OIL PRICE: NEAR $72 AGAIN

REUTERS - Oil prices fell on Wednesday after industry data showed an increase in U.S. crude inventories and as Saudi Arabia pledged to keep markets balanced.

However, analysts said oil markets remained tight amid supply cuts led by producer group OPEC and as political tension escalates in the Middle East.

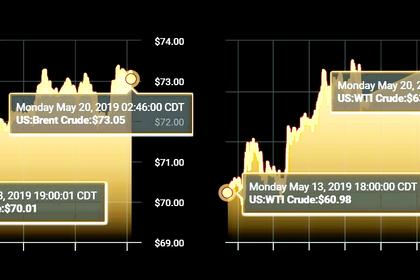

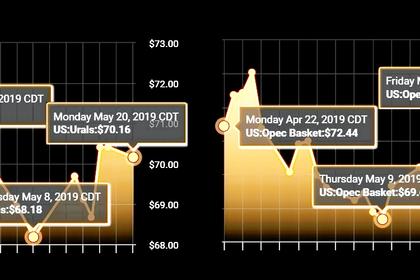

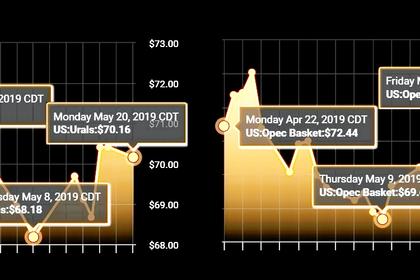

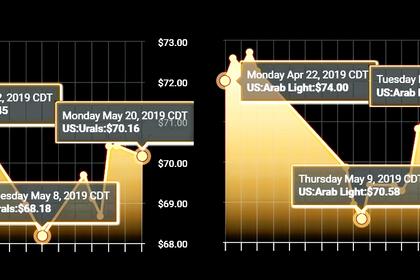

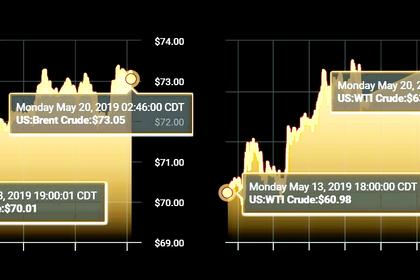

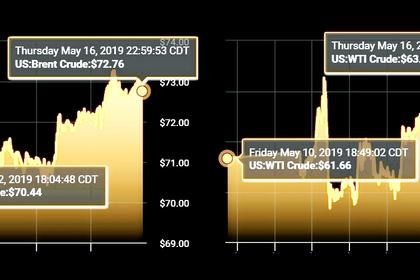

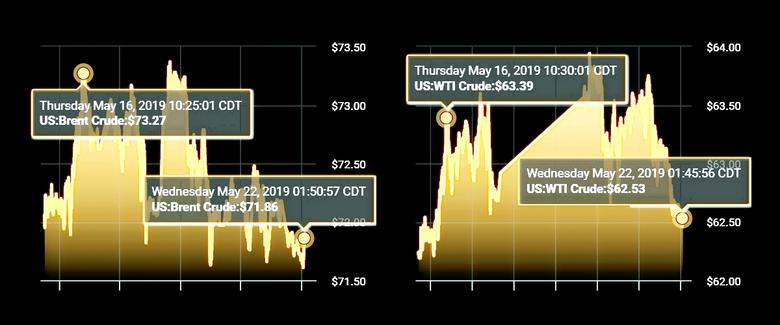

Brent crude futures were down 39 cents, or 0.5 percent, at $71.79 at barrel by 0658 GMT.

U.S. West Texas Intermediate (WTI) crude futures for July delivery were down 59 cents, or 0.9 percent, at $62.54. The June contract expired on Tuesday, settling at $62.99 a barrel, down 11 cents.

The American Petroleum Institute (API) said on Tuesday that U.S. crude stockpiles rose by 2.4 million barrels last week, to 480.2 million barrels, compared with analyst expectations for a decrease of 599,000 barrels.

Official data from the U.S Energy Information Administration's oil stockpiles report is due later on Wednesday.

Outside the United States, Saudi Arabia on Wednesday said it was committed to a balanced and sustainable oil market.

Saudi Arabia has been at the forefront of supply cuts led by the Organization of the Petroleum Exporting Countries (OPEC), of which the kingdom is the de-facto leader, that began in January and are aimed at reducing global oversupply.

Because of the cuts, Bank of America Merrill Lynch said crude output by OPEC and its allies fell by 2.3 million barrels per day (bpd) between November 2018 and April 2019. That has helped push up Brent crude prices by more than a third since the start of the year.

The bank said some of the impact of the cuts was offset by a slowdown in global oil demand growth due to trade tensions to just 0.7 million bpd in the fourth quarter of 2018 and the first quarter of this year, versus a five-year average of 1.5 million bpd.

Despite the slowdown, U.S. bank Morgan Stanley said it expected Brent prices to trade in a $75-$80 per barrel range in the second-half of this year, pushed up by tight supply and demand fundamentals.

The physical oil market is also showing signs of tightness.

Qatar Petroleum has sold al-Shaheen July delivery crude at the highest average premium since 2013 - $3.06 per barrel above the benchmark Dubai quote - on robust demand for medium-heavy grades in Asia, according to multiple trade sources.

Beyond market fundamentals, oil traders are looking to the tensions between the United States and Iran.

U.S. President Donald Trump on Monday threatened Iran with "great force" if it attacked U.S. interests in the Middle East.

On Tuesday, acting U.S. Defense Secretary Patrick Shanahan said threats from Iran remained high.

Tensions have risen since Trump re-imposed sanctions on Iranian oil exports to try to strangle the country's economy and force Tehran to halt its nuclear program.

-----

Earlier: