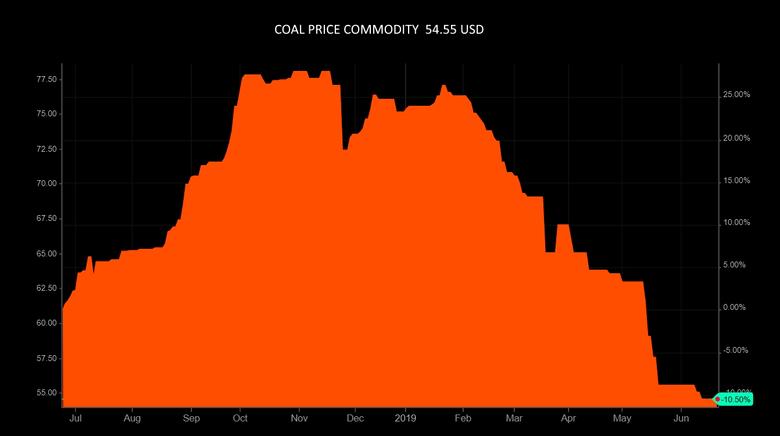

COAL PRICES DOWN

REUTERS - Slowing economic growth in China is weighing on demand expectations for thermal coal in the world's biggest market for the fuel, while global moves toward cleaner energy are compounding problems arising from a glut in supply.

This supply-demand tandem is likely to keep prices for coal used in power plants and the manufacture of cement under pressure in coming months and perhaps longer, industry sources said as Asia's biggest coal conference got underway.

Prices for benchmark premium Australian coal out of Newcastle hit their weakest since September 2016 last week at $70.78 per ton and are likely to fall further given a slowing global economy.

In top consumer China, factory activity weakened in April and May, hit hard by a bruising trade war with the United States. That accounts for some, but hardly all, of the 4.9% fall in China's coal-fired power generation in May compared with the year before, said analyst Helen Lau at Argonaut in Hong Kong.

"Weak consumption of thermal coal is mainly because of increasing competition from hydro and other clean energy," she said in a report.

Coal at China's Qinhuang port has fallen as well, to $95.53 per ton on June 10, according to price publisher McCloskey, a whisker from two year lows.

"Thermal coal is under huge pressure at this moment, even though demand should pick up during summer time," said a coal trader based in Jingtang port. Jingtang is a major coal-receiving port in northern China.

"I cannot make money with current prices, so I am diverting my business and doing some niche products like pulverized coal now," the trader said.

A major culprit is the expansion of the use of cheap natural gas in Europe, said an energy trader in Singapore.

"Cheap gas in the United States is moving into Europe and that is pushing coal from South Africa and Colombia across to Asia. Russia has also ramped up selling in the Pacific basin," he said.

China's wind-generated power grew 5.6 percent in the first five months of the year, hydroelectric power grew 12.8 percent, compared with 0.2 percent growth in LNG and coal combined, according to Commonwealth Bank of Australia (CBA).

A prolonged period of low thermal prices may signal that the global economy is decarbonizing - that is, moving away from carbon-based fuels to renewables such as solar and wind power - at a faster rate than expected, said CBA analyst Vivek Dhar.

This may hurt Australia the most because developed countries, which can afford to pay more for the high-energy, less-polluting coal it produces, are decarbonizing at the fastest rates, Dhar said.

Germany already sources 40% of its power from renewable energy and has set a target of 65% by 2030. Britain is set this year to use more electricity from zero-carbon sources than from fossil fuel plants for the first time.

Already, prices for Newcastle 6,000-kilocalorie coal, have slumped around 58 percent since September, compared with a more modest decline of 20 percent for 5,500-kilocalorie grades, which were last trading at $51 a ton, according to commodities pricing agency S&P Global Platts.

"I think the Australians are going to feel it," the Singapore energy trader said.

-----

Earlier: