CHINA'S OIL GAS RULES DOWN

PLATTS - China has lifted restrictions on foreign investment in its conventional oil and gas upstream and city gas distribution sectors, in an attempt to boost resource development, and setting the stage to break the monopoly of national oil companies.

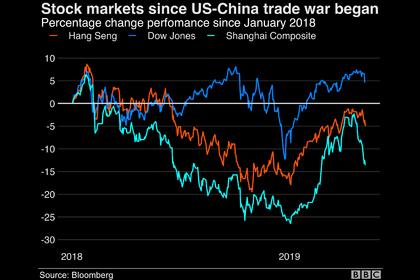

The new policy, which will take effect on July 30, is part of a wider swathe of ongoing market reforms aimed at opening up Chinese industries to foreign companies, and comes on the backdrop of the trade conflict with the US.

China's policy regulator National Development and Reform Commission and the Ministry of Commerce on Sunday published the 2019 edition of the Special Management Measures for Foreign Investment Access, also known as the "Negative List," which details restrictions on foreign companies in China.

The new policy removed ownership restrictions under which foreign companies were required to enter a joint venture or partnership with Chinese companies for upstream oil and gas activities. They will now be able to operate fully-owned entities in the country.

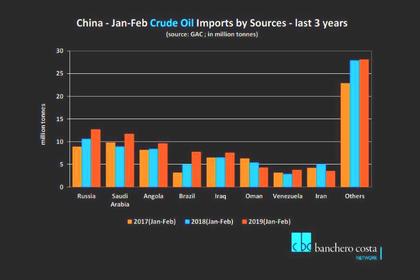

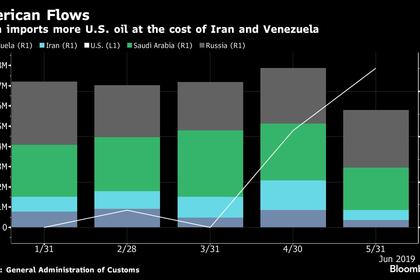

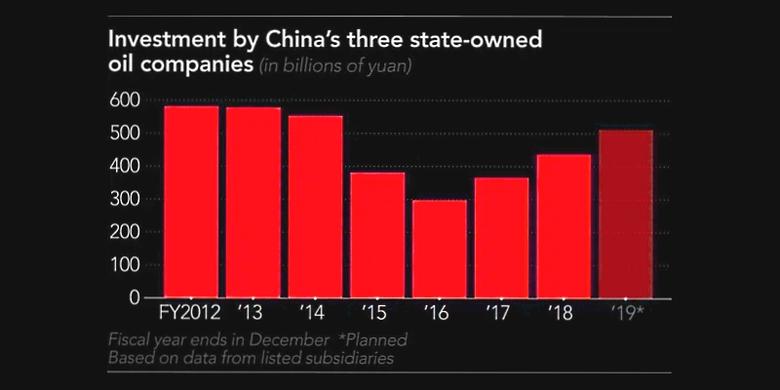

It is aimed at boosting production of conventional oil and gas that has plateaued in recent years due to depleting reserves, forcing China to rely increasingly on energy imports. Ownership controls on unconventional resources had already been removed in 2017.

Attracting upstream investment to China could still be challenging, because oil majors have been diverting capex to high growth areas like US shale, but China's city gas networks have been in the crosshairs of energy companies due to the global shift towards natural gas.

DOMESTIC OIL AND GAS

China's upstream sector was controlled by four state-owned companies until a few years ago -- China National Petroleum Corp (CNPC), Sinopec Group, China National Offshore Oil Corp (CNOOC) and Yanchang Petroleum Group.

Out of these, only the first three are allowed to form upstream joint ventures with foreign companies -- CNPC, Sinopec and CNOOC.

In July 2015 China, for the first time, opened up its oil and gas blocks to domestic independent exploration companies with the offer of six blocks in the western Xinjiang Uygur Autonomous Region for prospecting, according to the Ministry of Natural Resources.

Several independent companies won the exploration licenses in October 2015 but almost none of them have made any progress due to the lack of E&P expertise and no major discoveries.

Data from the National Bureau of Statistics showed China's crude oil production peaked at 4.45 million b/d in June 2015 and fell to a more than 10-year low of 3.71 million b/d in September 2018, due to low oil prices and the aging Daqing and Shengli oil blocks.

Natural gas production, however, continued to rise, hitting 72.50 Bcm in the first five months of this year, up 9.8% year on year, the data showed.

The new policy will help attract foreign investment where NOCs and domestic companies have failed.

"Wood Mackenzie believes more regulatory changes, that will specify how these rules will work in practice, are on the way," the consultancy said in a note this week.

"Further incentives and/or acreage to be released to attract new, non-NOC investment in the upstream sector are also to be expected," it said.

"The two main goals for the Chinese government are to increase domestic production and diversify sources of upstream investment, and these changes are just a first step in the right direction."

To explore or develop upstream projects in China, a company must first win a license, according to China's Mining Resources Law released by the State Council in 1986 and updated in 2009. The next step for foreign companies is to compete for contracts that will enable them to win a license, a Beijing-based upstream source said.

CITY GAS HEATS UP

The opening up of China's city gas distribution is expected to increase M&A activity in the gas sector, especially with oil majors and energy companies eyeing China's downstream gas business as a growing market for their global LNG portfolios.

The new policy removes restrictions on foreign shareholding in Chinese city gas companies in cities with a population of more than 500,000, opening the door for stiff competition between foreign and domestic gas companies.

Some companies already have a presence in China's city gas market through joint ventures, like South Korea's SK Energy and India's Gail, which are shareholders of China Gas, and others are on the lookout.

A source with PetroChina said the new policy is in line with other countries where the government controls the midstream or transportation infrastructure, and leaves the two ends of upstream and downstream for the private sector.

-----

Earlier: