U.S. OIL PRODUCTION 12.2 MBD

РЕЙТЕР -

-----

Раньше:

2018, March, 14, 11:45:00

REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $60.77 a barrel at 0753 GMT, up 6 cents, or 0.1 percent, from their previous settlement. Brent crude futures LCOc1 were at $64.62 per barrel, down just 2 cents from their last close.

|

2018, March, 7, 15:00:00

РЕЙТЕР - К 9.17 МСК фьючерсы на североморскую смесь Brent опустились на 0,85 процента до $65,23 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $62,07 за баррель, что на 0,85 процента ниже предыдущего закрытия.

|

2018, March, 7, 14:00:00

EIA - North Sea Brent crude oil spot prices averaged $65 per barrel (b) in February, a decrease of $4/b from the January level and the first month-over-month average decrease since June 2017. EIA forecasts Brent spot prices will average about $62/b in both 2018 and 2019 compared with an average of $54/b in 2017.

|

2018, March, 5, 11:35:00

РЕЙТЕР - К 9.28 МСК фьючерсы на североморскую смесь Brent поднялись на 0,33 процента до $64,58 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $61,44 за баррель, что на 0,31 процента выше предыдущего закрытия.

|

2018, March, 4, 11:30:00

МИНФИН РОССИИ - Средняя цена нефти марки Urals по итогам января – февраля 2018 года составила $ 65,99 за баррель.

|

2018, February, 27, 14:15:00

РЕЙТЕР - К 9.18 МСК фьючерсы на североморскую смесь Brent опустились на 0,15 процента до $67,40 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $63,80 за баррель, что на 0,17 процента ниже предыдущего закрытия.

|

2018, February, 27, 14:05:00

МИНФИН РОССИИ - Средняя цена на нефть Urals за период мониторинга с 15 января по 14 февраля 2018 года составила $66,26457 за баррель, или $483,7 за тонну.

|

U.S. OIL PRODUCTION 12.2 MBD

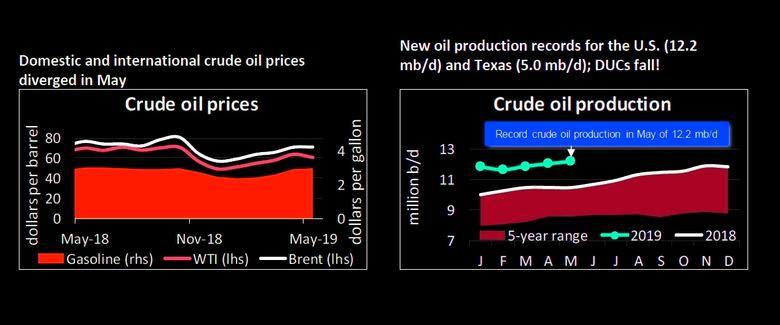

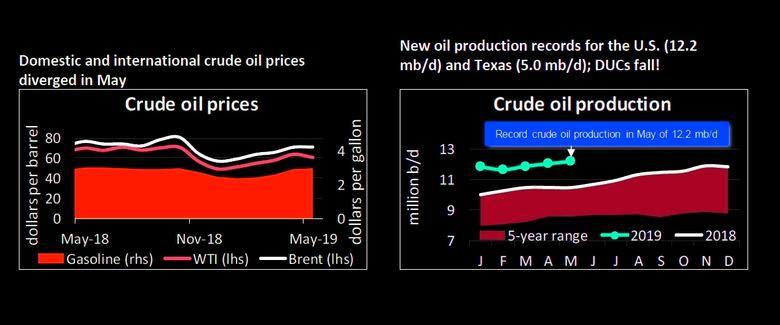

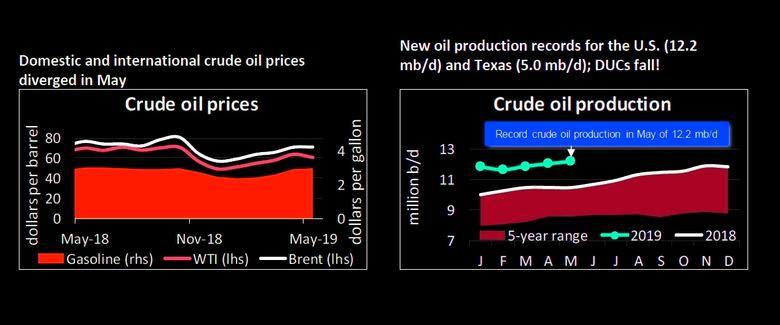

API - The American Petroleum Institute today released its latest Monthly Statistical Report and API Industry Outlook detailing the continued growth and resiliency of the U.S. natural gas and oil industry. U.S. crude oil production reached a new all-time high of 12.2 million barrels per day (mb/d) in May 2019 driven by a combination of productivity gains and new pipeline capacity that enabled previously drilled but uncompleted wells (DUCs) to begin supplying product to the market.

Highlights from the May 2019 Monthly Statistical Report:

- World-leading U.S. crude oil production of 12.2 million barrels per day (mb/d)

- Texas crude oil production exceeded 5.0 mb/d for the first time

- U.S. natural gas liquids production of 4.8 mb/d, the highest ever for the month of May

- Record U.S. petroleum exports at 8.1 mb/d, the highest ever for the month of May

- U.S. crude oil inventories increased by 10.5 percent over May 2018 levels despite the record exports

Highlights from the API Industry Outlook (Q2 2019):

- Oil markets appeared balanced despite an expected slowdown in the global economic outlook

- Solid productivity has underpinned continued natural gas and oil production growth, and the nationwide production rate has stabilized over the past three years as shale production has grown

- The Permian basin and Bakken formation are poised for continued growth with the expansion of pipeline takeaway capacity, which heightens urgency to expand U.S. crude export capacity

- Global LNG prices dropped to record lows driven by LNG capacity additions in the U.S. and Australia, which should stimulate global LNG demand

- Decreased ethane feedstock prices have supported competitiveness of U.S. petrochemical production that furthers the energy revolution

“The historic milestones in U.S. oil production this quarter underscore the necessity of pipeline infrastructure to continued U.S. energy leadership,” said API Chief Economist Dean Foreman. “With the surge expected to continue, our focus must now shift toward ensuring the necessary infrastructure and logistics are in place to support growth in providing energy to consumers, as well as exports. If current predictions by the U.S. Energy Information Administration and others prove correct, the U.S. will likely push up against the lower bound of existing crude oil export capacity by the end of this year, which creates urgency around building new infrastructure to ensure we don’t miss out on this rare opportunity.”

-----

Earlier:

2019, June, 18, 17:20:00

U.S. PRODUCTION: OIL + 70 TBD, GAS + 798 MCFD

U.S. EIA - Crude oil production from the major US onshore regions is forecast to increase 70,000 b/d month-over-month in June from 8,450 to 8,8,520 thousand barrels/day, gas production to increase 798 million cubic feet/day from 80,564 to 81,362 million cubic feet/day .

2019, June, 18, 17:15:00

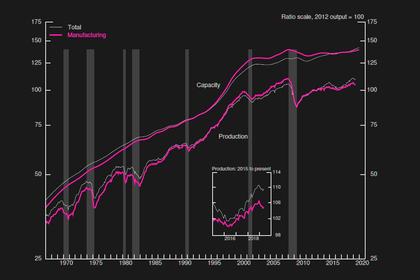

U.S. INDUSTRIAL PRODUCTION UP 0.4%

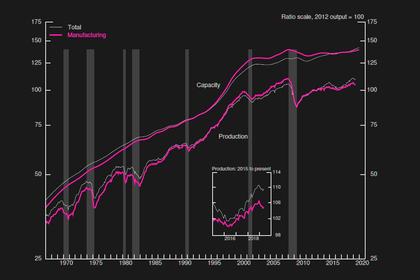

Industrial production rose 0.4 percent in May after falling 0.4 percent in April. The indexes for manufacturing and mining gained 0.2 percent and 0.1 percent, respectively, in May; the index for utilities climbed 2.1 percent. At 109.6 percent of its 2012 average, total industrial production was 2.0 percent higher in May than it was a year earlier. Capacity utilization for the industrial sector moved up 0.2 percentage point in May to 78.1 percent, a rate that is 1.7 percentage points below its long-run (1972–2018) average.

2019, June, 17, 12:10:00

U.S. RIGS DOWN 6 TO 969

BHGE - U.S. Rig Count is down 6 rigs from last week to 969, with oil rigs down 1 to 788, gas rigs down 5 to 181, and miscellaneous rigs unchanged at 0. Canada Rig Count is up 4 rigs from last week to 107, with oil rigs up 10 to 69 and gas rigs down 6 to 38.

All Publications »

Tags:

USA,

OIL,

GAS,

PRODUCTION