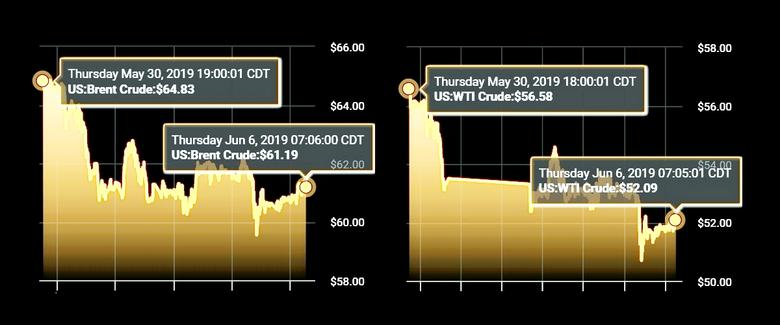

OIL PRICE: ABOVE $61 YET

REUTERS - Oil prices on Thursday hovered around their lowest levels since January as markets remain under pressure from rising U.S. supply and stalling demand amid an economic slowdown.

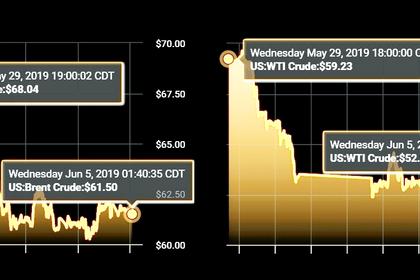

Front-month Brent crude futures, the international benchmark for oil prices, were at $60.50 at 0108 GMT. That was 13 cents, or 0.2%, below last session's close.

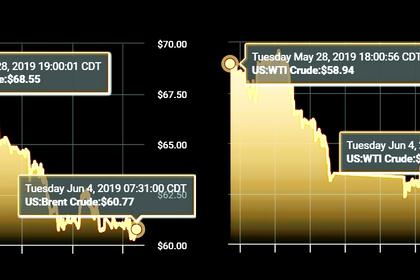

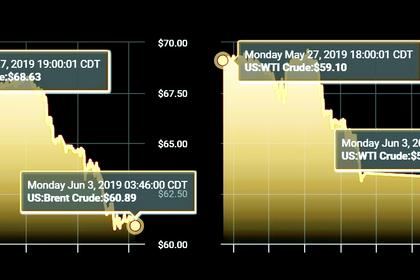

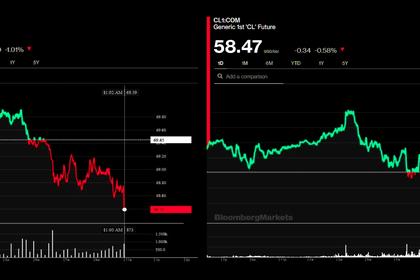

U.S. West Texas Intermediate (WTI) crude futures were at $51.62 per barrel, 6 cents, or 0.1%, below their last settlement.

Brent and WTI on Wednesday hit their lowest levels since January, at $59.45 and $50.60 per barrel respectively, amid a surge in U.S. crude inventories and record production, and as a global economic slowdown was starting to hit energy demand.

U.S. crude oil production rose to a record 12.4 million barrels per day (bpd) in the week to May 31, the Energy Information Administration (EIA) said on Wednesday, an increase of 1.63 million bpd since May 2018.

Amid surging output, U.S. commercial crude oil inventories surged by 6.8 million in week to May 31, to 483.26 million barrels, their highest levels since July 2017.

The Middle East-dominated producer club of the Organization of the Petroleum Exporting Countries (OPEC) as well as some non-affiliated producers including Russia, known as OPEC+, have been withholding oil supply since the start of the year to prop up the market.

With supply ample despite the OPEC-led cuts, much will depend on demand.

Global economic growth took a dip late last year but started to recover in early 2019, but analysts now warn that growth is threatened again.

-----

Earlier: