OPEC+ WILL STAY

PLATTS - Supply risks abound from Iran to Venezuela to Libya and the peak summer oil demand season is just around the corner, but Saudi energy minister Khalid al-Falih still sees a world awash in crude.

In case anyone doubted Saudi Arabia's resolve to maintain price-boosting production discipline, when many forecasters are warning of a potential supply squeeze ahead and US President Donald Trump is pressuring the kingdom to open the taps, Falih could not have been more clear Sunday.

"We see inventories rising, we see plentiful supplies," the minister told reporters in Jeddah, Saudi Arabia, where an OPEC/non-OPEC monitoring committee that he co-chairs with Russian counterpart Alexander Novak met to debate how much to pump going forward. "All in all we should be in a comfortable situation in the weeks to months to come," Falih added.

So comfortable, in fact, that he said the OPEC kingpin will keep its crude production in May and June at around 9.7 million to 9.8 million b/d. That is more than half a million b/d below its quota under an OPEC/non-OPEC supply accord of 10.31 million b/d. Saudi crude exports would not surpass 7 million b/d in either month, he added.

Even if the deal is not extended beyond its June expiry when the producer coalition meets in five weeks in Vienna, the minister declared that Saudi Arabia will still hold to its quota for at least an extra month -- boldly risking its own market share in the name of price support.

"We are not going to deviate from our target for July," Falih said. "I hope my other colleagues will do the same."

The prospects of rolling over the production cuts are not yet clear. Several ministers at the monitoring committee meeting said they supported in principle a continuation of the supply agreement, but the group as a whole was not ready to be locked into a commitment just yet.

Changing market dynamics may necessitate some kind of amendment to the deal, such as loosening some quotas and adjusting the level of cuts, some delegates said.

Novak said geopolitical uncertainties, including the US enforcement of sanctions on Iran and Venezuela, complicate the OPEC/non-OPEC coalition's ability to stabilize the oil market, while the demand outlook is clouded by trade disputes and slowing economic growth.

"We need to remain flexible," he said after the committee meeting. "We are trying to base that decision on what's best for the market and do the right thing to keep it balanced."

Non-OPEC Russia has been less eager than Saudi Arabia to pledge further cuts, though President Vladimir Putin has said he sees political benefits to continuing engagement with OPEC.

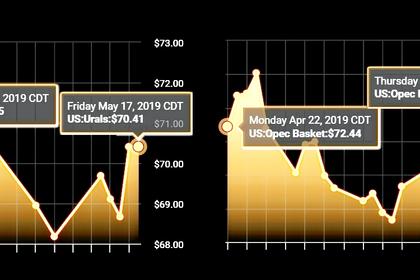

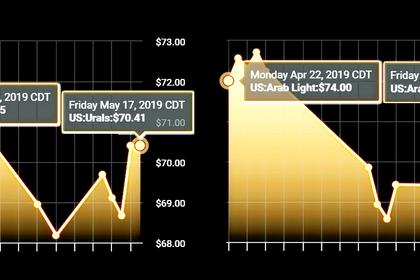

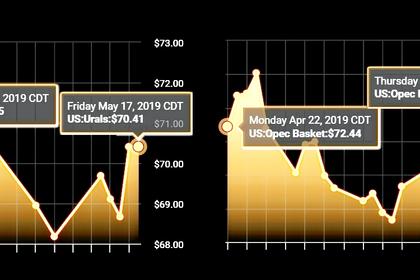

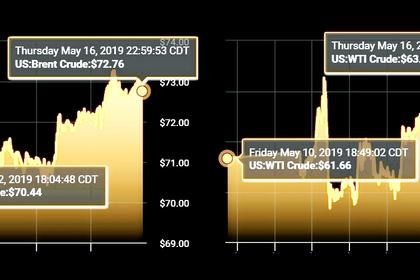

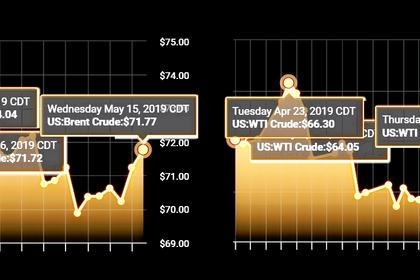

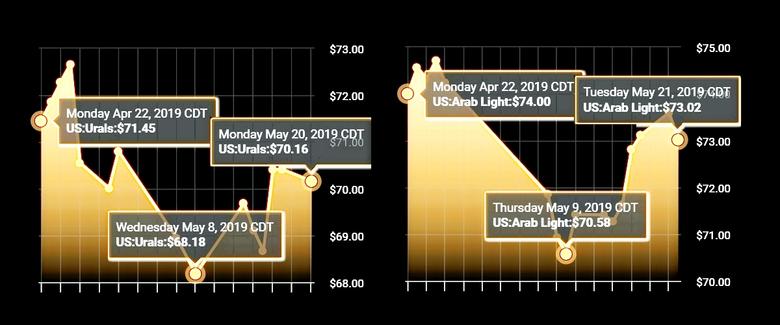

Based on the steep backwardation in Brent prices, the oil market appears to be anticipating an increasingly tight physical market due to the US crackdown on Iranian crude exports through sanctions and Venezuela's continued economic collapse.

Libya's instability also presents a supply risk, with Mustafa Sanalla, the chairman of the country's state-owned oil company, saying Saturday that warring factions are putting some 95% of its production at risk.

Front-month Brent futures have risen more than a third since the beginning of the year, but Falih dismissed the market structure as not grounded in reality and said that prices had greater downside risk than upside.

"We're not fooled by current prices," he said. "We think the market has been fragile."

Even US sanctions on Iran have not clamped down on Iranian oil exports as much as believed, he said. Iran has said it will try to sell barrels on the so-called "gray market" to try to avoid US detection, through clandestine shipments and third-party sales.

"I think there is a lot of oil that is leaving the shores of Iran or the borders of Iran that is not accounted as Iranian oil," Falih said. "It's presented in the markets, and therefore we are not seeing as much demand for other crudes as many analysts are expecting."

What Falih said he is laser focused on is tackling the global oil inventory glut.

Oil stocks have risen some 65 million to 70 million barrels since last July, he said, though much of that is due to Saudi Arabia raising its production under pressure from the US to keep the market well-supplied in advance of the reimposition of Iran sanctions in November.

Saudi crude production reached a record high above 11 million b/d that month. Sanctions waivers the US granted to eight countries to continue purchasing Iranian oil for six months wrong-footed the Saudis and caused a severe downturn in the market.

Once bitten and twice shy, Saudi Arabia will not raise output again without evidence that global demand warrants the extra barrels -- but Falih said that surge should provide ample evidence that Saudi Arabia can rise to the occasion if a supply shortage does materialize.

However, the kingdom may not want to risk a further rift in OPEC by producing beyond its quota, with geopolitical tensions with Iran already high in the wake of last week's drone attack on a major Saudi pipeline that officials have blamed on Iranian-backed Yemeni Houthis. Iran, which did not send a representative to the committee meeting in Jeddah, has warned other countries not to encroach on its sanctions-hit market share.

"We want to bring inventories down to a more normal levels," Falih said. "We need to stay the course and do that in the weeks and months to come."

-----

Earlier: