OIL DEMAND GROWTH 1.2 - 1.4 MBD

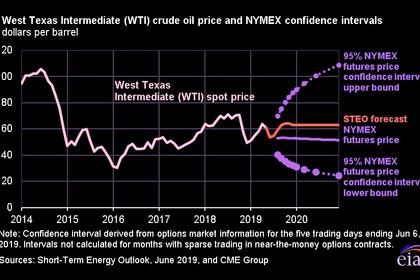

IEA - Volatility has returned to oil markets with a dramatic sell-off in late May seeing Brent prices fall from $70/bbl to $60/bbl.

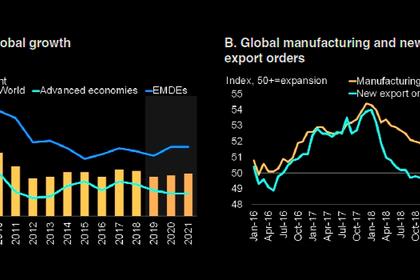

In May, the OECD published an outlook for global GDP growth for 2019 of 3.2%, lower than our previous assumption. World trade growth has fallen back to its slowest pace since the financial crisis ten years ago, according to data from the Netherlands Bureau of Economic Policy Analysis and various purchasing managers' indices.

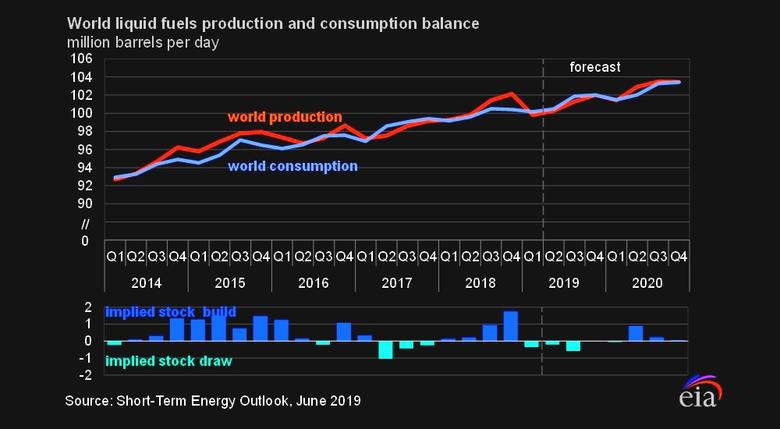

The consequences for oil demand are becoming apparent. In 1Q19, growth was only 0.3 mb/d versus a very strong 1Q18, the lowest for any quarter since 4Q11. The main weakness was in OECD countries where demand fell by a significant 0.6 mb/d, spread across all regions. There were various factors: a warm winter in Japan, a slowdown in the petrochemicals industry in Europe, and tepid gasoline and diesel demand in the United States, with the worsening trade outlook a common theme across all regions. In contrast, the non-OECD world saw demand rise by 0.9 mb/d, although recent data for China suggest that growth in April was a lacklustre 0.2 mb/d. In 2Q19, we see global demand growth 0.1 mb/d lower than in last month's Report. For now though, there is optimism that the latter part of this year and next year will see an improved economic picture. The OECD sees global GDP growth rebounding to 3.4% in 2020, assuming that trade disputes are resolved and confidence rebuilds. This suggests that global oil demand growth will have scope to recover from 1.2 mb/d in 2019 to 1.4 mb/d in 2020.

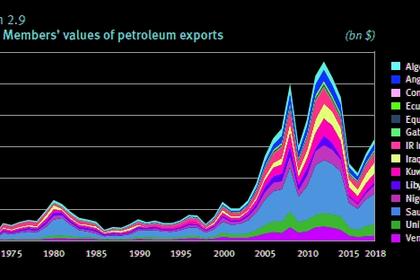

Meeting the expected demand growth is unlikely to be a problem. Plentiful supply will be available from non-OPEC countries. The US will contribute 90% of this year's 1.9 mb/d increase in supply and in 2020 non-OPEC growth will be significantly higher at 2.3 mb/d with US gains supported by important contributions from Brazil, Canada, and Norway. Later this month, Vienna Agreement oil ministers, faced with short-term uncertainty over the strength of demand and relentless supply growth from their competitors, are due to discuss the fate of their output deal.

Ministers will note that OECD oil stocks remain at comfortable levels 16 mb above the five-year average. However, they will also note that although in 1Q19 weak demand helped create a surplus of 1.1 mb/d, in 2Q19 the market is in deficit by an estimated 0.4 mb/d, with the backwardated price structure reflecting tighter markets. This deficit is partly due to the fact that in May the Vienna Agreement countries cut output by 0.5 mb/d in excess of their committed 1.2 mb/d. In 3Q19, the market could receive further support from an expected pick-up in refining activity.

Recently, high levels of maintenance in the US and Europe, low runs in Japan and Korea, and fallout from the Druzhba pipeline contamination contributed to weak growth in global refining throughput. This could be about to change: according to our estimates, crude runs in August could be about 4 mb/d higher than in May. This might cause greater tightness in crude markets, particularly for sour barrels if the Vienna Agreement is extended and there is no change in the situations in Iran and Venezuela. Of course, much depends on the strength of oil demand later in the year.

There is plenty of non-OPEC supply growth available to meet any likely level of demand, assuming no major geopolitical shock, and the OPEC countries are sitting on 3.2 mb/d of spare capacity. This is welcome news for consumers and the wider health of the currently vulnerable global economy, as it will limit significant upward pressure on oil prices. However, this must be viewed against the needs of producers particularly with regard to investment in the new capacity that will be needed in the medium term.

-----

Earlier: