BRAZIL'S GDP UP 0.8%

IMF - On July 15, 2019 the Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation with Brazil.

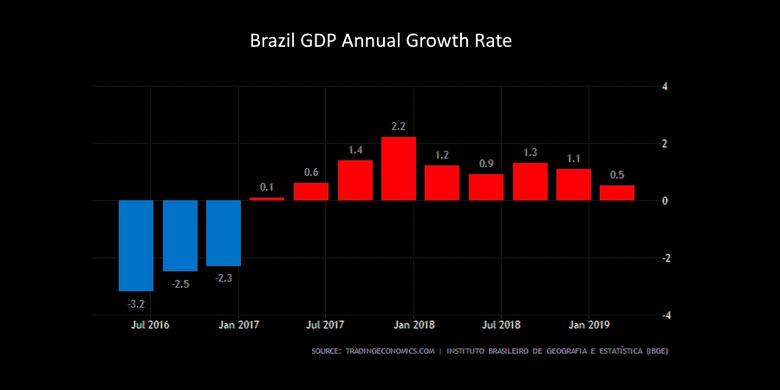

A sluggish recovery is underway, constrained by subdued aggregate demand and lackluster productivity. After contracting by almost 7 percent during the 2015-16 recession, real GDP grew by 1.1 percent per year in 2017 and 2018. Short-term economic indicators show weakness in the first half of 2019. Investment remains subdued, given large spare capacity and uncertainty over prospects for fiscal and structural reforms. Weak global growth and the recession in Argentina are holding back exports and contributed to a widening of the current account deficit to 0.8 percent of GDP last year. The fiscal stance was broadly neutral in 2018, with a slight improvement in the nonfinancial public sector primary balance to ˗1.7 percent of GDP. The central bank has held the policy rate at the historic low of 6.5 percent since March 2018, providing the economy with some monetary stimulus. Headline inflation is around the 4.25 percent inflation target for 2019, while core inflation is more muted. Improvement in social conditions has stalled in recent years, in part due to elevated unemployment rates.

Growth is projected at 0.8 percent in 2019 and to accelerate in 2020 conditional on the approval of a robust pension reform and favorable financial conditions. The current budget is guided by the federal expenditure ceiling, entailing a minor reduction of the structural primary balance in 2019. Compliance with the ceiling in the following years will depend on approval of the pension reform and other consolidation measures. The current account deficit is foreseen to deteriorate to 1.5 percent of GDP in 2019 mostly on account of one-off operations related to the energy sector and the recession in Argentina. Nonetheless, Brazil’s external position remains strong thanks to a large amount of reserves, a flexible exchange rate, and a contained current account deficit fully financed by large FDI inflows. The financial system is well capitalized. Intermediation margins in the banking sector remain high, hindering credit demand and investment.

Executive Board Assessment

Executive Directors agreed with the thrust of the staff appraisal. They concurred that the pace of the economic recovery has been sluggish and is subject to downside risks stemming from uncertainty on fiscal consolidation and structural reforms.

Directors underscored that fiscal consolidation and bold reforms are needed to address Brazil’s legacies of low growth and high public debt. They concurred that pension reform is imperative to ensure fiscal sustainability and improve equity, and welcomed recent progress in this area. Furthermore, to put public finances on a sustainable path, Directors considered that additional measures are required, including containing the public wage bill, reducing other current expenditure, and addressing budget rigidities. Simplifying the overly complicated and distortive tax system will support growth. Directors also emphasized the need to protect public investment and effective social programs, including Bolsa Familia.

Directors agreed that the current monetary policy stance should remain accommodative in the context of a still large output gap and anchored inflation expectations. They noted that in the future there may be scope to loosen monetary policy further in case fiscal consolidation proves contractionary and inflation expectations remain anchored.

Directors noted that the flexible exchange rate and large reserves remain important to absorb shocks and underscored that intervention in the foreign exchange market should be limited to addressing disorderly conditions. They welcomed the recent bill on the relationship between the Treasury and the Central Bank, which enhances the institutional framework, and underscored the importance of formalizing central bank independence.

Directors agreed that the financial system is broadly resilient but firms and households face an unduly high cost of borrowing. They welcomed progress on strengthening the financial sector and agreed that further steps should be taken to enhance oversight of banks in line with the 2018 FSAP recommendations, particularly the implementation of a new financial resolution regime. Directors also agreed on the importance of improving the efficiency of financial intermediation and welcomed the recent approval of the credit registry law.

Directors encouraged the authorities to step up implementation of structural reforms essential to raise potential growth, including improving the business environment, lowering trade barriers, and boosting productivity. In this respect, they welcomed the recent trade agreement between Mercosur and the EU, which, once ratified, will be key to open up the economy. Reform efforts should also focus on continuing to reduce state intervention in credit markets and improving public infrastructure. Directors underscored that the ongoing efforts to combat corruption and the effective implementation of anti-money laundering remain critically important.

It is expected that the next Article IV consultation with Brazil will be held on the standard 12-month cycle.

|

Table 1. Brazil: Selected Economic Indicators |

|||||||||||||||

|

I. Social and Demographic Indicators |

|||||||||||||||

|

Area (thousands of sq. km) |

8,512 |

Health |

|||||||||||||

|

Agricultural land (percent of land area) |

28.7 |

Physician per 1000 people (2018) |

2.1 |

||||||||||||

|

Hospital beds per 1000 people (2018) |

2.0 |

||||||||||||||

|

Population |

Access to safe water (2015) |

98.1 |

|||||||||||||

|

Total (million) (est., 2018) |

208.8 |

||||||||||||||

|

Annual rate of growth (percent, 2015) |

0.8 |

Education |

|||||||||||||

|

Density (per sq. km.) (2018) |

24.5 |

Adult illiteracy rate (2016) |

7.2 |

||||||||||||

|

Unemployment rate (Jan 2019) |

12.0 |

Net enrollment rates, percent in: |

|||||||||||||

|

Primary education (2017) |

99 |

||||||||||||||

|

Population characteristics (2017) |

Secondary education (2015) |

84 |

|||||||||||||

|

Life expectancy at birth (years) |

76 |

||||||||||||||

|

Infant mortality (per thousand live births) |

13 |

Poverty rate (in percent, 2017) 1/ |

25.4 |

||||||||||||

|

Income distribution (2017) |

|||||||||||||||

|

Ratio between average income of top 10 |

GDP, local currency (2018) |

R$6,825 billion |

|||||||||||||

|

percent of earners over bottom 40 percent |

12.4 |

GDP, dollars (2018) |

US$1,868 billion |

||||||||||||

|

Gini coefficient (2017) |

54.9 |

GDP per capita (2018) |

US$8,995 |

||||||||||||

|

Main export products: airplanes, metallurgical products, soybeans, automobiles, electronic products, iron ore, coffee, and oil. |

|||||||||||||||

|

II. Economic Indicators |

|||||||||||||||

|

Proj. |

|||||||||||||||

|

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

||||||||

|

(Percentage change) |

|||||||||||||||

|

National accounts and prices |

|||||||||||||||

|

GDP at current prices |

4.6 |

4.2 |

5.2 |

6.9 |

6.9 |

6.7 |

6.7 |

6.7 |

|||||||

|

GDP at constant prices |

1.1 |

1.1 |

0.8 |

2.4 |

2.4 |

2.2 |

2.2 |

2.2 |

|||||||

|

Consumption |

0.8 |

1.5 |

0.7 |

2.1 |

1.9 |

1.4 |

1.6 |

1.6 |

|||||||

|

Investment |

2.0 |

2.6 |

4.2 |

5.8 |

6.3 |

6.1 |

5.8 |

5.7 |

|||||||

|

Consumer prices (IPCA, end of period) |

2.9 |

3.7 |

4.1 |

4.0 |

4.0 |

4.0 |

4.0 |

4.0 |

|||||||

|

(Percent of GDP) |

|||||||||||||||

|

Gross domestic investment |

15.0 |

15.4 |

15.8 |

16.2 |

16.7 |

17.3 |

17.8 |

18.3 |

|||||||

|

Private sector |

13.7 |

14.2 |

14.7 |

15.2 |

15.8 |

16.4 |

16.9 |

17.5 |

|||||||

|

Public sector |

1.3 |

1.2 |

1.1 |

1.0 |

0.9 |

0.9 |

0.8 |

0.7 |

|||||||

|

Gross national savings |

14.7 |

14.6 |

14.3 |

14.7 |

15.1 |

15.6 |

15.9 |

16.3 |

|||||||

|

Private sector |

21.1 |

20.6 |

20.7 |

21.0 |

21.4 |

21.4 |

21.5 |

21.5 |

|||||||

|

Public sector |

-6.5 |

-5.9 |

-6.4 |

-6.3 |

-6.3 |

-5.9 |

-5.5 |

-5.1 |

|||||||

|

Public sector finances |

|||||||||||||||

|

Central government primary balance 2/ |

-1.9 |

-1.7 |

-1.9 |

-1.4 |

-0.8 |

-0.3 |

0.3 |

0.7 |

|||||||

|

NFPS primary balance |

-1.8 |

-1.7 |

-1.9 |

-1.3 |

-0.7 |

-0.1 |

0.4 |

0.9 |

|||||||

|

NFPS cyclically adjusted primary balance |

-0.6 |

-0.6 |

-0.8 |

-0.6 |

-0.3 |

0.0 |

0.4 |

0.9 |

|||||||

|

NFPS overall balance |

-7.9 |

-7.3 |

-7.6 |

-7.4 |

-7.3 |

-6.8 |

-6.4 |

-6.0 |

|||||||

|

Net public sector debt |

51.6 |

54.2 |

57.8 |

60.2 |

61.4 |

62.8 |

63.4 |

64.1 |

|||||||

|

General Government gross debt, |

|||||||||||||||

|

Authorities’ definition |

74.1 |

77.2 |

... |

... |

... |

… |

… |

… |

|||||||

|

NFPS gross debt |

84.1 |

87.9 |

92.2 |

94.1 |

94.9 |

95.9 |

96.1 |

96.4 |

|||||||

|

Of which: Foreign currency linked |

3.7 |

4.2 |

4.4 |

4.5 |

4.4 |

4.4 |

4.2 |

4.1 |

|||||||

|

(Annual percentage change) |

|||||||||||||||

|

Money and credit |

|||||||||||||||

|

Base money 3/ |

9.6 |

1.6 |

5.2 |

6.9 |

6.9 |

6.7 |

6.7 |

6.7 |

|||||||

|

Broad money 4/ |

4.6 |

8.1 |

6.6 |

8.8 |

8.9 |

8.6 |

8.6 |

8.6 |

|||||||

|

Bank loans to the private sector |

0.0 |

7.7 |

7.5 |

9.0 |

8.5 |

8.0 |

8.0 |

8.0 |

|||||||

|

(Billions of U.S. dollars, unless otherwise specified) |

|||||||||||||||

|

Balance of payments |

|||||||||||||||

|

Trade balance |

64.0 |

53.6 |

52.4 |

50.6 |

53.6 |

58.2 |

60.1 |

61.2 |

|||||||

|

Exports |

217.2 |

239.0 |

250.9 |

255.1 |

268.6 |

282.9 |

296.3 |

310.5 |

|||||||

|

Imports |

153.2 |

185.4 |

198.5 |

204.5 |

215.0 |

224.8 |

236.2 |

249.2 |

|||||||

|

Current account |

-7.2 |

-14.5 |

-27.4 |

-29.6 |

-32.4 |

-35.0 |

-39.5 |

-43.7 |

|||||||

|

Capital account and financial account |

0.8 |

9.8 |

27.4 |

29.6 |

32.4 |

35.0 |

39.5 |

43.7 |

|||||||

|

Foreign direct investment (net inflows) |

50.9 |

74.3 |

65.3 |

60.1 |

57.8 |

57.0 |

57.5 |

58.0 |

|||||||

|

Terms of trade (percentage change) |

0.0 |

-5.5 |

1.0 |

0.0 |

1.1 |

0.1 |

-0.1 |

0.0 |

|||||||

|

Merchandise exports (in US$, annual percentage change) |

17.8 |

10.0 |

5.0 |

6.7 |

7.0 |

5.3 |

4.7 |

4.8 |

|||||||

|

Merchandise imports (in US$, annual percentage change) |

9.9 |

21.0 |

7.1 |

10.3 |

8.3 |

4.5 |

5.1 |

5.5 |

|||||||

|

Total external debt (in percent of GDP) |

32.5 |

35.6 |

37.1 |

35.4 |

33.5 |

31.7 |

29.9 |

28.3 |

|||||||

|

Memorandum items |

|||||||||||||||

|

Current account (in percent of GDP) |

-0.4 |

-0.8 |

-1.5 |

-1.6 |

-1.6 |

-1.7 |

-1.8 |

-1.9 |

|||||||

|

Unemployment rate |

12.8 |

12.3 |

11.6 |

10.4 |

10.0 |

9.7 |

9.5 |

9.4 |

|||||||

|

Gross official reserves |

374 |

375 |

375 |

375 |

375 |

375 |

375 |

375 |

|||||||

|

REER (annual average in percent; appreciation +) |

8.5 |

-10.4 |

... |

... |

... |

... |

... |

... |

|||||||

|

1/ Computed by IBGE using the World Bank threshold for upper-middle income countries of U$5.5/day. This number is not comparable to the estimates provided by IPEA in previous years due to methodological differences. |

|||||||||||||||

|

2/ Includes the federal government, the central bank, and the social security system (INSS). Based on the 2017 draft budget, recent announcements by the authorities, and staff projections. |

|||||||||||||||

Earlier:

2019, July, 1, 11:05:00

BRICS ENERGY SECURITY

"As BRICS participants are leading global consumers and producers of energy, our association could be more actively involved in issues of ensuring global energy security and universal access to energy," Putin said, during a meeting of the leaders of the BRICS countries ahead of the G20 Summit in Osaka. The BRICS group comprises Brazil, Russia, India, China and South Africa.

|

2019, May, 30, 17:45:00

BRAZIL'S OIL UP

Brazil has seen its exports of crude grow from 734,000 b/d in 2015 to 1.3 million b/d in Q1 of this year. In contrast, Mexico, which was once a powerhouse of oil production, has maintained its export status only through curtailment of domestic refining, not increased crude oil output.

|

2019, May, 29, 10:25:00

BRAZIL'S GDP UP 1%

After contracting by almost 7 percent during the 2015-16 recession, real GDP grew by only 1.1 percent per year in 2017 and 2018.

|