude prices have also been under pressure from a return in U.S. oil production to a record 12.3 million barrels per day, and a much smaller than expected decline in U.S. stockpiles.

The U.S. Energy Information Administration (EIA) said crude stocks fell by around 300,000 barrels last week, to 476.49 million barrels.

That was much less than the 900,000-barrel decline analysts had forecast in a Reuters poll, and well below the 5.3 million-barrel drawdown seen by the API industry body.

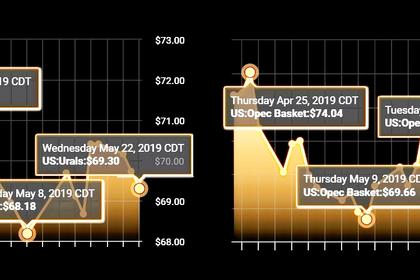

Giving a floor to prices, top oil exporter Saudi Arabia's increased output in May was not enough to compensate for lower Iranian exports, which collapsed after the United States tightened the screws on Tehran, a Reuters survey found.

Washington will sanction any country that buys oil from Iran after the expiration of waivers on May 2, U.S. Special Representative for Iran Brian Hook said on Thursday.

The Wall Street Journal had reported earlier on Thursday that countries like China and India that were issued waivers in November to buy Iranian oil could continue the purchases after May 2 until they reached a negotiated cap.

-----

Earlier: