CONOCO EARNINGS $1.6 BLN

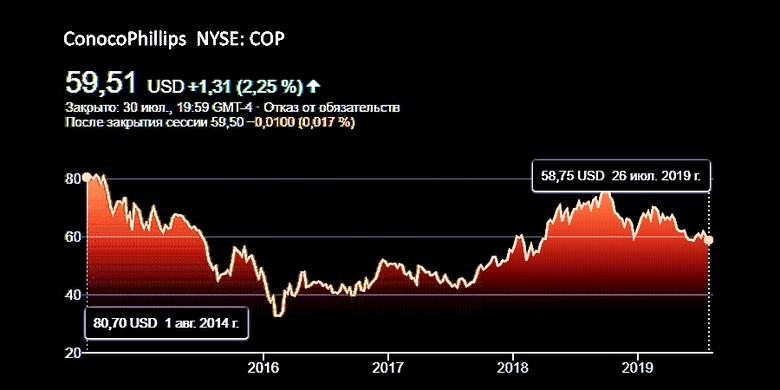

CONOCOPHILLIPS - JULY 30, 2019, ConocoPhillips (NYSE: COP) today reported second-quarter 2019 earnings of $1.6 billion, or $1.40 per share, compared with second-quarter 2018 earnings of $1.6 billion, or $1.39 per share. Excluding special items, second-quarter 2019 adjusted earnings were $1.1 billion, or $1.01 per share, compared with second-quarter 2018 adjusted earnings of $1.3 billion, or $1.09 per share. Special items for the current quarter were primarily driven by a financial tax benefit related to the previously announced U.K. disposition, settlement of certain tax disputes, and amounts recognized from the PDVSA International Chamber of Commerce (ICC) settlement.

Second-Quarter Highlights

• Cash provided by operating activities was $2.9 billion. Excluding working capital, cash from operations (CFO) of $3.4 billion exceeded capital expenditures and investments, generating free cash flow of $1.7 billion.

• Increased 2019 planned share repurchases to $3.5 billion.

• Repurchased $1.2 billion of shares and paid $0.3 billion in dividends in the second quarter; both funded entirely from free cash flow, representing a return of 47 percent of CFO to shareholders.

• Second-quarter production excluding Libya of 1,290 MBOED exceeded the high end of guidance; year-over-year underlying production grew 4 percent overall and 6 percent on a per debt-adjusted share basis.

• Grew production from the Lower 48 Big 3 unconventionals by 26 percent year-over-year.

• Executed turnarounds in Europe, Canada and Alaska.

• Ended the quarter with cash, cash equivalents and restricted cash totaling $6.2 billion and short-term investments of $0.7 billion, equating to $6.9 billion of ending cash and short-term investments.

• Generated $0.6 billion in proceeds from dispositions.

• Acquired approximately $0.1 billion in Lower 48 Big 3 bolt-on interests and acreage.

"This was our seventh consecutive quarter of generating free cash flow while executing our disciplined plans and delivering on our targets," said Ryan Lance, chairman and chief executive officer. "Over that time frame we fully funded our capital expenditures, dividends and buybacks within cash from operations. ConocoPhillips has embraced an approach to our cyclical industry that we believe will deliver superior returns and create value across a range of commodity prices. This quarter represents a continuation of strong performance on our business model that prioritizes financial returns, discipline, resilience with upside and shareholder distributions. At our Analyst & Investor Meeting in November we will lay out a plan that demonstrates our ability to successfully perform on this model for the long term."

Second-Quarter Review

Production excluding Libya for the second quarter of 2019 was 1,290 thousand barrels of oil equivalent per day (MBOED), an increase of 79 MBOED compared with the same period a year ago. Excluding a net benefit of 27 MBOED from acquisitions and dispositions (A&D), production increased by 52 MBOED primarily due to growth from the Big 3 unconventionals, development programs and major projects in Alaska, Europe and Asia Pacific. This growth more than offset normal field decline and downtime from planned turnarounds. Production from Libya was 42 MBOED.

In Alaska, the winter exploration program was completed with encouraging results on the Greater Willow Area and Narwhal appraisal tests. In the Lower 48, ramp-up from the Big 3 unconventionals was accelerated, increasing production for the quarter to 367 MBOED. In Canada, completion operations on the 14-well Montney pad and infrastructure construction progressed as planned with startup on track for the fourth quarter.

Turnarounds were successfully completed during the quarter primarily at Greater Ekofisk in Norway, Surmont in Canada and Prudhoe Bay in Alaska. Additional turnarounds and maintenance will continue in the third quarter.

Earnings were lower compared with the second quarter of 2018 primarily due to lower realized prices and a lower unrealized gain on our Cenovus Energy equity, partially offset by higher volumes and a financial tax benefit related to the planned U.K. disposition. Excluding special items, adjusted earnings were lower compared with second-quarter 2018 due to lower realized prices, partially offset by higher volumes. Sales volumes for the quarter were lower than production, reducing earnings by $32 million. The company's total realized price was $50.50 per barrel of oil equivalent (BOE), compared with $54.32 per BOE in the second quarter of 2018, reflecting the impact of lower marker prices.

For the quarter, cash provided by operating activities was $2.9 billion. Excluding a $0.5 billion change in operating working capital, ConocoPhillips generated $3.4 billion in cash from operations (CFO), which included approximately $0.3 billion from APLNG distributions and $0.1 billion from the PDVSA ICC settlement. In addition, the company generated $0.6 billion in disposition proceeds. The company incurred $1.7 billion in capital expenditures and investments that included approximately $0.1 billion of Lower 48 bolt-on acquisitions, repurchased $1.2 billion in shares and paid $0.3 billion in dividends, all entirely funded by CFO.

Six-Month Review

ConocoPhillips' six-month 2019 earnings were $3.4 billion, or $3.00 per share, compared with six-month 2018 earnings of $2.5 billion, or $2.13 per share. Six-month 2019 adjusted earnings were $2.3 billion, or $2.01 per share, compared with six-month 2018 adjusted earnings of $2.4 billion, or $2.05 per share.

Production excluding Libya for the first six months of 2019 was 1,303 MBOED, an 87 MBOED increase from 1,216 MBOED for the same period in 2018. Excluding a net A&D benefit of 28 MBOED, production increased 59 MBOED, or 5 percent, largely driven by growth from the Big 3 unconventionals, development programs and major projects, more than offsetting normal field decline and higher planned downtime.

The company's total realized price during this period was $50.55 per BOE, compared with $52.37 per BOE in the first six months of 2018. This reduction reflected lower crude, natural gas liquids and natural gas prices, partially offset by higher bitumen and liquefied natural gas prices.

In the first half of 2019, cash provided by operating activities was $5.8 billion. Excluding a $0.6 billion change in operating working capital, ConocoPhillips generated $6.4 billion in CFO, exceeding the total of $3.4 billion in capital expenditures and investments, $2.0 billion in share repurchases and $0.7 billion in dividends. In addition, the company generated $0.7 billion in disposition proceeds. Capital expenditures and investments included approximately $0.1 billion primarily for Lower 48 bolt-on acquisitions.

Outlook

Operating plan capital is now expected to be $6.3 billion versus $6.1 billion, attributable to additional exploration and appraisal drilling in Alaska and the addition of a drilling rig in the Eagle Ford Field at mid-year. This guidance excludes approximately $0.3 billion for opportunistic acquisitions completed or announced. Guidance also excludes obligations under the recently announced production sharing contract extension awarded by the Government of Indonesia.

Third-quarter 2019 production is expected to be 1,290 to 1,330 MBOED, reflecting planned turnarounds in Alaska, Europe and Asia Pacific. Full-year production guidance is 1,310 to 1,340 MBOED. The guidance excludes Libya.

-----

Earlier:

2019, April, 22, 08:15:00

CONOCO SELLS BRITAIN $2.67 BLN

ConocoPhillips's gas-focused North Sea assets pumped 72,000 b/d of oil equivalent last year, and the acquisition will help boost Chrysaor's total production this year to over 185,000 boe/d, Chrysaor said in a statement.

|

2019, March, 11, 11:15:00

VENEZUELA'S PAYMENT TO CONOCO $8.7 BLN

PLATTS - An international tribunal on Friday ordered Venezuela to pay ConocoPhillips roughly $8.7 billion in compensation for the seizure of company assets in 2007.

|

2019, February, 1, 10:35:00

CONOCO EARNINGS $5.3 BLN

CONOCOPHILLIPS - Full-year 2018 earnings were $6.3 billion, or $5.32 per share, compared with a full-year 2017 net loss of $0.9 billion, or ($0.70) per share. Excluding special items, full-year 2018 adjusted earnings were $5.3 billion, or $4.54 per share, compared with full-year 2017 adjusted earnings of $0.7 billion, or $0.60 per share.

|