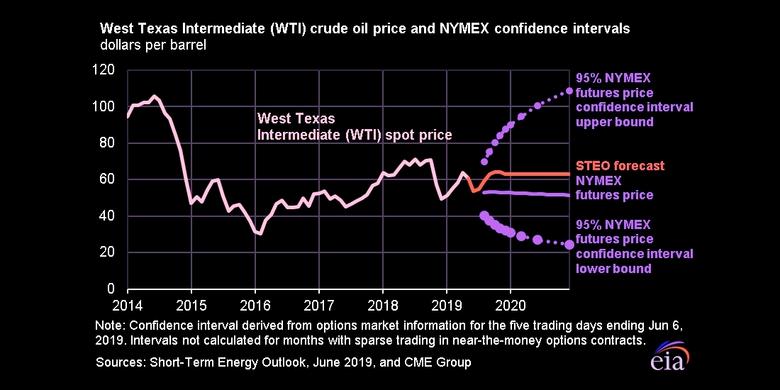

OIL PRICES 2019-20: $67

U.S. EIA - SHORT-TERM ENERGY OUTLOOK

Forecast Highlights

Global liquid fuels

Brent crude oil spot prices averaged $71 per barrel (b) in May, largely unchanged from April 2019 and almost $6/b lower than the price in May of last year. However, Brent prices fell sharply in recent weeks, reaching $62/b on June 5. EIA forecasts Brent spot prices will average $67/b in 2019, $3/b lower than the forecast in last month's STEO, and remain at $67/b in 2020. EIA's lower 2019 Brent price path reflects rising uncertainty about global oil demand growth.

EIA forecasts global oil inventories will decline by 0.3 million barrels per day (b/d) in 2019 and then increase by 0.3 million b/d in 2020. Although global liquid fuels demand outpaces supply in 2019 in EIA's forecast, global liquid fuels supply is forecast to rise by 2.0 million b/d in 2020, with 1.4 million of that growth coming from the United States. Global oil demand rises by 1.4 million b/d in 2020 in the forecast, up from expected growth of 1.2 million b/d in 2019.

Annual U.S. crude oil production reached a record 11.0 million b/d in 2018. EIA forecasts that U.S. production will increase by 1.4 million b/d in 2019 and by 0.9 million b/d in 2020, with 2020 production averaging 13.3 million b/d. Despite EIA's expectation for slowing growth, the 2019 forecast would be the second-largest annual growth on record (following 1.6 million b/d in 2018), and the 2020 forecast would be the fifth-largest growth on record.

For the 2019 summer driving season, which runs from April through September, EIA forecasts that U.S. regular gasoline retail prices will average $2.76 per gallon (gal), down from an average of $2.85/gal last summer. The lower forecast gasoline prices primarily reflect EIA's expectation of lower crude oil prices this summer.

Natural gas

The Henry Hub natural gas spot price averaged $2.64/million British thermal units (MMBtu) in May, almost unchanged from April. EIA expects strong growth in U.S. natural gas production to put downward pressure on prices in 2019. EIA expects Henry Hub natural gas spot prices will average $2.77/MMBtu in 2019, down 38 cents/MMBtu from 2018. EIA expects natural gas prices in 2020 will again average $2.77/MMBtu.

EIA forecasts that U.S. dry natural gas production will average 90.6 billion cubic feet per day (Bcf/d) in 2019, up 7.2 Bcf/d from 2018. EIA expects natural gas production will continue to grow in 2020, albeit at a slower rate, averaging 91.8 Bcf/d next year.

U.S. natural gas exports averaged 9.9 Bcf/d in 2018, and EIA forecasts that they will rise by 2.5 Bcf/d in 2019 and by 2.9 Bcf/d in 2020. Rising exports reflect increases in liquefied natural gas exports as new facilities come online. Rising natural gas exports are also the result of an expected increase in pipeline exports to Mexico.

EIA estimates that natural gas inventories ended March at 1.2 trillion cubic feet (Tcf), 15% lower than levels from a year earlier and 28% lower than the five-year (2014–18) average. EIA forecasts that natural gas storage injections will outpace the previous five-year average during the 2019 April-through-October injection season and that inventories will reach almost 3.8 Tcf at the end of October, which would be 17% higher than October 2018 levels and about equal to the five-year average.

Electricity, coal, renewables, and emissions

EIA expects the share of U.S. total utility-scale electricity generation from natural gas-fired power plants to rise from 35% in 2018 to 37% in 2019 and to 38% in 2020. EIA forecasts that the share of generation from coal will average 24% in 2019 and 23% in 2020, down from 27% in 2018. The forecast nuclear share of generation falls from 20% in 2019 to 19% in 2020, reflecting the retirement of some nuclear reactors. Hydropower averages a 7% share of total generation in the forecast for 2019 and 2020, similar to 2018. Wind, solar, and other nonhydropower renewables together provided 10% of U.S. generation in 2018. EIA expects they will provide 11% in 2019 and 13% in 2020.

EIA forecasts that renewable fuels, including wind, solar, and hydropower, will collectively produce 18% of U.S. electricity in 2019 and almost 20% in 2020. EIA expects that annual generation from wind will surpass hydropower generation for the first time in 2019 to become the leading source of renewable electricity generation and maintain that position in 2020.

EIA forecasts that U.S. coal consumption, which reached a 39-year low of 687 million metric tons (MMst) in 2018, will fall to 602 MMst in 2019 and to 567 MMst in 2020. The falling consumption reflects lower demand for coal in the electric power sector.

After rising by 2.7% in 2018, EIA forecasts that U.S. energy-related carbon dioxide (CO2) emissions will decline by 2.0% in 2019 and by 0.9% in 2020. EIA expects U.S. CO2 emissions will fall in 2019 and in 2020 because its forecast assumes that temperatures will return to near normal, and because the forecast share of electricity generated from natural gas and renewables increases while the forecast share generated from coal, which produces more CO2 emissions, decreases. Energy-related CO2 emissions are sensitive to weather, economic growth, energy prices, and fuel mix.

-----

Earlier: