OILFIELD SERVICES RATING DOWN

BLOOMBERG - Schlumberger Ltd. had its debt rating lowered by S&P Global Inc. as belt-tightening in the U.S. shale patch translates into less drilling and fracking work for the world's top oilfield services provider.

The rating was cut a notch to A+, the fifth-highest invest grade, from AA-, S&P said on Friday. Its biggest rival, Halliburton Co., had its outlook revised to negative from stable by the ratings firm. Under pressure from shareholders, exploration and production companies are keeping spending in check, which is reducing demand for oilfield services, S&P said.

"Oilfield services companies will no longer be able to generate the high operating margins they did in 2014," Carin Dehne-Kiley, an analyst at S&P, wrote Friday in a report to investors. "The oilfield services industry has fundamentally changed due to permanent efficiency and productivity gains realized by E&P companies as well as investor sentiment calling for E&P companies to live within cash flow and limit production growth."

Oil services were hit hard by the steep sell-off in the oil market that started in 2014. North American customers cut back in response and now face an urge to return more cash to investors. A seperate report from oil servicer Baker Hughes on Friday showed the number of rigs drilling for crude in the U.S. fell to the lowest in more than a year.

Representatives for Schlumberger and Halliburton declined to comment.

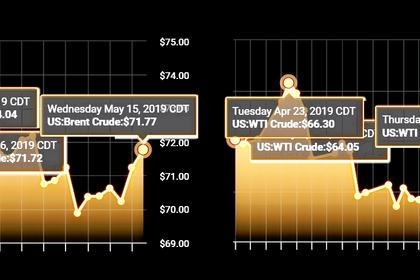

Companies in the Philadelphia Oil Services Index have failed to keep up with the overall recovery in the global oil market. While global crude prices have more than doubled since hitting bottom in January of 2016, the index is down about 40% over the same period. Energy producers in the S&P 500 are up 17%.

Schlumberger, based in Houston and Paris, has about $13.5 billion in bonds and loans, according to Bloomberg data.

-----

Earlier: