GLOBAL GROWTH 2.6%

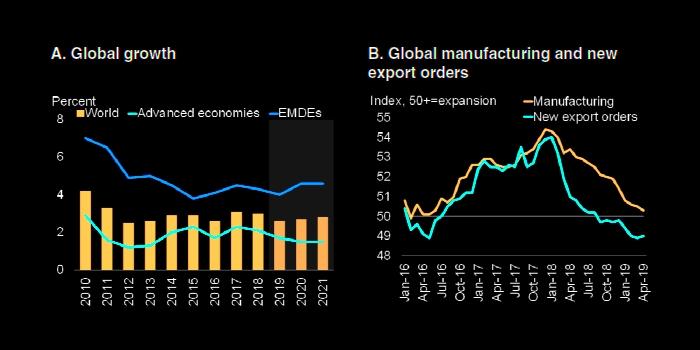

WBG - WASHINGTON, June 4, 2019 — Global economic growth is forecast to ease to a weaker-than-expected 2.6% in 2019 before inching up to 2.7% in 2020. Growth in emerging market and developing economies is expected to stabilize next year as some countries move past periods of financial strain, but economic momentum remains weak.

Emerging and developing economy growth is constrained by sluggish investment, and risks are tilted to the downside. These risks include rising trade barriers, renewed financial stress, and sharper-than-expected slowdowns in several major economies, the World Bank says in its June 2019 Global Economic Prospects: Heightened Tensions, Subdued Investment. Structural problems that misallocate or discourage investment also weigh on the outlook.

“Stronger economic growth is essential to reducing poverty and improving living standards,” said World Bank Group President David Malpass. “Current economic momentum remains weak, while heightened debt levels and subdued investment growth in developing economies are holding countries back from achieving their potential. It’s urgent that countries make significant structural reforms that improve the business climate and attract investment. They also need to make debt management and transparency a high priority so that new debt adds to growth and investment.”

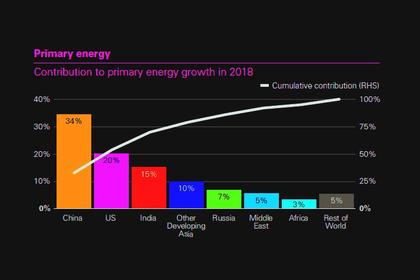

Growth among advanced economies as a group is anticipated to slow in 2019, especially in the Euro Area, due to weaker exports and investment. U.S. growth is forecast to ease to 2.5% this year and decelerate to 1.7% in 2020. Euro Area growth is projected to hover around 1.4% in 2020-21, with softness in trade and domestic demand weighing on activity despite continued support from monetary policy.

Growth among emerging market and developing economies is projected to fall to a four-year low of 4% in 2019 before recovering to 4.6% in 2020. A number of economies are coping with the impact of financial stress and political uncertainty. Those drags are anticipated to wane and global trade growth – which is projected to be the weakest in 2019 since the financial crisis a decade ago -- is expected to recover somewhat.

Download the June 2019 Global Economic Prospects report.

“While almost every economy faces headwinds, the poorest countries face the most daunting challenges because of fragility, geographic isolation, and entrenched poverty,” said World Bank Group Vice President for Equitable Growth, Finance and Institutions, Ceyla Pazarbasioglu. “Unless they can get onto a faster growth trajectory, the goal of lowering extreme poverty under 3 percent by 2030 will remain unreachable.”

Analytical sections address key current topics:

- Government debt has risen substantially in emerging and developing economies, as hard-won cuts in public debt ratios prior to the financial crisis have to a large extent been reversed. Emerging and developing economies need to strike a careful balance between borrowing to promote growth and avoiding risks associated with excessive borrowing.

- Growth rates in low-income countries are expected to rise to 6% in 2020 from 5.4% in 2019, but that is still not enough to substantially reduce poverty. While a number of low-income countries progressed to middle income status between 2000 and 2018, the remaining low-income countries face steeper challenges to achieving similar progress. Many are poorer than the countries that made the leap to higher income levels and are fragile, disadvantaged by geography and heavily reliant on agriculture.

- Investment growth among emerging and developing economies is expected to remain subdued and below historical averages, held back by sluggish global growth, limited fiscal space, and structural constraints. A sustained pickup in investment growth is necessary to meet key development goals. Business climate reforms can help encourage private investment.

- Sharp currency depreciations are more common in emerging and developing economies than in advanced economies, and central banks are often required to respond to these fluctuations to maintain price stability. The exchange rate pass-through to inflation is more limited when central banks pursue credible inflation targets, operate within a flexible exchange rate regime, and are independent of the central government.

“In the current environment of low global interest rates and weak growth, additional government borrowing might appear to be an attractive option for financing growth-enhancing projects.” said World Bank Prospects Group Director Ayhan Kose. “However, as the long history of financial crises has repeatedly shown, debt cannot be treated as a free lunch.”

Regional Outlooks:

East Asia and Pacific: Growth in the East Asia and Pacific region is projected to slow from 6.3 percent in 2018 to 5.9 percent in 2019 and 2020. This is the first time since the 1997-1998 Asian financial crisis that growth in the region has dropped below 6%. In China, growth is expected to decelerate from 6.6 percent in 2018 to 6.2 percent in 2019, predicated on a deceleration in global trade, stable commodity prices, supportive global financial conditions, and the ability of authorities to calibrate supportive monetary and fiscal policies to address external challenges and other headwinds. In the rest of the region growth is also expected to moderate to 5.1 percent in 2019, before rebounding modestly to 5.2 percent in 2020 and 2021, as global trade stabilizes.

Europe and Central Asia: Regional growth is expected to firm to 2.7% in 2020 from a four-year low of 1.6% this year as Turkey recovers from an acute slowdown. Excluding Turkey, regional growth is expected to grow 2.6% in 2020, slightly up from 2.4% this year, with modest growth in domestic demand and a small drag from net exports. In Central Europe, fiscal stimulus and the resulting boost to private consumption will begin to fade in some of the subregion’s largest economies next year, while growth is expected to modestly recovery to 2.7% in Eastern Europe and moderate to 4% in Central Asia. Growth in the Western Balkans is anticipated to rise to 3.8% in 2020.

Latin America and the Caribbean: Regional growth expected to be a subdued 1.7% in 2019, reflecting challenging conditions in several of the largest economies, and to build to 2.5% in 2020, helped by a rebound in fixed investment and private consumption. In Brazil, a weak cyclical recovery is expected to gain traction, with growth rising to 2.5% next year from 1.5% in 2019. Argentina is projected to revert to positive growth in 2020 as the effects of financial market pressures fade, while easing policy uncertainty in Mexico is expected to help support a moderate growth uptick in Mexico next year, to 2%.

Middle East and North Africa: Regional growth is projected to rise to 3.2% in 2020, largely driven by rebound in growth among oil exporters. Growth among oil exporters is anticipated to pick up to 2.9% in 2020, supported by capital investment in the GCC and higher growth in Iraq. Among oil importing economies, increasing growth is predicated on policy reform progress and healthy tourism prospects.

South Asia: The outlook for the region is solid, with growth picking up to 7% in 2020 and 7.1% in 2021. Domestic demand growth is expected to remain robust with support from monetary and fiscal policy, in particular in India. Growth in India is projected to accelerate to 7.5% in FY 2019/20, which begins April 1. Pakistan’s growth is expected to slow further to 2.7% in FY2019/20, which begins July 16.

Sub-Saharan Africa: Regional growth is expected to accelerate to 3.3% in 2020, assuming that investor sentiment toward some of the large economies of the region improves, that oil production will recover in large exporters, and that robust growth in non-resource-intensive economies will be underpinned by continued strong agricultural production and sustained public investment. While per capita GDP is expected to rise in the region, it will nevertheless be insufficient to significantly reduce poverty. In 2020, growth in South Africa is anticipated to rise to 1.5%; growth in Angola is anticipated to pick up to 2.9%; and growth in Nigeria is anticipated to edge up to 2.2% in 2020.

-----

Earlier: