NORWAY'S FUND RENEWABLE INVESTMENT

WSJ - Norway's sovereign-wealth fund is embracing renewable energy and winding down fossil-fuel investments.

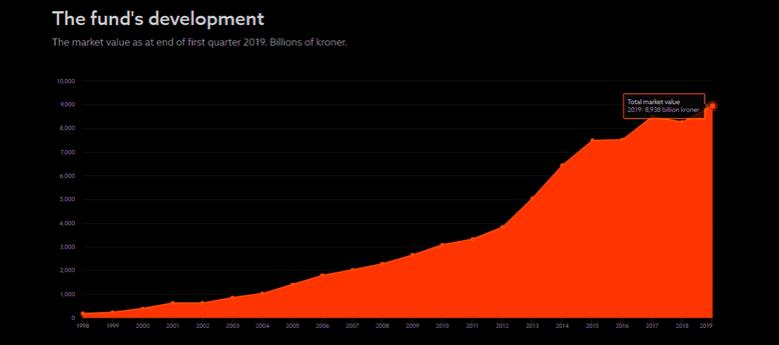

The Scandinavian nation's parliament voted on Wednesday to instruct its $1 trillion fund to pull an estimated more than $13 billion from oil, gas and coal extracting companies and move up to $20 billion into renewable-energy projects and companies, representing around 2% of the fund.

The Government Pension Fund Global—which has around 6% of its holdings in fossil-fuel equities—won't pull investments from major oil companies, but will divest from smaller energy exploration and production firms, according to a proposal from the Ministry of Finance. The move could affect several of its U.S. investments including its 1.08% stake in Anadarko Petroleum Corp. , 0.98% in Occidental Petroleum Corp. and 0.96% in EOG Resources Inc.

EOG declined to comment while Andarko and Occidental didn't respond to requests.

Norway's sovereign-wealth fund is one of the largest in the world, investing in nearly 9,200 companies globally as of the end of 2018, according to government data. It has a stake in some 341 oil-and-gas companies, the largest share in the U.S., at 31% of those holdings.

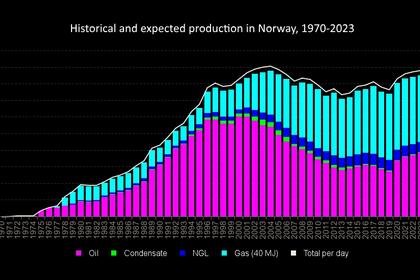

Norway forged its social wealth fund in 1990 with profits from the North Sea oil fields. The country's divestment comes as government pension funds face mounting political pressure to exit fossil fuels and realign their strategies around green businesses and clean energy to meet the goals of the Paris Agreement on climate change.

"Unless oil companies dramatically increase their investment in renewables and change their business model, I expect the political pressure for more divestment will increase," said Kari Elisabeth Kaski, the finance committee lead of the Socialist Left party.

While political forces helped drive the divestment, the decision also reduces financial risk because the oil-and-gas industry is no longer as profitable since the oil-price drop in 2014—while renewables are in a growth phase, said Tom Sanzillo, director of finance at the Institute for Energy Economics and Financial Analysis, a research firm.

Anders Runevad, chief executive at Denmark's Vestas Wind Systems A/S, one of the world's largest listed wind-power companies, said the decision would help guarantee a solid return for future generations.

"We are at a tipping point in terms of where to invest to create long-term value, which is driven by the clear need to act on the global climate crisis and renewable energy increasingly outcompeting fossil fuel on cost," Mr. Runevad said.

Proponents of fossil fuels disagree with the reasoning behind divesting from oil and gas, pointing to how coal, oil and natural gas will account for 77% of energy by 2040 globally, according to the U.S. Energy Information Administration.

"Clean natural gas and oil power our modern world—and there has never been a better time to invest in it," said a spokeswoman for the American Petroleum Institute.

Some divestment analysts argue that Norway's decision isn't significant since its fund will retain investments in oil-and-gas giants, including its 2.45% stake in Royal Dutch Shell PLC and 0.94% in Exxon Mobil Corp. as of the end of 2018.

"Norway's empty gesture decision to divest its oil fund from select fossil fuel companies is hypocritical at worst and limited at best," said a spokesman for Divestment Facts, a project of the Independent Petroleum Association of America, a trade association representing U.S. oil and gas producers.

-----

Earlier: