IRAN'S OIL TO CHINA DOWN

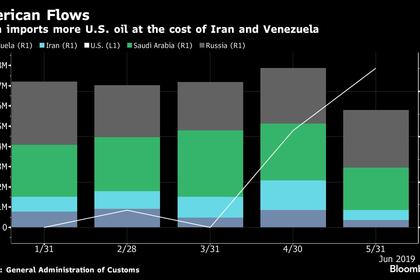

PLATTS - China imported 1.08 million mt, or 255,065 b/d, of crude oil from Iran in May, down 66.7% from the five-year high of 3.24 million mt in April as the US' sanction waivers for Iranian oil expired on May 2.

The volume fell 63.1% year on year, the latest data released by the General Administration of Customs showed.

The US, which re-imposed oil sanctions on Iran in November 2018, gave sanction waivers to Iran's biggest crude and condensate buyers, including China, which expired on May 2.

Iranian crude oil and condensate exports, which averaged about 1.7 million b/d in March, fell to about 1 million b/d in April and an estimated 800,000 b/d in May, according to S&P Global Platts cFlow trade flow data and shipping sources. The majority of those flows in May were to China, Turkey and Syria, according to these sources.

VENEZUELAN VOLUME FALLS TO 56-MONTH LOW

Meanwhile, the country's crude oil imports from Venezuela fell to a 56-month low of 799,318 mt in May, down 56.1% year on year, GAC data showed.

Imports from Venezuela was last lower at 608,795 mt in September 2014, GAC data showed.

Arrivals from the Latin American country had been halved due to tight supplies, a source with PetroChina International said and added that Venezuelan Merey crude was the only crude that the Shandong-based independent refineries wanted to buy currently.

The low inflow from Venezuela in May led to it falling off China's top 10 list of crude oil suppliers for the first time in 2019.

The supplier ranked 13th on China's list, followed by the US which delivered 786,638 mt of crude oil to China in May.

The US arrivals were at an eight-month high despite falling 57.8% year on year from 1.86 million mt in May 2018.

Sinopec's refineries have booked US cargoes for delivery in the months between June and September and the refiner' trading company, Unipec, has even found an alternative way of shipping barrels between the two countries that cuts travel time in half by utilizing Panama's Pacific terminal, Platts reported previously.

This suggests that the trade flow between the two countries was sustained despite trade tensions.

Chinese refiners and analysts expect the coming trade talks between China's Xi Jinping and the US' Donald Trump during the G20 meeting in Osaka, Japan over the weekend, to provide some direction.

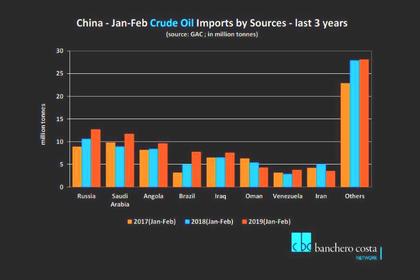

RUSSIA RETURNS TO TOP SEAT

Russia returned to the top of China's list of crude suppliers in May as shipments from Saudi Arabia fell.

China received 6.36 million mt of crude from Russia in May, rising 8.9% year on year and 3.8% from April.

On the contrary, supplies from Saudi Arabia dropped 25.3% month on month to 4.7 million mt in May, losing the top seat it had been in from February to April.

Meanwhile, increasing demand for Nemina crude from independent refiners had pushed Malaysia to become one of China's top 10 crude suppliers in May with 1.38 million mt of arrivals. The last time Malaysia was one of China's top 10 suppliers was in April 2017, when it was ranked tenth.

Nemina is blended in Malaysia with different origin crudes. It was typically blended for refineries under ChemChina, and has now found more outlets among independent refiners in Shandong province in eastern China.

In May, independent refineries and ChemChina imported 1.31 million mt of crude from Malaysia, including 1.06 million mt of Nemina, S&P Global Platts' data showed. Last month's imports from Malaysia surged 169.1% year on year and 119.9% from April.

Platts will publish China's year-to-date crude imports by country once it is available on the website authorized by GAC.

-----

Earlier: