LNG RISKS UP

REUTERS - Construction delays and cost blowouts could hit the next wave of liquefied natural gas (LNG) projects as there are a limited number of contractors able to handle the huge projects, three developers said on Wednesday.

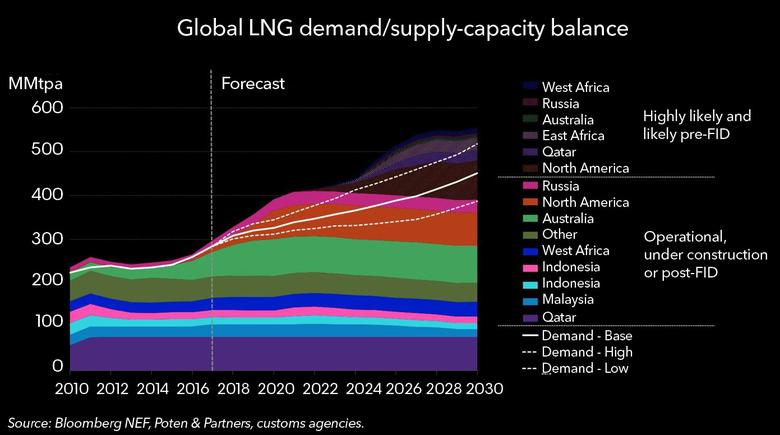

Around $200 billion in projects across the globe from Australia to the United States are racing to be approved over the next two years, vying to provide around 65 million tonnes of new annual supplies that are needed by 2025, according to estimates by consultants Wood Mackenzie.

The race is not just to make final investment decisions (FIDs) on projects, but to enter front end engineering and design (FEED) work to lock in contractors before others snap them up, the three developers said at Credit Suisse's Australian Energy Conference.

"Unless you're in FEED in the next six to nine months, unless you're in FID in the next two years, there's going to be no one to build your project," Oil Search Executive General Manager Ian Munro told the conference.

Oil Search aims to enter FEED in the next few months with its major partners Exxon Mobil Corp and Total SA on a $13 billion expansion of the PNG LNG plant in Papua New Guinea.

Martin Houston, co-founder of Tellurian Inc, which wants to make FID this year on a $30 billion LNG project in the United States, said LNG developers who fail to sign major contractors, such as Bechtel Corp or Chiyoda Corp, who can offer fixed price construction contracts are likely to struggle to make much profit.

Tellurian has lined up Bechtel for its 27.5 million-tonne-a-year project with a lump sum contract, which Houston said gave it an advantage over rival projects.

"We can say to our customers this is exactly the price you're going to pay. We're competing with second wave projects that have absolutely no idea how they're pricing anything," Houston told the conference.

To win project approvals, developers are pushing to line up long-term buyers, but with spot prices stuck at three-year lows and a flood of cheap U.S. LNG, buyers are holding out for lower prices from new projects worldwide.

Oil Search and Santos played down that threat.

Santos is a stakeholder in PNG LNG and is also marketing gas from the Barossa field off northern Australia that may feed the Darwin LNG project run by ConocoPhillips.

Santos' head of gas commercialisation, Jane Norman, said Australia's and Papua New Guinea's locations gave their projects an advantage in selling to Asian buyers, and also offered the diversity and security of supply that buyers want.

Oil Search's Munro said the high heating value of Papua New Guinea's gas, valued by Japan and South Korea, also meant that its LNG is not competing directly with U.S. gas.

Despite those advantages, cheap U.S. gas prices are setting a low bar for pricing, Norman said, with Santos focused on trying to deliver LNG into Asia at $7 to $9 per million British thermal units (mmBtu).

In contrast, five years ago, before the rapid rise in U.S. output, the former CEO of Santos, David Knox, said new Australian projects would be viable as long as they could deliver gas to Tokyo for $14 per mmBtu.

"What we're seeing now with the U.S. LNG coming in is that the whole market is focused on taking costs out of the system," Norman told the conference.

-----

Earlier: