ARAMKO WILL MEET DEMAND

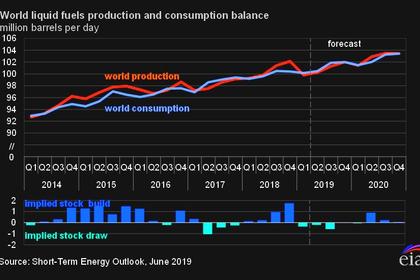

REUTERS - Saudi Aramco can meet the oil needs of customers using its spare capacity despite developments in the Gulf that are a cause for concern, the head of the state-run energy giant said on Tuesday.

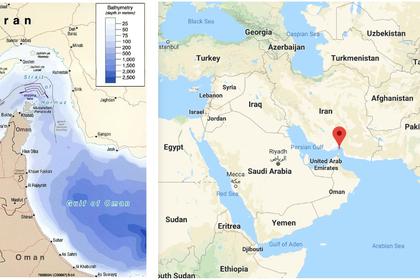

Attacks in May and June on oil tankers near the Strait of Hormuz, the entrance to the Gulf, has raised concerns about the safety of ships using the strategic shipping route.

"What's happening in the Gulf is definitely a concern," Amin Nasser, president and chief executive of Aramco, told Reuters in an interview in Seoul.

"At the same time we went through a number of crises in the past ... we've always met our customer commitments and we do have flexibility and the system availability in terms of available additional spare capacity," he added.

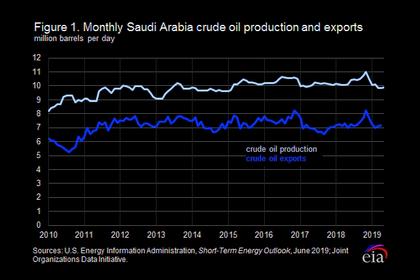

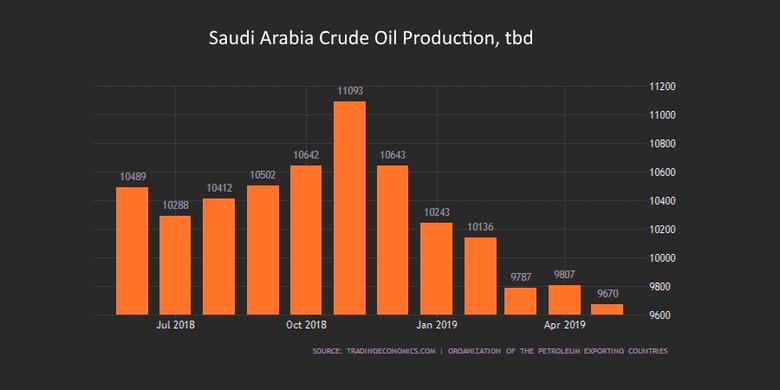

Nasser, who is in the South Korean capital before a visit by Saudi Crown Prince Mohammed bin Salman, said Aramco had no plan to increase maximum output capacity of 12 million barrels per day (bpd), given its current output was well below that level.

"If you look at our production, it is hovering around 10 million bpd so we do have additional spare capacity," he said.

The oil giant, which has been developing its domestic gas resources, has been eyeing gas assets in the United States, Russia, Australia and Africa.

Nasser said Aramco was in talks to buy a stake in Russian gas company Novatek's Arctic LNG-2 project.

He also said Aramco was in discussions about buying a stake in India's Reliance Industries and in talks with other Asian companies about investment opportunities.

"We will continue to explore opportunities in different markets and different companies, and these things take time," he said.

Nasser said the company, South Korea's top oil supplier, wanted to increase crude oil supplies to the Asian nation where it has partnerships and investments with South Korean refiners.

Aramco supplies between 800,000 bpd and 900,000 bpd to South Korea, the world's fifth-largest crude importer.

Aramco will sign a memorandum of understanding with state-run Korea National Oil Corp (KNOC) for crude storage, sources familiar with the matter said.

The sources said Aramco planned to seal a 20-year deal with South Korean refiner Hyundai Oilbank to supply 150,000 bpd a year of Saudi crude, while Aramco's trading arm planned to sign a refined products offtake agreement with Hyundai Oilbank.

Saudi Aramco said in April it had bought a 17% stake in Hyundai Oilbank. It is also the biggest shareholder in South Korea's No.3 refiner S-Oil.

-----

Earlier: