OIL PRICE: NOT ABOVE $72

REUTERS - Oil prices fell on Thursday, pulled down by record U.S. crude production that led to a surge in inventories.

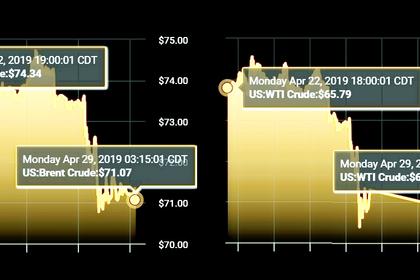

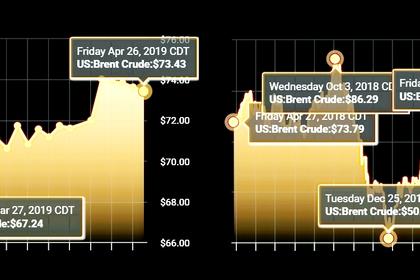

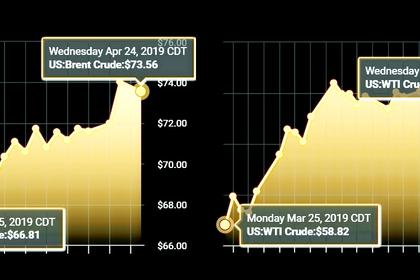

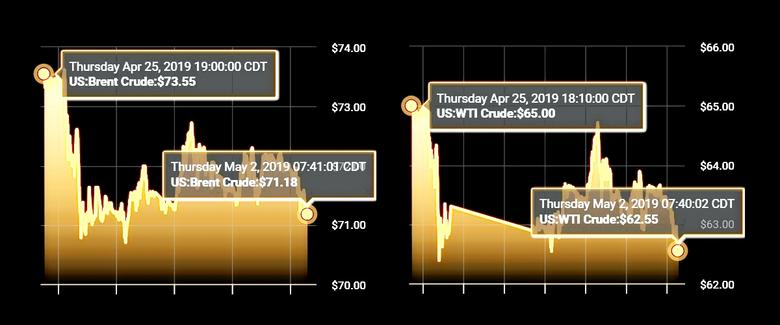

Brent crude oil futures were at $71.47 per barrel at 1037 GMT, 71 cents below their last close. Brent is set for a weekly loss, which would break its longest string of weekly gains for a year.

U.S. West Texas Intermediate crude futures were down 76 cents at $62.84 per barrel.

U.S. crude stockpiles last week rose to their highest since September 2017, jumping by 9.9 million barrels to 470.6 million barrels as production hit a record high of 12.3 million barrels per day (bpd), government data showed.

Meanwhile, Poland's energy ministry said it decided to release mandatory oil reserves following the suspension of contaminated oil deliveries from Russia in April, to secure regular output at local refineries.

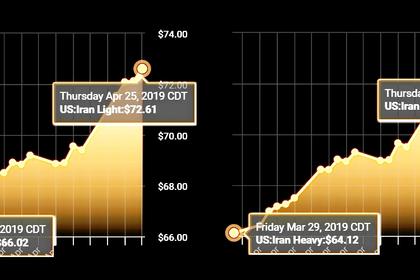

Oil prices, though, are still supported by the political crisis in Venezuela, stricter U.S. sanctions against Iran that allow no more exemptions from May, and as the Organization of the Petroleum Exporting Countries continues to withhold supply.

Oman's energy minister Mohammed bin Hamad al-Rumhy said on Wednesday it was OPEC's goal to extend the production cuts, which started in January, when the group and its allies next meet in June.

Despite the desire of many OPEC members to continue supply cuts, the group may eventually be forced into action to meet demand in a market that has seen prices rise more than 30 percent this year.

Russia has sent signals about potentially increasing output. In April, however, the country's oil output fell to 11.23 million bpd from 11.3 million bpd in March, still above OPEC quotas.

"Warnings about fragile economic growth, rising U.S. production and exports and the U.S. president's low pain threshold for high oil prices coupled with his bullying tactics. Will (OPEC's concerted effort) continue?" PVM's Tamas Varga said.

Fitch Solutions analysts also warned, beyond Venezuela, of risks to supply from Libya, where a civil war threatens to cut oilfields off from markets.

-----

Earlier: