FRANCE'S GROWTH 1.5%

IMF - France’s growth has slowed but remains resilient and job rich, in part reflecting important labor-market and tax reforms implemented in recent years. But external risks have risen, and France’s structural challenges persist: high public and private debt, still high structural unemployment, sluggish productivity growth, and inequality of opportunity. Building on the government’s agenda, reforms must continue to address these long-term challenges and bolster resilience to shocks. Social consensus around reform priorities is essential to ensure their success, for the benefit of all citizens and future generations. Key reform areas are as follows:

- Safeguarding fiscal sustainability and bolstering public-sector efficiency: If completed and ambitiously implemented, planned civil-service, pensions, and unemployment-benefit reforms should bolster equity, incentivize work, and generate efficiency savings. Additional spending reforms are needed to ensure that the ongoing tax-burden reduction can be sustained and public debt placed on a firm downward path.

- Boosting employment and productivity: Resolute implementation of recent and upcoming labor-market reforms, coupled with further liberalization of product and service markets, is essential to reduce the high level of structural unemployment and support inclusive, long-run growth.

- Continuing to strengthen the resilience of the financial sector: Building on important progress to date, the authorities need to continue to bolster the monitoring and oversight of financial conglomerates, proactively manage cyclical risks, and ensure adequate capital and liquidity buffers to address shocks.

Context and Challenges

In recent years, the authorities legislated important labor-market and tax reforms to support investment, jobs, and growth. This helped contribute to the resilience of the economy last year, even as growth slowed relative to 2017 as the cyclical recovery ran its course and external demand softened. The labor market continued to improve: the employment rate reached a ten-year high, permanent work contracts increased, and the unemployment rate declined to 8.7 percent at end-March 2019.

While the outlook remains positive, uncertainty is high, and risks have risen.Growth is expected to reach 1.3 percent this year and stabilize at around 1.5 percent in the medium term, predicated on a recovery of domestic and external demand and on gains from recent reforms. But risks have increased, related to trade tensions, an uncertain Brexit outcome, possible renewed tensions inside the Euro Area, weaker-than-expected growth in Europe, and, in France, erosion of support for necessary economic reforms among the general public.

Social consensus around reforms is key to address France’s long-standing challenges and bolster resilience to shocks. Despite a decline in the fiscal deficit to 2.5 percent of GDP last year, public debt remains high, and public spending relative to GDP is the highest in Europe. While aggregate inequality and poverty outcomes are better than in peers, structural unemployment remains elevated, especially for vulnerable groups, living standards have been sluggish, and inequality of opportunity persists. Private debt has also risen in recent years. Addressing these problems requires sustained policy efforts, building on the ongoing government reform agenda.

Safeguarding Fiscal Sustainability

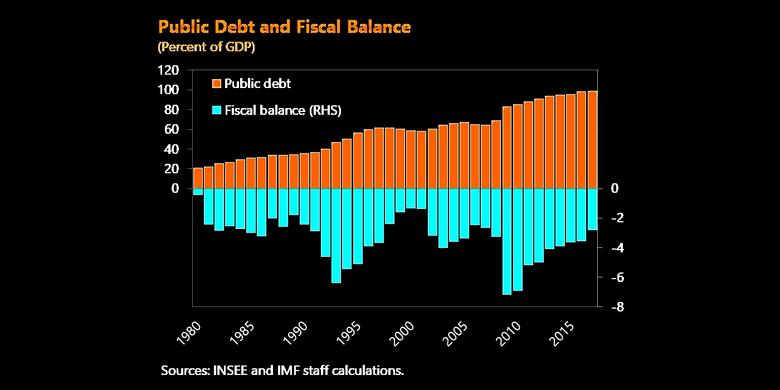

France’s public debt is too high for comfort. While there is no immediate risk, as the currently low interest rates suggest that higher debt can be sustained at this juncture, the elevated debt level provides little comfort from a medium and long-term perspective. Indeed, France’s public debt has been on a rising trend since the 1980s, increasing from around 20 to close to 100 percent of GDP today, as successive governments did not take full advantage of good times to reverse the spending increases undertaken during downturns. Developments since the global financial crisis are in line with this historical pattern.

An ambitious structural consolidation effort is needed to place debt on a firm downward path. Reducing debt is key to building buffers against shocks to avoid pro-cyclical tightening—which can affect vulnerable groups disproportionately—while supporting intergenerational equity. A structural primary fiscal effort of some ½ percent of GDP per year during 2020-23 could reduce debt by close to 10 percent and bring the structural fiscal balance to its medium-term objective by 2023. For next year’s budget, this entails consolidation measures to both offset the April relaxation measures and to materially reduce the deficit.

To reconcile the government priorities with debt reduction, significant fiscal effort on the spending side is needed. The authorities have legislated and announced significant medium-term tax reduction to support investment, purchasing power, and job creation. At the same time, they plan to boost investment to upgrade skills for the youth and long-term unemployed, protect the environment, and support digitalization and innovation. To finance these priorities, while also reducing the deficit and debt, public spending in other areas must be rationalized and its efficiency increased. The 2018 spending containment is a welcome step in the right direction.

Completing and strengthening planned reforms, together with further measures, can help underpin consolidation, while improving efficiency and long-term growth:

- The planned civil-service reform can help streamline and improve the flexibility and efficiency of the public sector, while preserving essential services. To help generate medium term savings, the authorities should target an ambitious decline in the workforce through attrition, especially at the local government level.

- The upcoming pension reform aiming to unify existing pension systems under one scheme with common rules would improve the transparency, efficiency, and equity of the system. To safeguard long-term sustainability, improve intergenerational equity, boost labor-force participation, and generate fiscal savings, the authorities should consider accelerating the planned increase in the effective retirement age and linking it to life expectancy.

- The planned unemployment-benefit reform could generate fiscal savings by revising the rules to calculate and cumulate benefits and reducing the maximum benefit level. This would also help improve the fairness of the system and incentivize work.

- Additional reforms could focus on areas where France’s spending is high relative to peers, while enhancing its efficiency and preserving its redistributive character. Reform areas could include: (i) further rationalizing tax expenditures and subsidies in selected areas (transport, housing); (ii) streamlining health costs (medical products, hospitals, outpatient centers), while protecting the quality of public health services and R&D spending; (iii) improving the allocation of educational spending among different levels (from secondary to primary and tertiary); and (iv) better targeting social benefits and streamlining their administrative costs (family, housing). Merging small municipalities and eliminating overlaps between local and central government functions can also help generate efficiency gains.

Supporting Inclusive Growth

High structural unemployment and inequality of opportunity weigh on living standards. France’s unemployment is still too high, particularly for vulnerable groups (the youth, low-skilled, and non-EU immigrants) and in certain regions, creating societal disparities. Moreover, unequal educational and training opportunities result in weak intergenerational mobility. The government appropriately frontloaded structural reforms aiming to address these problems and boost long-run growth.

The focus should be on the full implementation of recent and planned labor-market reforms. Having legislated key labor-code and apprenticeship and professional-training reforms over the last year—which should help to increase labor market flexibility and opportunities for vulnerable groups—efforts should now concentrate on making them fully effective, including by facilitating decision-making on extensions of branch agreements, finalizing the electronic training app, and regulating training centers. Implementation of the unemployment-benefit reform can also incentivize work. The authorities should monitor the effects of reforms and stand ready to adjust them if outcomes fall short of objectives.

Further liberalization of product and service markets can boost productivity and resilience. Implementation of the recent railway reform, the PACTE law, and upcoming measures to liberalize personal transport (auto schools, parts) and online sales of medicines will be useful to spur competition, entrepreneurship, and innovation. Further efforts to bring France in line with best practice by fostering competition in regulated professions (accountants, lawyers, architects), sales (pharmacies), and retail distribution (authorization and registration requirements) would support lower prices and higher productivity. The combination of labor and product market reforms can help create virtuous synergies and boost living standards.

Bolstering the Financial System’s Resilience

The IMF’s Financial Sector Assessment Program (FSAP) finds that important progress has been made to strengthen the institutional and policy framework in support of financial stability. Key accomplishments include the unification of supervision and resolution under the European framework, establishment of the High Council for Financial Stability, implementation of the Banking Resolution and Restructuring Directive and Solvency II. Moreover, banks have improved their capital positions and asset quality, and both banks and insurers’ balance sheets are presently resilient to simulated stress scenarios.

Given the systemic significance and complexity of France’s financial system, the FSAP has identified three policy priorities:

- Further integration of conglomerate-level monitoring and oversight: France’s key banks are systemic, globally active, and interlinked with insurance and asset management institutions via financial-conglomerate structures. While this helps with diversification of business models and profit sources, it adds to the supervisory burden and potential risks. Common guidance, reporting, and stress testing at the conglomerate level can help ensure that risks are promptly identified and addressed.

- Preemptive management of cyclical risks: To address rising private debt, particularly by corporates, the authorities have taken proactive measures, including by reducing the large exposure limit to indebted corporates and increasing the countercyclical capital buffer (CCyB). They should evaluate the effectiveness of these measures, continue to monitor risks closely, and stand ready to further use macro and micro-prudential policies if needed, including a systemic risk buffer, other capital measures calibrated to corporate exposure, or adjusting the CCyB. Further reducing the tax bias favoring debt rather than equity financing could also help limit leverage.

- Maintaining adequate liquidity management and buffers: While aggregate bank liquidity buffers appear adequate, the supervisory authorities could consider additional liquidity buffers in all currencies to minimize risks related to potential disruptions in wholesale funding in case of severe shocks. Bancassurance liquidity-risk management requirements could be strengthened further, and common supervisory guidance on liquidity-risk management within financial conglomerates is desirable, including for asset-management operations.

The mission thanks the authorities for their constructive policy dialogue and kind hospitality.

-----

Earlier: