U.S. LNG TO CHINA CUTS

МИНЭНЕРГО РОССИИ - Министр энергетики Российской Федерации Александр Новак в ходе заседания Правительства России под руководством Председателя Правительства РФ Дмитрия Медведева доложил о текущей ситуации с поставками российской нефти по нефтепроводу "Дружба".

Глава Минэнерго России напомнил, что по поручению Председателя Правительства Российской Федерации Дмитрия Медведева была создана межведомственная комиссия по проверке нарушения показателей качества нефти, транспортируемой по магистральному нефтепроводу "Дружба".

"По итогам проверки был определен источник загрязнения нефти - это узел учета "Лопатино" в Самарской области. Следственные действия выявили группу компаний, осуществлявших незаконную деятельность по сдаче в систему некондиционной нефти. Материалы проверки переданы в Генпрокуратуру России, возбуждено уголовное дело", - доложил глава Минэнерго России.

Что касается ситуации непосредственно на нефтепроводе "Дружба", Александр Новак рассказал, что уже было произведено оперативное изолирование источника загрязнения от системы магистральных нефтепроводов.

"В настоящий момент осуществляется работа по переориентации нефтепотоков, компанией "Транснефть" ведется ежесуточный режим контроля качества нефти на трубопроводах", - отметил Министр.

Минэнерго России, в свою очередь, продолжается планомерная работа и со странами-покупателями российской нефти, на данный момент дорожная карта по улучшению ситуации на нефтепроводе была согласована с Польшей, Республикой Беларусь, Украиной, Словакией и Венгрией, добавил Александр Новак.

"4 мая с опережением на два дня кондиционная нефть поступила на Мозырский НПЗ, 6 мая началась прокачка кондиционной нефти в сторону узла учета "Броды" для поставки европейским потребителям, сейчас мы ожидаем согласования прокачки нефти в Польшу. Параллельно продолжается прокачка нефти в сторону порта Усть-Луга, утром 8 мая нефть достигнет порта", - сказал он.

При этом ситуация на нефтепроводе "Дружба" не повлияла на объемы добычи и экспорта нефти Россией, заверил Александр Новак. По его словам, завершение всех мероприятий по ликвидации последствий загрязнения нефти на нефтепроводе "Дружба" ожидается во второй половине мая. Чтобы не допустить повторение подобных случаев в будущем, Минэнерго России были подготовлены соответствующие предложения по корректировке нормативно-правовой базы, добавил Александр Новак.

"Ключевое предложение касается изменений в ГОСТ по контролю качества нефти. В настоящее время ГОСТом предусмотрен обязательный контроль в транспортируемой нефти 11-ти показателей и содержания хлорорганики и парафинов не реже раза в 10 дней. Мы предлагаем внести изменения в ГОСТ по учету и контролю качества нефти с целью расширения перечня проверяемых показателей, методов отбора и хранения арбитражных проб нефти, то есть введения требований по ежедневному измерению", - пояснил глава Минэнерго России.

Кроме того, Минэнерго России предлагает внести поправки в закон "О промышленной политике России" для того, чтобы законодательно установить требования к качеству нефти, сдаваемой на транспортировку, а также закрепить неприменение хлорорганики, сообщил он.

По итогам работы комиссии, по словам Александра Новака, также предложено поручить Ростехнадзору и Росстандарту провести проверки всех коммерческих пунктов учета нефти, а Росстандарту и Росаккредитации - сделать обязательной процедуру аккредитации химико-аналитических лабораторий для проведения товарно-коммерческих операций с нефтью и нефтепродуктами. Также предлагается повысить административную ответственность юридических лиц за нарушения требований Техрегламента по нефти и по топливу - с нынешних 300 тыс. рублей до штрафа в размере 2% от оборота, заключил глава Минэнерго России.

-----

U.S. LNG TO CHINA CUTS

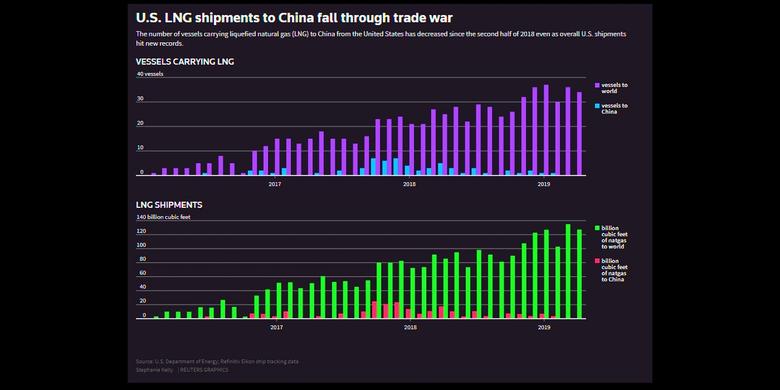

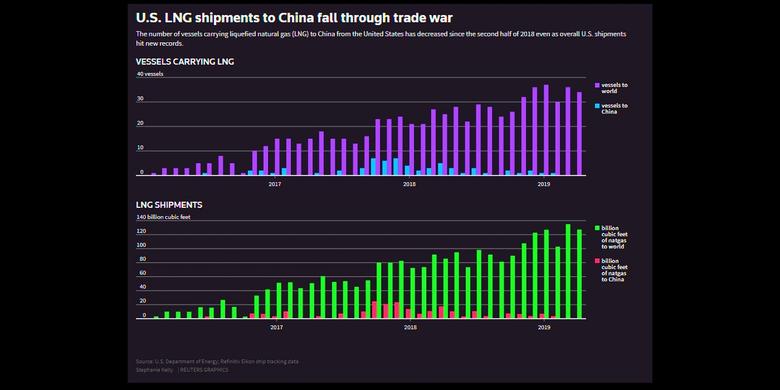

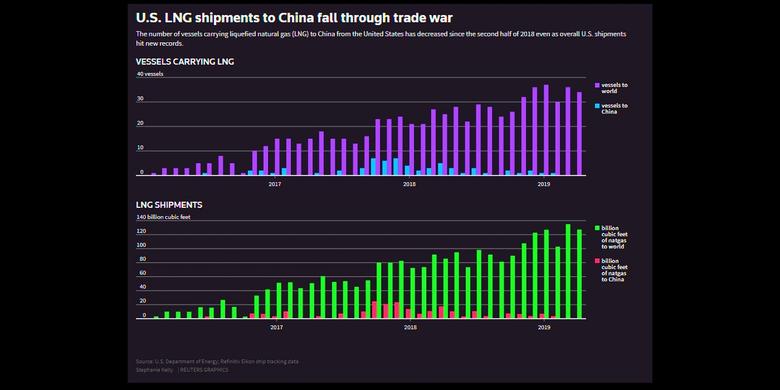

REUTERS - No liquefied natural gas (LNG) vessels that left the United States in March and April have gone to China, Refinitiv Eikon shipping data shows, as the trade war between the two nations escalates.

On Friday, the United States increased its tariffs on $200 billion in Chinese goods to 25% from 10%, rattling financial markets already worried the 10-month trade war between the world's two largest economies could spiral out of control.

So far this year, only two vessels have gone from the United States to China - one in January and one in February - versus 14 during the first four months of 2018 before the start of the trade war.

The data, however, shows a handful of vessels from the United States are still sailing across the Pacific Ocean and some could end up in China.

In 2018, 27 LNG vessels went from the United States to China, down from 30 in 2017. Most of those, however, left U.S. ports before the trade war started, with 18 tankers going to China in the first half of the year and just nine during the second half.

Executives at Cheniere Energy Inc, which owns two of the three big operating U.S. LNG export terminals, said this week that the trade war is "unproductive and creates some added costs for our Chinese consumers" but "hasn't had an impact on us" and is not expected to have an impact going forward.

The United States and China started imposing tariffs on each other's goods in July 2018. As the dispute heated up, China added LNG to its list of proposed tariffs in August and imposed a 10-percent tariff on LNG in September.

The United States is the fastest-growing LNG exporter in the world, while China is the fastest-growing importer of the fuel.

U.S. LNG sales jumped 61 percent in 2018 versus 2017, making the country the fourth-biggest exporter in the world, while China, the world's second-biggest buyer of the fuel, increased its purchases by 39 percent last year as it weans its power and industrial sectors off coal to reduce pollution, according to data from the International Gas Union.

-----

Earlier:

2019, April, 26, 11:20:00

GLOBAL LNG TRADE UP 8%

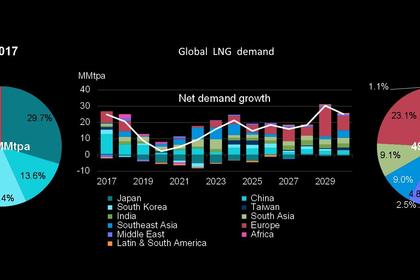

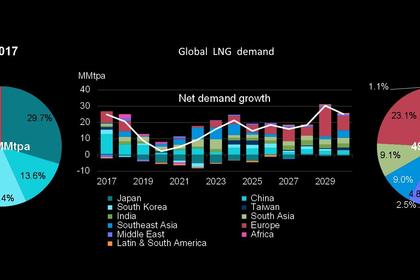

In 2018, global trade in liquefied natural gas (LNG) increased by 3.2 billion cubic feet per day (Bcf/d) to 41.3 Bcf/d, an 8% increase from 2017

2019, April, 26, 11:15:00

FLEXIBLE LNG MARKET

Global oversupply that has pulled spot LNG prices down by more than 50 percent over the past half-year has producers succumbing to consumer demands for fuel on shorter notice and without sourcing or destination restrictions.

2019, April, 26, 11:05:00

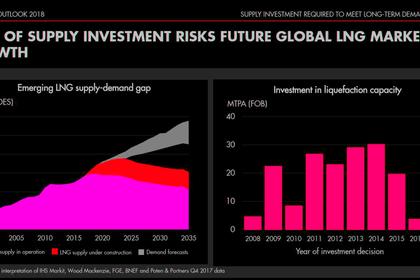

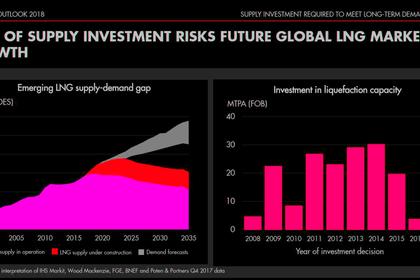

GLOBAL LNG INVESTMENT $200 BLN

World capital expenditure for both LNG plant and upstream infrastructure will total more than $200bn between 2019 and 2025.

2019, April, 24, 10:45:00

EXXON'S LNG FOR CHINA

ExxonMobil said that it signed a sales and purchase agreement with Zhejiang Provincial Energy Group for liquefied natural gas (LNG) supply. Under the agreement, Zhejiang Energy is expected to receive 1 million metric tons per annum of LNG over 20 years.

All Publications »

Tags:

USA,

CHINA,

LNG,

GAS