OIL PRICE: NEAR $67

REUTERS - Oil prices recouped around 1% on Friday but were on track for their biggest weekly loss this year after swelling inventories and jitters over an economic slowdown led to big falls earlier in the week.

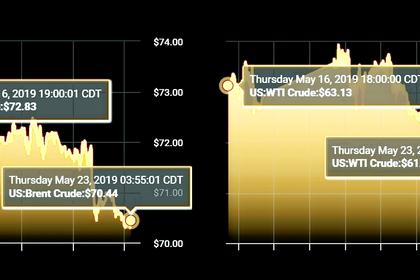

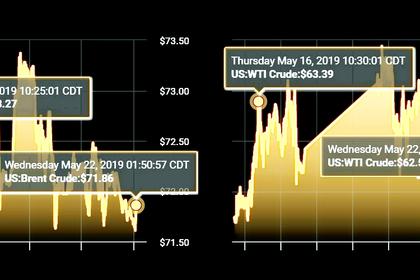

Brent crude futures were at $68.48 per barrel at 0654 GMT, up 72 cents, or 1.1%, from their last close, with prices underpinned by OPEC supply cuts and Middle East tensions.

U.S. West Texas Intermediate (WTI) crude futures were up 66 cents, or 1.1%, at $58.57 per barrel.

"Multiple supply risks remain, as tension continues between Iran and the U.S., which could turn disruptive," ANZ bank said on Friday.

The forward price curve for Brent crude futures remains in backwardation, in which prices for prompt delivery are higher than those for later dispatch, implying tight market conditions and making it profitable to produce and sell oil immediately rather than store it for later sale.

"Despite the big declines in the Brent flat price, the backwardation in the forward curve steepened this week," U.S. investment bank Jefferies said on Friday.

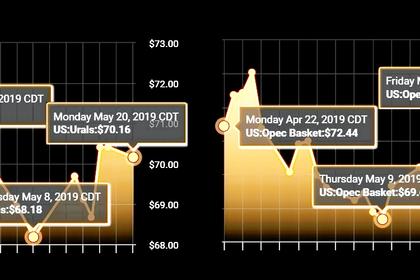

The Organization of the Petroleum Exporting Countries (OPEC) has led supply cuts since the start of the year aimed at tightening the market and propping up prices.

ANZ said U.S. sanctions on Iran's and Venezuela's oil industries would likely further reduce crude exports from OPEC, of which both countries are members.

But Friday's firmer prices could not make up the much bigger slumps earlier in the week, which have put crude futures on track for their biggest weekly losses this year, with Brent set for a decline of more than 5%.

"Brent prices are down ... this week as U.S.-China trade concerns are dominating the headlines," Jefferies bank said.

From mid-week, rising oil inventories in the United States started weighing on prices.

"Increasing (oil) inventories and slumping U.S. manufacturing activity exacerbated trade related concerns about global demand," Michael McCarthy, chief market strategist at CMC Markets in Australia, said in a note, pulling WTI below $60 per barrel and Brent below $70 per barrel.

And the glut has spread beyond North America. Struggling to cope with an economic slowdown and oversupply from fuels, Asian refinery margins this week fell to their lowest seasonal levels since at least the financial crisis a decade ago, triggering plans for refinery run cuts.

With the trade dispute between the United States and China ongoing, analysts say more drops in financial markets, including crude oil futures, could follow.

"Without a resolution to the ongoing trade dispute quickly, which now looks very unlikely, oil could struggle to push higher," said Jasper Lawler, Head of Research at futures brokerage London Capital Group.

"We expect rallies in oil to be short lived," he added.

Stock markets on Friday fell to four-month lows on worries the U.S.-China trade spat was developing into a more entrenched strategic dispute between the world's two largest economies.

-----

Earlier: