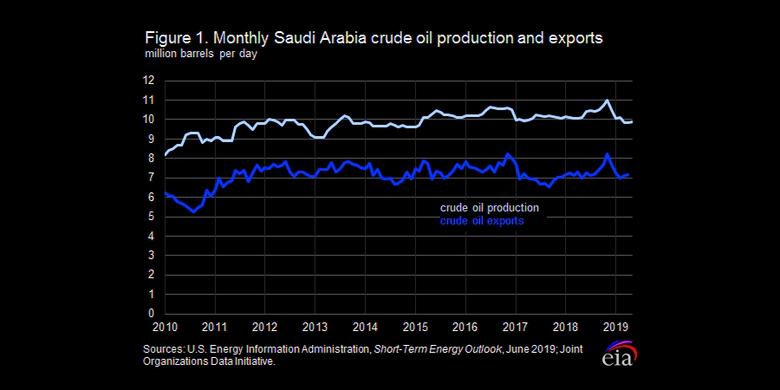

SAUDI ARABIA'S OIL PRODUCTION 9.9 MBD

U.S. EIA - The U.S. Energy Information Administration (EIA) estimates that during May 2019, Saudi Arabia's crude oil production approached a four-year low, averaging an estimated 9.9 million barrels per day (b/d). Production declined more than 1 million b/d since its estimated all-time high production levels in October and November 2018 (Figure 1). Although the country's total crude oil exports are also lower than recent highs, its crude oil exports to some Asia Pacific countries actually increased during the period of declining production. China in particular has increased its crude oil imports from Saudi Arabia, which is partially a result of new Chinese refining capacity. In contrast, U.S. crude oil imports from Saudi Arabia reached a 31-year low in February, with weekly estimates for April, May, and June suggesting even further declines.

Four Asia Pacific countries that publish crude oil imports by country of origin—China, Japan, South Korea, and Taiwan—collectively imported an average of 3.5 million b/d of crude oil from Saudi Arabia in 2018 (Figure 2). Chinese and Japanese 2019 year-to-date crude oil imports from Saudi Arabia are higher than their 2018 annual averages, whereas Taiwan's are flat and South Korea's have declined slightly. China's crude oil imports from Saudi Arabia, in particular, have increased by 0.4 million b/d year-to-date through April compared with the 2018 annual average, significantly higher than Japan's increase of less than 0.1 million b/d.

In contrast, U.S. crude oil imports from Saudi Arabia have declined year-to-date through March 2019 compared with the 2018 average by more than 0.2 million b/d, averaging 0.6 million b/d for the first quarter of 2019. Weekly estimates through June 14 of this year show continued declines, indicating that imports from Saudi Arabia averaged less than 0.5 million b/d in May and the first half of June. As a result of these shifts in crude oil flows, the U.S. share of total Saudi Arabian crude oil exports fell to 9% in March, and China's share increased to 24% (Figure 3). Collectively, the United States, China, Japan, Taiwan, and South Korea historically accounted for about 60%–65% of total Saudi Arabian crude oil exports.

These recent changes in crude oil trade patterns are partially because of long-term structural trends within China and the United States, but they are also a result of recent oil market dynamics. From 2010 through 2018, EIA estimates total Chinese petroleum consumption has increased from 9.3 million b/d to 13.9 million b/d, whereas Chinese domestic production has increased from 4.6 million b/d to 4.8 million b/d. As a result, China's need to meet incremental oil consumption has come primarily from imports. China's crude oil imports from Saudi Arabia have gradually increased in recent years, and in March 2019 reached the highest level for any month since at least 2004, at 1.7 million b/d. Other countries, including Russia and Brazil, have had larger increases in crude oil export growth to China, however, with Russia overtaking Saudi Arabia as the largest source of crude oil on an annual average basis in 2016.

U.S. crude oil imports, on the other hand, have steadily decreased during this period as domestic crude oil production has increased. In addition, U.S. crude oil imports from members of the Organization of the Petroleum Exporting Countries (OPEC) have declined, in particular, following increases from other countries such as Canada. Canadian crude oil can substitute for certain OPEC grades and have lower transportation costs when shipped by available pipeline capacity.

Saudi Arabian crude oil exports to China increased recently at least in part as a result of the startup of a new 0.4 million b/d refinery in Dalian, Liaoning Province, which has a supply agreement with Saudi Aramco, Saudi Arabia's national oil company. Saudi Aramco also has a supply agreement with another 0.4 million b/d refining and petrochemical complex in Zhejiang Province, which started trial operations this year.

Other near-term developments, however, could reduce the volume of Saudi Arabian crude oil headed to China for May, June, and through the summer. Saudi Arabia typically increases domestic crude oil consumption in the summer months because the country directly burns the fuel for power generation. Although Saudi Arabia has gradually been increasing the use of fuel oil and natural gas instead of crude oil for power generation, the seasonal increase is dependent on the weather and can still amount to several hundred thousand barrels per day in additional domestic consumption during summer months. The five-year (2014–18) average crude oil burn for electric power generation peaks in July at 0.7 million b/d, an increase of 0.3 million b/d from the April average. In addition, Chinese crude oil refinery demand could be lower in the second quarter of 2019 than in the first quarter of 2019. Bloomberg data suggest that Chinese refinery outages in May and June month-to-date were 2.1 million b/d and 1.7 million b/d, respectively, 0.5 million b/d and 0.6 million b/d higher than their respective five-year averages for those months.

Recent global oil supply issues could keep Saudi Arabian crude oil exports to China, Japan, South Korea, and Taiwan relatively high in the coming months, however, in spite of the previously mentioned seasonal factors. These four countries were all initially granted Iranian sanctions waivers through May 2019. However, because waivers were not renewed, each country will likely need an alternative to Iranian crude oil. This development could keep their crude oil imports from Saudi Arabia near first-quarter 2019 levels for the coming months as a partial substitute for Iranian barrels. Saudi Arabia's support of maintaining current OPEC production cuts or increasing output levels in the upcoming late-June or early-July OPEC meeting will be a critical determinant for future export flows.

-----

Earlier: