ARABIAN OIL DEMAND UP

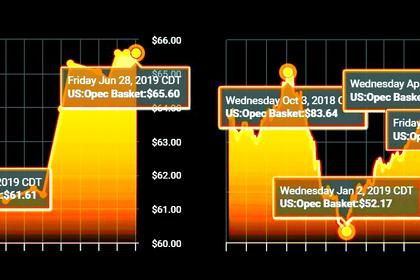

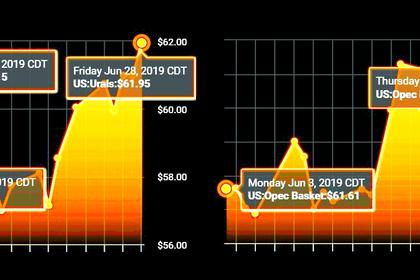

AN - Despite two major news events that should have supported the oil price, the market finished the week on a bearish note.

At the G20 summit, the US and China agreed not to escalate tariffs and instead resume trade talks. Meanwhile OPEC and its allies outside the group agreed a nine-month extension of production cuts taking us through the first quarter of 2020.

OPEC+, as the enlarged group has come to be known, also sealed a long-term cooperation agreement "the Charter of Cooperation," which aims to bring the 24 oil producing countries together to promote stability to a market that has been characterized by intense volatility in recent months.

So that all makes for a higher oil price? Well, not quite — as broader macroeconomic concerns kept a lid on prices as traders looked to the overall global demand picture.

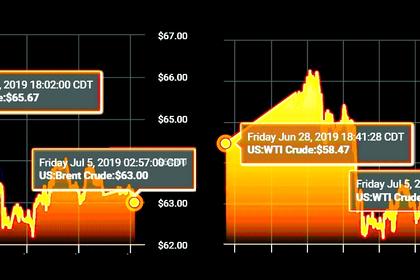

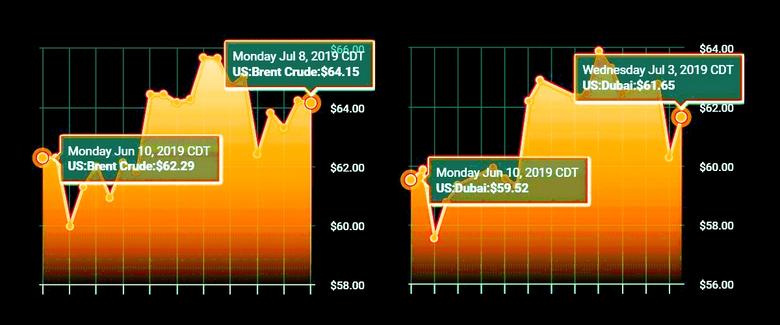

Brent crude fell to $64.23 per barrel at the end of the week. The grade remains some 15 percent off its late-April high, despite escalating tensions in the Arabian Gulf as shipping premiums soar because of the increased risk of attacks on tankers.

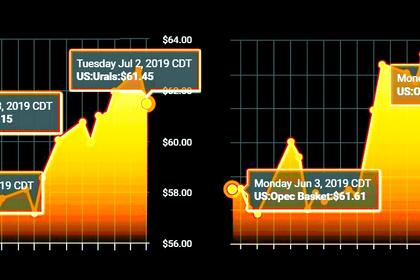

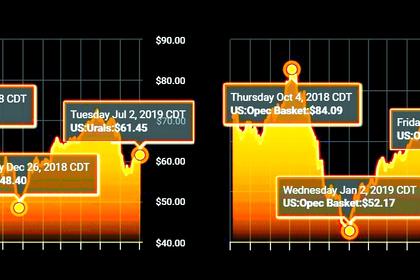

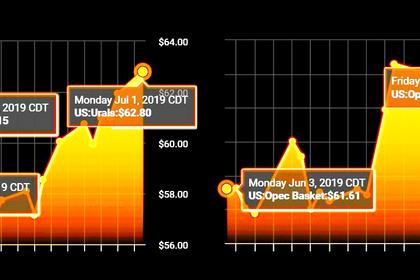

Still, the OPEC+ output cuts extension has made sour crude oil grades from the Arabian Gulf firmer amid a stronger physical spot market for medium and heavy sour crude grades.

This was clearly shown in a narrower Brent/Dubai spread that points to stronger demand for Arabian Gulf sour crude grades.

The resumption of trade negotiations between the world's two largest economies should pave the way for the recovery of commodity trade flows between the pair.

So though we have not seen it yet, that should eventually be reflected in a stronger oil price.

Despite the expected positive recovery of commodity trade flows, oil traders seem focused on the volatile geopolitical situation.

Some suggest that shale oil producers are the biggest beneficiary in gaining market share as US shale will likely continue to define the future of OPEC+.

However, it is questionable whether US shale producers will continue to pump more oil at lower prices, given that they are not profitable at current price levels.

Before the trade war, China was the largest oil importer of US shale oil, with almost 500,000 bpd last year that went to zero once the trade dispute started even though Beijing has not imposed tariffs on US crude imports.

A resumption of more normalized trade flows between the US and China should benefit demand for US oil, especially after the removal of Iranian and Venezuelan barrels from the market.

-----

Earlier: