OPEC + IRAN, VENEZUELA

РЕЙТЕР -

-----

Раньше:

2018, March, 14, 11:45:00

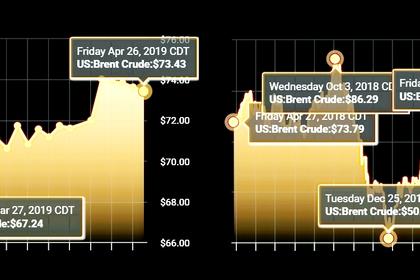

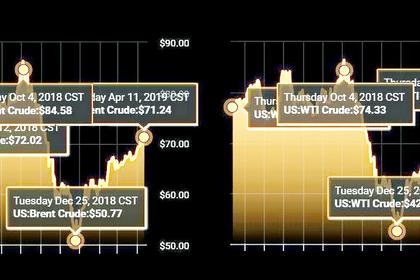

REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $60.77 a barrel at 0753 GMT, up 6 cents, or 0.1 percent, from their previous settlement. Brent crude futures LCOc1 were at $64.62 per barrel, down just 2 cents from their last close.

|

2018, March, 7, 15:00:00

РЕЙТЕР - К 9.17 МСК фьючерсы на североморскую смесь Brent опустились на 0,85 процента до $65,23 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $62,07 за баррель, что на 0,85 процента ниже предыдущего закрытия.

|

2018, March, 7, 14:00:00

EIA - North Sea Brent crude oil spot prices averaged $65 per barrel (b) in February, a decrease of $4/b from the January level and the first month-over-month average decrease since June 2017. EIA forecasts Brent spot prices will average about $62/b in both 2018 and 2019 compared with an average of $54/b in 2017.

|

2018, March, 5, 11:35:00

РЕЙТЕР - К 9.28 МСК фьючерсы на североморскую смесь Brent поднялись на 0,33 процента до $64,58 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $61,44 за баррель, что на 0,31 процента выше предыдущего закрытия.

|

2018, March, 4, 11:30:00

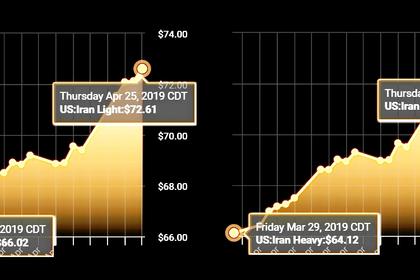

МИНФИН РОССИИ - Средняя цена нефти марки Urals по итогам января – февраля 2018 года составила $ 65,99 за баррель.

|

2018, February, 27, 14:15:00

РЕЙТЕР - К 9.18 МСК фьючерсы на североморскую смесь Brent опустились на 0,15 процента до $67,40 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $63,80 за баррель, что на 0,17 процента ниже предыдущего закрытия.

|

2018, February, 27, 14:05:00

МИНФИН РОССИИ - Средняя цена на нефть Urals за период мониторинга с 15 января по 14 февраля 2018 года составила $66,26457 за баррель, или $483,7 за тонну.

|

OPEC + IRAN, VENEZUELA

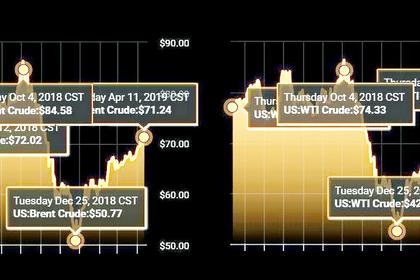

PLATTS - OPEC and other oil producers in the cuts pact are following developments in Venezuela and other countries to ensure an energy crisis is avoided, Secretary General Mohammed Barkindo said Thursday.

"Our objective remains as an organization that we will continue to work with all member countries as well as the participating countries in the declaration of cooperation to avoid any energy crisis in the world despite current travails in several of our member countries," Barkindo told journalists in Tehran, referring to the agreement by OPEC and other producers led by Russia to reduce oil output.

With two OPEC members under sanctions, Iran and Venezuela, "we are conscious of the times that we have found ourselves. But the good news is that talking to all member countries we remain committed, we remain focused on our principal objective as an organization to ensure stability at all times in n the oil market, to ensure that we avoid any energy crisis that will impact on the global economy."

In accordance with the organization's plans to draw down inventories and remove 1.2 million b/d from global markets, OPEC canceled a meeting in April to re-evaluate its policy and its next meeting -- a Joint Ministerial Monitoring Committee meeting -- will take place on May 19 on Jeddah. The next full OPEC meeting is scheduled for June when "all options will be reviewed," Barkindo said.

"All I can say is that the group is committed to stay united, is committed to ensure that our objective of not returning or slipping back into the chaos that we witnessed in the market following the longest cycle that we have seen from 2014 to 2016 does not repeat itself, including the volatility that we have seen in the fourth quarter of 2018," he said.

-----

Earlier:

2019, April, 29, 12:00:00

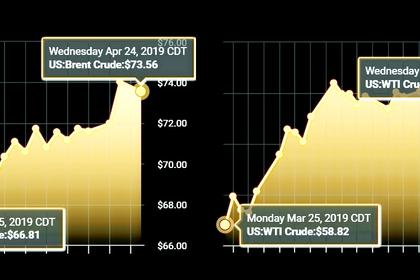

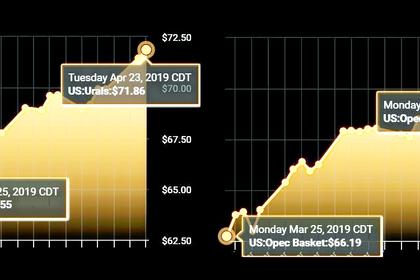

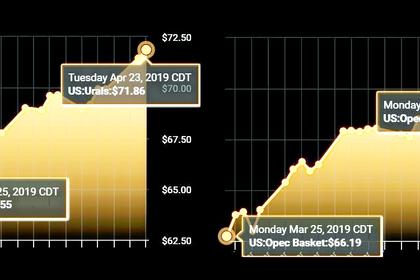

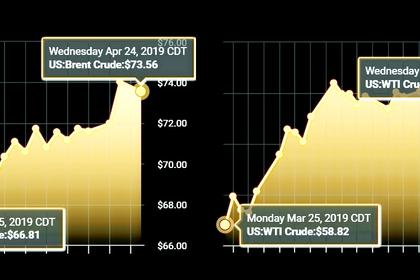

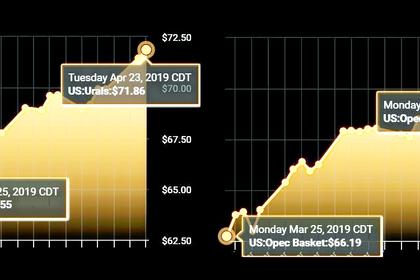

OIL PRICE: ABOVE $71 ANEW

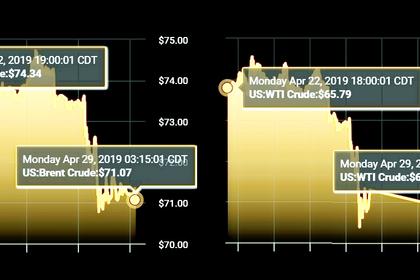

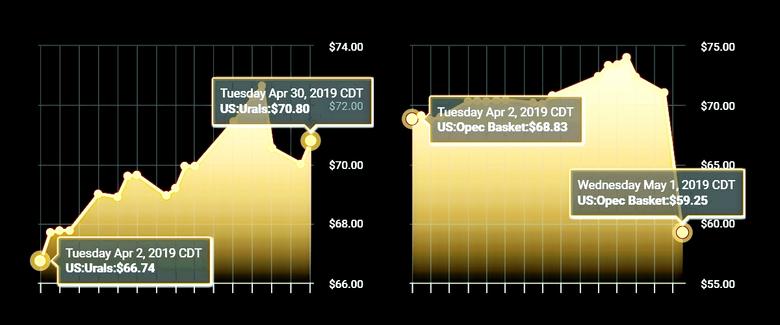

Oil prices fell on Monday, extending a slump from Friday that ended weeks of rallying, after President Donald Trump demanded that producer club OPEC raise output to soften the impact of U.S. sanctions against Iran.

2019, April, 29, 11:30:00

OIL PRICE: WILL BE $100

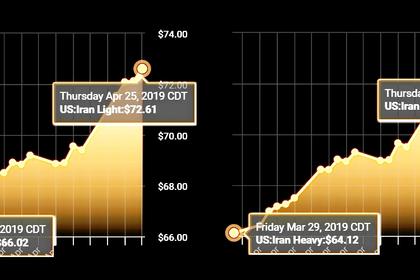

"Not extending the oil waivers of some countries is another side of the US measures against Iran. But if Iran's oil is fully sanctioned, oil price will go higher than $100 per barrel,"

2019, April, 24, 11:30:00

OIL MARKET IS FINE

The International Energy Agency is monitoring developments in global oil markets, and notes that markets are now adequately supplied, and that global spare production capacity remains at comfortable levels.

2019, April, 24, 11:25:00

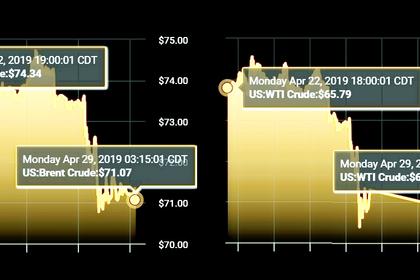

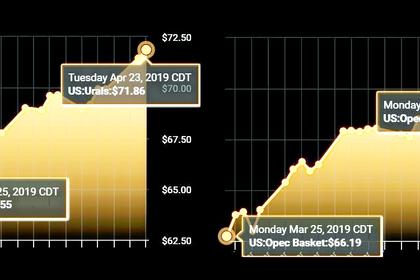

OIL PRICE: OPEC + IRAN

OPEC is due to meet in June, where the Iran question will no doubt be raised. But oil and gas leaders are taking a cautious approach, with Kuwait's oil minister Khaled Al Fadhel noting that a decision would be taken only after a review of oil prices.

2019, April, 24, 11:20:00

OIL PRICE: OPEC + RUSSIA

the risk of oil prices heading well above $70/b to the oil market and the global economy, while also saying that if prices were too low it would hit investment in the industry and key oil producing countries.

2019, April, 12, 11:55:00

2019 GLOBAL OIL DEMAND EXCEED 100 MBD

Total world demand for the year is now expected to reach 99.91 mb/d and exceed the 100.00 mb/d threshold during 2H19. OECD oil demand growth is projected to reach 0.21 mb/d, with OECD Americas leading the increase, while oil demand in the non-OECD region is projected to rise by around 1.0 mb/d, with Other Asia and China being the primary contributors to growth.

All Publications »

Tags:

OIL,

PRICE,

OPEC,

IRAN,

VENEZUELA