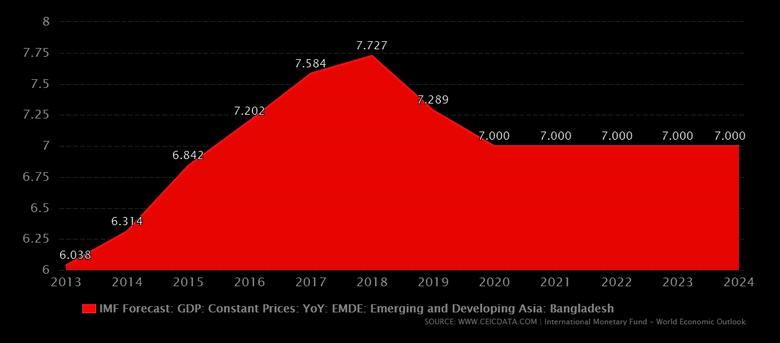

BANGLADESH'S GDP UP 7%

IMF - IMF Staff Completes 2019 Article IV Visit to Bangladesh

- Bangladesh’s macroeconomic performance is set to remain strong in FY2019/20, with growth projected at above mid-7 percent and inflation close to the central bank’s target.

- Important policy challenges remain to realize the authorities’ aspiration to reach upper middle-income status and preserve the sustainability of growth.

- Reducing elevated banking sector vulnerabilities and increasing tax revenues should receive priority attention. Diversifying the economy by strengthening the business environment will also enhance resilience of the economy.

An International Monetary Fund (IMF) staff team, led by Mr. Daisaku Kihara, visited Dhaka from June 16-27 to hold discussions on the 2019 Article IV Consultation with Bangladesh.

At the conclusion of the visit, Mr. Kihara made the following statement:

“Economic growth in Bangladesh continues to be strong. Robust private consumption pushed real GDP growth close to 8 percent in FY2018, while inflation increased slightly, due mainly to higher food prices. Export growth has picked up recently, based on solid performance of the ready-made garments sector. Remittances inflows have also strengthened. This has led to a narrowing of the current account deficit despite higher imports of capital goods. Macroeconomic performance is set to remain strong in FY2019/20, with growth projected at above mid-7 percent and inflation close to the central bank’s target.

“Monetary policy should be geared toward containing risks to the inflation outlook stemming from higher global oil prices, rapid economic growth, and elevated inflation expectations. Continuous efforts to control the issuance of National Savings Certificates should support deepening of the capital market and reduce budget interest payments. Fiscal policy should keep the public debt ratio stable by strengthening revenue mobilization and containing spending pressures from higher subsidies, accompanied by efforts to improve public investment management. While fiscal pressures from the Rohingya refugee crisis appear to be limited so far, continued financial support from donors remains essential.

“Important challenges remain to realize the authorities’ aspiration to reach upper middle-income status and preserve the resilience and sustainability of growth. Reform priorities include: (i) reducing elevated banking sector vulnerabilities; (ii) creating fiscal space to address social needs, infrastructure requirements, and climate change vulnerabilities; and (iii) diversifying the economy by strengthening the business environment through improved governance .

“The financial situation in the banking sector continues to deteriorate despite strong growth. Resolutely addressing the high level of non-performing loans in the banking sector is essential to address financial stability risks and associated fiscal risks. A comprehensive, credible, and time-bound action plan could notably focus on: strengthening banking sector supervision and avoiding regulatory forbearance; a close assessment of banking sector assets; tighter criteria and limited use of rescheduling/restructuring of loans; improving corporate governance; reforming the legal system to strengthen creditor rights; redefining the role and mandate of state-owned commercial banks; and developing bank crisis management and resolution mechanisms.

“Implementation of the new VAT law in FY 2020 is a step towards modernization of the tax regime, but its revenue impact is uncertain because of multiple rates and implementation challenges. Efforts to increase tax revenues should continue. Tax policy reforms should focus on tax base broadening and ensuring tax compliance. The organizational structure of the National Board of Revenue needs to be modernized to improve its coordination and efficiency. On the expenditure side, a priority remains to improve public investment management through better project appraisal and selection and alignment of public investment priorities with national and sectoral plans.

“Bangladesh has succeeded in fostering a dynamic and fast-growing economy with significant poverty reduction. To preserve and build on that achievement, diversification into more complex products would spur integration into global value chains and make exports more robust to changes in global demand patterns. Improving the business environment and strengthening frameworks to limit vulnerability to corruption would also be fundamental to the realization of development goals.

“The IMF stands ready to support the government’s reform efforts through policy advice and capacity building, including on monetary and fiscal policies, financial sector supervision and regulation, and macroeconomic statistics.”

The team met with the Bangladesh Bank Governor, the Finance Secretary, the Chairman of the National Board of Revenue, and other senior officials, as well as members of Parliament, representatives of the business and banking sectors, labor unions, think tanks, and development partners. The team would like to thank the Bangladesh authorities for their hospitality and candid discussions.

-----

Earlier:

2019, May, 24, 09:50:00

FIRST BANGLADESH'S LNG

Bangladesh’s second liquefied natural gas (LNG) floating facility is set to receive its first ship-to-ship transfer of gas from an Algerian cargo,

|

2019, February, 6, 10:20:00

BANGLADESH'S FIRST NUCLEAR

IAEA - The plant, being built in Rooppur, about 160 kilometers northwest of the Bangladesh's capital, will have the capacity to generate 2400 megawatts of electricity. The construction project is being implemented by a subsidiary of Russia’s State Atomic Energy Corporation ROSATOM. It is high on the Bangladeshi government’s agenda, all the way up to the Prime Minister’s office.

|

2019, January, 18, 10:25:00

BANGLADESH'S NEW ENERGY

PLATTS - Bangladesh is planning to step up efforts to liberalize its gas and LNG sectors from 2019 in order to boost private investment and enhance energy security, a move that would likely increase domestic downstream competition and affect the competitiveness of existing oil-linked LNG supply contracts.

|