IMF TO ANGOLA $1.24 BLN

IMF- On June 12, 2019, the Executive Board of the International Monetary Fund (IMF) completed the First Review of Angola's economic program supported by an extended arrangement under the Extended Fund Facility (EFF). Completion of this review makes available SDR 179 million (about US$248.15 million), bringing total disbursements under the extended arrangement to SDR 894 million (about US$1.24 billion). The Board also approved the authorities' request for a waiver of nonobservance of the continuous performance criterion on the non-accumulation of external arrears,

Angola's three-year extended arrangement was approved by the IMF Executive Board on December 7, 2018, in the amount of SDR 2.673 billion (about US$3.7 billion at the time of approval), the equivalent of 361 percent of Angola's quota.

Following the Executive Board discussion of Angola's economic program, Mr. David Lipton, First Deputy Managing Director and Acting Chair, issued the following statement:

"The Angolan authorities have demonstrated strong commitment to policies under the Fund-supported program. However, a weakened external environment, notably the heightened volatility in the international price of crude oil, is posing challenges to their reform efforts. The authorities are responding decisively by enacting a conservative supplementary budget for 2019.

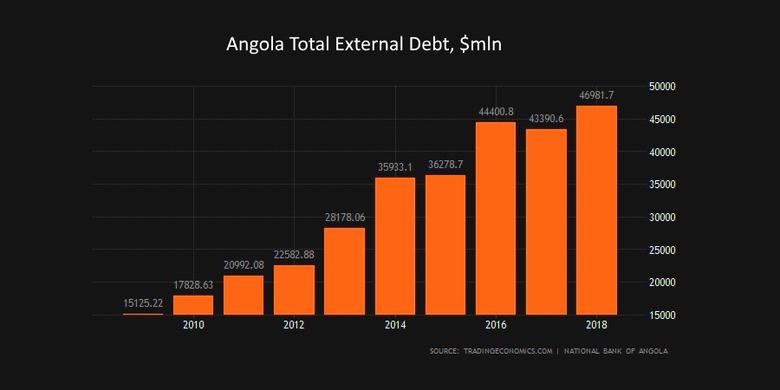

"Fiscal consolidation will continue in 2019, under the recently approved supplementary budget. This is supported by a conservative expenditure envelope, which preserves social spending, and by non-oil revenue mobilization, including the adoption of a value-added tax in mid-2019. A prudent fiscal stance and adherence to the recently published debt management strategy are important to ensure debt sustainability. The authorities are committed to gradually eliminating subsidies and to clearing payments arrears. They are also developing a cash-transfer program to mitigate the side-effects of reforms on the most vulnerable. Supported by technical assistance from the IMF and their development partners, the authorities are taking steps to strengthen public financial management, improve the allocation of scarce public resources, and strengthen fiscal policy formulation and implementation.

"Pursuing exchange rate flexibility and eliminating the remaining restrictions in foreign exchange markets are still needed to restore external competitiveness and facilitate market-based price formation. A tighter monetary policy will help support the flexible exchange rate regime and keep inflation in check.

"Safeguarding financial sector stability remains critical for the success of the program. The authorities are about to finalize a strategic restructuring plan for Angola's largest state-owned bank. They are also working on a strategy to determine the State's appropriate footprint in the banking industry; limit fiscal risks and political interference; increase banks' efficiency; and improve governance. An asset quality review for the 12 largest banks will inform possible recapitalization and restructuring needs of public and private banks. Enactment of a new AML/CFT framework is expected to contribute to easing pressures on correspondent banking relationships. The forthcoming Financial Institutions Law will incorporate good international practice to strengthen bank supervision and resolution. A revised central bank law will ensure greater central bank autonomy, a stronger mandate, and strict limits on monetary financing of the budget.

"The authorities are progressing with structural and governance reforms to diversify the economy, reduce fiscal risks and the State's footprint in the economy, foster private sector development, and reduce opportunities for corruption. A Privatization Law has been just enacted, providing the foundations for the Government to implement its privatization program. Publication of audited annual reports of the 15 largest state-owned enterprises will resume in the second half of 2019."

-----

Earlier:

2018, December, 29, 13:55:00

IMF FOR ANGOLA: $3.7 BLN

IMF - The oil endowment allowed Angola to rebuild critical infrastructure, and progress has also been achieved in reducing poverty. Still, much remains to be done to reduce the economy’s dependence on oil and its vulnerability to oil price fluctuations so that enough resources can be made available to improve living standards for all the Angolan people.

|

2018, November, 12, 12:00:00

TOTAL'S INVESTMENT TO ANGOLA: $16 BLN

THE LOCAL FRANCE - Angola and French oil giant Total formally launched a major new offshore oil project Saturday to aid the country's economy that plunged into crisis following oil price dips in 2014.

|

2018, August, 13, 13:30:00

ANGOLA'S OIL EXPORTS UP TO 1.63 MBD

PLATTS - Angola's crude oil exports rebounded to a four-month high of 1.63 mil b/d in June even as the OPEC member struggles to arrest declines at some of its ageing deepwater oil fields, finance ministry data showed.

|