U.S. SHALE PROBLEM

FT - Independent shale drillers in the US are facing pressure to either expand or be acquired, Robert Kaplan, president of the Federal Reserve Bank of Dallas, has said.

Despite the classic "wildcatting" image of plucky entrepreneurs trying their luck, smaller, independent drillers are losing access to capital and hearing complaints from shareholders, he said in an interview with the Financial Times.

Mr Kaplan's comments come less than two weeks after Occidental Petroleum agreed to acquire rival Anadarko Petroleum, one of the largest US independent oil and gas groups, for $56bn.

"People have said to me in this industry, you're either a buyer or a seller today," Mr Kaplan said. "But if you stand pat, where you are, you're going to be in a dangerous place . . . Even shale is not immune from disruption and capital discipline, and they're feeling it right now. And this is why you're seeing more merger activity."

In the Dallas Fed's most recent Energy Survey — a quarterly poll of about 200 oil and gas companies — one anonymous oil industry executive wrote that "the shrinkage in market capitalisation of some companies is breathtaking".

Investors, according to the survey, are no longer willing to speculate on new, unproven acreage.

"Vertical drilling prospects are dead," wrote another oil industry executive. "Deep pockets for manufacturing oil and gas have taken over the patch here."

The development of the US shale oil and gas industry was pioneered by smaller and midsized exploration and production companies.

But larger groups are becoming increasingly important, particularly in the Permian Basin, the heartland of the latest oil boom.

ExxonMobil and Chevron, the two largest US oil groups, have both set out plans for rapid growth in the Permian region, and other international companies have either been making acquisitions there, as BP has done, or are looking at possible deals, which Royal Dutch Shell is doing.

There are two principal forces driving consolidation in the industry. One is the value of having larger areas with drilling rights that are contiguous or at least close together, to make it easier to manage the logistics of production.

In agreeing to buy rival Anadarko, for example, Occidental argued that it could save $3.5bn a year in annual capital spending and operating costs by combining the two businesses.

It has highlighted the opportunities for using its infrastructure, such as a supply depot in eastern New Mexico, to support operations at Anadarko's properties just across the border in western Texas.

The other important factor is finance. Larger companies with stronger balance sheets and better credit ratings find it easier to raise capital, and investors have recently become less willing to finance smaller production companies that are unable to generate free cash flow.

Investors were sceptical when Vicki Hollub, Occidental's chief executive, promised that she was not simply adding Anadarko's acres, but that her company was better able to exploit them. It took a trip to Omaha and 90 minutes with Warren Buffett to find an investor who would commit to the plan. Mr Buffett pledged to invest $10bn to finance the deal.

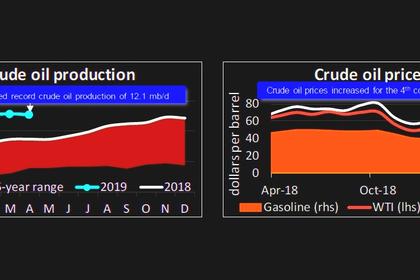

Mr Kaplan said that fracking had made the US oil industry more "nimble" in responding quickly to shifts in global oil prices. This has anchored barrels of West Texas Intermediate, the US benchmark, around $60 a barrel.

There is less hope among shareholders for a happy surprise on price, and less appetite for potential future revenue, he said, adding that at the same time, exploration and production companies needed to produce net-positive cash flow, at current oil prices.

"The point of it is, technology and the characteristics of the industry are causing people to consolidate," said Mr Kaplan. "Because if you're going to have to drill upon drill upon drill upon drill to maintain just the same level of production, it's expensive, and people are realising just to do that, I need scale."

-----

Earlier: