OIL PRICE: ABOVE $60

REUTERS - Oil prices plunged by more than 1.5% to below $61 a barrel on Monday, extending last week's heavy losses as deepening U.S. trade wars fanned fears of a global economic slowdown.

Saudi Arabia, the de-facto leader of OPEC, sought to stem the price slide with assurances that the group of oil producers together with Russia would continue managing global crude supplies to avoid a surplus.

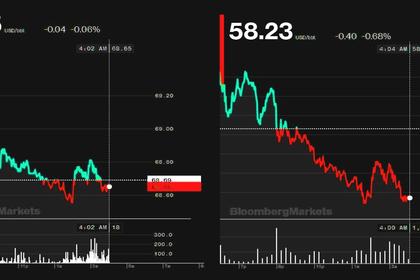

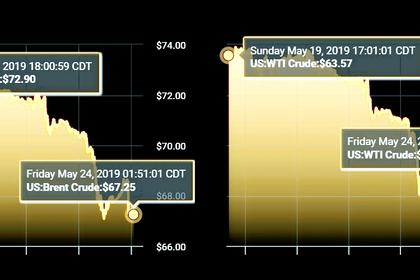

Front-month Brent crude futures were at $60.96 at 0844 GMT, down $1.03 or 1.7% below Friday's close. Prices had dropped by more than 3% on Friday, with May recording the biggest monthly loss in six months.

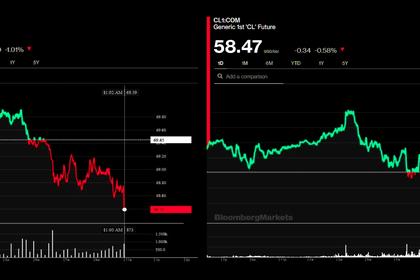

U.S. West Texas Intermediate (WTI) crude futures were at $52.98 per barrel, down 52 cents, or 1%.

Global markets have reeled in recent weeks over concerns that the global economy could stall amid rising trade tensions between the United States and China, the world's two largest economies and biggest energy consumers.

SUPPLY ASSURANCES

Brent crude oil prices have dropped almost 20% from their 2018 peak as global supplies tightened due to output curbs by the Organization of the Petroleum Exporting Countries and Russia, as well as a drop in Iranian exports due to U.S. sanctions and Venezuelan production.

Saudi Arabia, the world's top exporter, pumped 9.65 million barrels of oil per day (bpd), cutting deeper than its production target under a global pact to reduce oil supply, a Saudi oil industry source said on Monday.

The Saudi output target under the OPEC-led pact is 10.3 million bpd.

U.S. drillers this week increased the number of oil rigs operating for the first time in four weeks. Weekly production last stood at a record 12.3 million bpd.

-----

Earlier: