AUSTRALIA'S COAL TO CHINA UP

PLATTS - Coal exports from the Port of Gladstone in Queensland, Australia, rose to a five-month high in June aided by a surge in volumes to China, which helped offset a slump in total Chinese coal imports, data from the Gladstone Ports Corp. showed Monday.

A total of 6.43 million mt were exported from Gladstone, up 2% year on year and 8% month on month, and the highest monthly volume since the 6.45 million mt seen in January, GPC figures showed.

CHINA'S STEEL SECTOR'S APPETITE GROWS IN 2019

China was sent the third largest volumes in a single month since the beginning of 2018 with a total of 1.41 million mt. While still down 7% from June last year, it was a 93% increase from May.

"Seasonal influences and import policies have led to fluctuations in China's metallurgical coal imports over 2019," Australia's Department of Industry said last week.

"Chinese [overall] imports fell sharply on a month-to-month basis in February -- as they do every year -- due to the Lunar New Year celebrations, and by 5% year on year, as extended customs clearance times held up cargoes at some ports," it said.

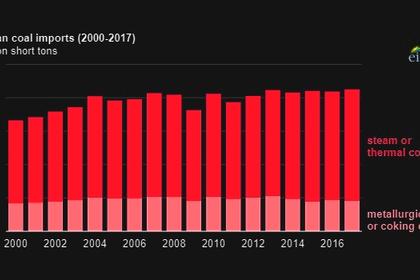

It added that China's steel sector, buoyed by the government's stimulus measures such as tax cuts and increased infrastructure investment, has increased its demand for metallurgical coal.

China's total metallurgical coal imports are forecast to rise to 68 million mt in 2019, from 65 million mt last year, before gradually declining to 62 million mt in 2021, as the Chinese government eases on the stimulus policies and as steel production moderates, the department added.

SOUTH KOREA-BOUND EXPORTS FALL TO 13-MONTH LOW

Gladstone coal exports to South Korea fell to a 13-month low of 547,000 mt in June, slumping 43% year on year and 49% month on month, according to GPC, while forecasts for the country's total metallurgical coal imports show a steady but subdued view for the next couple of years.

"South Korea's [overall] imports of metallurgical coal declined by 10% year on year in the first three months of 2019, despite steel production growing by 1.1% over the same period," the department said.

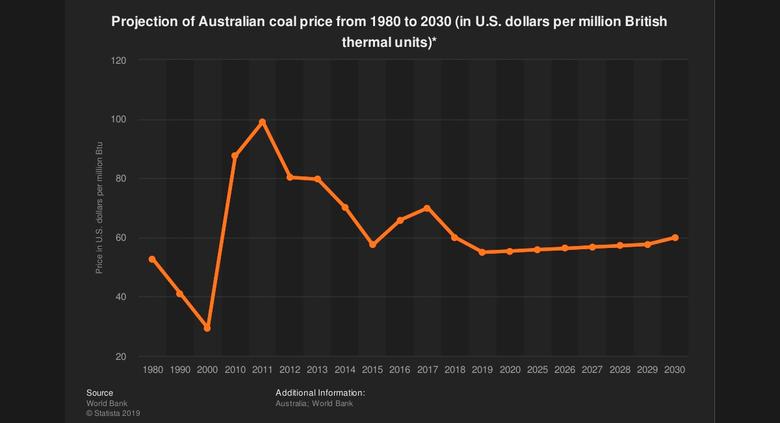

"Demand for metallurgical coal may have been dampened by high prices. Imports from Australia declined by 30%, while imports from Russia were flat, and imports from Canada increased by 31%, reflecting growing diversification in where South Korea sources metallurgical coal," it said.

The Canberra-based unit is expecting South Korea's met coal demand to edge lower from 35 million mt this year to 34 million mt/year in 2020 and 2021.

VOLUMES TO JAPAN RISE

There was a firm uptick in Gladstone's coal volumes to Japan in June. With 1.64 million mt sent to Japan from Gladstone in June, the volume was up by 14% year on year and 20% month on month, GPC said.

"Japan's imports of metallurgical coal fell by 40% year on year in the first three months of 2019. Crude steel production fell by 5.8% over the same period, due to production disruptions and slowing residential and Olympics-related construction," The department said.

Subdued economic growth is expected to see Japan's total met coal imports fall from 48 million mt/year in 2018, 2019 and 2020, to 47 million mt in 2021, it said.

INDIA LARGEST EXPORT DESTINATION FOR FIFTH MONTH IN A ROW

India -- which is on track to be the world's largest importer of metallurgical coal -- was for the fifth month in a row the largest recipient of Gladstone coal, with a total of 1.77 million mt sent in June. The figure was up 14% year on year and down 5% from May, GPC said.

"Infrastructure projects and investment slowed in the lead up to the May general election. Imports of metallurgical coal are expected to recover following the conclusion of the elections, with infrastructure investment and urban development expected to remain a government priority," the Department of Industry said.

India's total imports of metallurgical coal is forecast to rise from 60 million mt in 2018 to 64 million mt this year, 67 million mt in 2020 and to 70 million mt in 2021, it said.

"Steel production is expected to grow to meet rising domestic consumption. However, the pace at which India's steel sector is able to expand remains uncertain, and presents a risk to the outlook, with the sector facing ongoing financial, regulatory and other challenges," it said.

-----

Earlier: