AUSTRALIA'S GAS PRICES: ABOVE

IEEFA - The staggering cost of gas in Australia

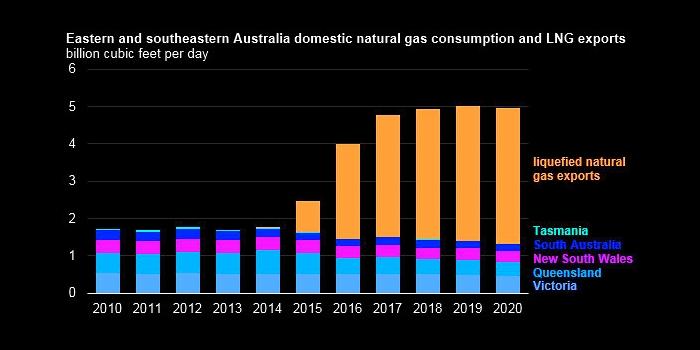

1. Australia is the largest LNG exporter in the world.

Australia is the leading global net exporter of gas, with exports from both the east and west coast of Australia. Qatar and the U.S. are the next lead exporters.

2. Gas prices on the eastern coast of Australia are higher than global parity.

Domestic gas is usually low cost for people living in top-tier gas exporting countries. However, people living on Australia's east coast (including the states of Victoria, Queensland, New South Wales, and Tasmania; as well as the Australian Capital Territory and Jervis Bay Territory) are paying well above international prices. At A$8-12 per gigajoule, east coast gas is twice the cost of gas that west Australian consumers pay.

This is because a few companies (effectively a cartel) are controlling both the price and the supply of gas to both retail and wholesale consumers on the east coast. This is occurring due to market deregulation in eastern Australia, and a lack of government oversight.

3. The eastern coast of Australia must import gas to meet demand.

The eastern coast of Australia produces three times more gas than it consumes. Most of this is exported, causing a shortage in domestic gas supplies. This is forcing a reliance on gas imports.

4. Australia is considering five import gas terminal proposals.

There are currently no import gas terminals in Australia. However, due to the shortage in domestic gas supplies, ExxonMobil has proposed an import terminal for Victoria, as has AGL; Australian Industrial Energy, Marubeni and Jera have all proposed a terminal each for Wollongong, New South Wales; Kogas has proposed a terminal for Newcastle, New South Wales; and Mitsubishi have lodged a proposal for South Australia. If these terminals are built, approximately 90% of the eastern Australian market will be supplied by imports.

Import gas terminals embed the cost of liquefication and shipping into the domestic price. This means prices will increase for domestic consumers. Liquefying gas for export/import is also a very energy intensive business. Allowing import terminals to proceed will ensure Australia's Paris Agreement targets are not met.

Australian consumers should not be paying additional costs, both in monetary and environmental terms, for gas already sourced from our region.

5. Increased gas production has not lowered the price of domestic gas.

In recent years, there has been a tripling in gas production on the eastern coast of Australia. At the same time, prices have tripled for people living in this region.

Australia's gas market is lacking a fundamental mechanism to ensure prices have international parity, and that is a competitive market. Without a competitive market, more gas production will not bring down the cost of gas.

6. New South Wales, Victoria, South Australia and Tasmania are producing sufficient gas to supply local markets.

Gas production from the south eastern states of New South Wales, Victoria, South Australia and Tasmania is above the levels needed to supply these domestic markets.

The Australian Energy Market Operator shows, in its Gas Statement of Opportunities 2019, that gas consumption in the south eastern states is below what is produced there. In 2018, actual production was 433 petajoules and consumption was just 431 petajoules.

Gas production in the southern states of New South Wales, Victoria and South Australia grows in the forecast period. It is expected that gas production will grow by 5% from 433 petajoules in 2018 to 456 petajoules in 2022.

7. Fracking has been losing money both in the U.S. and Australia.

Fracking is not a profitable industry. The U.S. fracking industry spent US$196 billion more than what it recouped from gas sold between 2010-2018.

There have also been massive fracking losses in Australia. The BG Group wrote down their Australian fracking project by AUS$5.4 billion before selling it to Shell. BHP and Santos have had multiple right-offs, while Origin wrote off an entire Queensland field because they were unable to find gas.

8. Coal seam gas is high cost gas.

The older coal seam gas fields in South Australia and the Bass Strait are fairly low-cost in terms of the production of gas.

Australia's newer fracking fields are high cost. Instead of producing gas between A$2.20 and A$2.70 a gigajoule as the operators expected, they produce gas between A$3.65 and A$6.40 a gigajoule, making it very expensive gas.

The fracking industry has misjudged the costs, both in terms of capital – as it is very expensive to build and operate the plants – but also in terms of what the fields actually produce. Operators have discovered the wells decline more quickly than expected, and fields produce less gas and more water, increasing costs.

9. High gas prices have crimped demand from industry.

Gas demand from the industrial sector has declined 14% since 2014. The worst is yet to come as legacy low-priced contracts roll off and companies are forced to pay globally uncompetitive prices – or shut down.

10.High gas prices have collapsed demand for gas powered electricity.

Gas usage for power generation is at its lowest level in a decade, at just 7.9% of Australia's National Energy Market in 2018. Gas demand for gas generated electricity in eastern Australia has declined 41% since 2014.

Simply put, gas is not a transition fuel in Australia. It is too expensive.

11.Gas is the price setter for electricity costs in Australia.

Under the rules of Australia's National Electricity Market, the gas market sets the price for electricity costs in Australia.

South Australia is home to the highest electricity prices in Australia.

The cost of domestic gas in South Australia is two times more than the U.S. and three times more than Qatar. South Australian gas consumers also pay twice the price of those in its neighbouring state of Western Australia.

South Australia's electricity market is the most concentrated in terms of competition, being primarily controlled by AGL Energy, Engie, and Origin Energy, holding 84% of the wholesale market and 86% of the retail market.

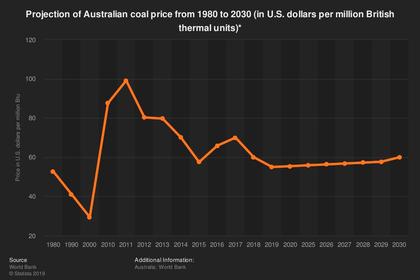

12.Global gas prices have collapsed.

The world is awash with gas and globally prices are very weak. In fact, prices for gas in Asia have collapsed.

Australians however are not the beneficiaries of their own natural wealth. Australian consumers pay more for gas than Australia's gas customers in Japan.

-----

Earlier: