GERMANY'S LNG PROJECTS

PLATTS- Germany currently imports over 80 Bcm/year of natural gas, or nearly one quarter of total European imports, primarily from Russia, Norway and the Netherlands.

Now, the country is looking to add to its import options, by launching at least two LNG import terminals in Northern Germany by the mid-2020s.

It's a plan that has been around since the 1970s, but that has recently gained firmer political and commercial support. Industry participants are now watching the developments with interest.

Two final investment decisions are expected by the end of the year, on the Brunsbuettel terminal and Wilhelmshaven floating storage and regasification unit (FSRU). These are at about the same stage of development, but the choice of strategic partnerships differs, with Brunsbuettel backed largely by European companies, and the FSRU project having attracted a more global cohort of investors.

Qatar Petroleum was reportedly said to be interested in the FSRU ownership and/or capacity.

The company has previously partnered with ExxonMobil in the Qatar liquefaction projects, the US Golden Pass export terminal, and in the Italian Adriatic LNG and UK South Hook regasification terminals.

"Qatar already has the QGII terminal in South Hook so having another outlet for its gas in Germany would make perfect sense," a London-based industry lawyer who did not want to be named told S&P Global Platts.

"A deep-water terminal in Germany with lots of room to manoeuvre (like an FSRU in Wilhelmshaven) would therefore be most attractive in my view, certainly to the Qataris," the lawyer added, pointing to political will on Qatar's part to create new alliances, given the standoff with Saudi Arabia.

Both terminals plan to develop and operate a multifunctional terminal, with services including large-scale and small-scale activities.

The German energy minister Peter Altmaier said in February, following a meeting with US officials, that the state will support two LNG terminals. Earlier, the government announced it would co-finance the construction of a $576 million LNG terminal in Germany.

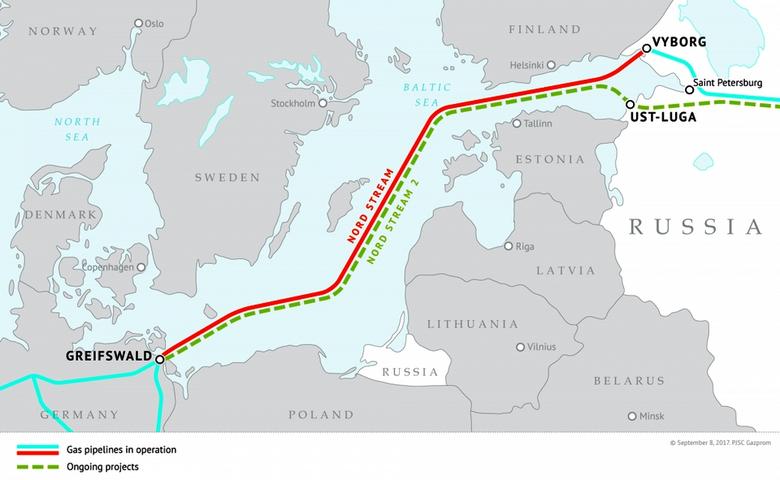

However, doubts persist on the true benefits of LNG facilities in Germany given the existing large supply from pipelines, which will soon be boosted further with the coming 55 Bcm/year Nord Stream 2 pipeline.

Supply gap looms

The commissioning of Nord Stream 2 could mean the diversion of most or all Russian gas transit flows through Ukraine. Many politicians across the EU are opposed to this development, arguing that gas supplies ought to be as diverse as possible, both in terms of origin and supply route.

In any case, even the new Russian pipeline will not provide sufficient extra capacity to plug the gap that is expected to open up between European demand and supply by the mid-2020s. S&P Global Platts Analytics forecasts that by 2025, Northwest Europe will need to replace 45 Bcm of domestic production compared with 2018. "Any additional infrastructure, so also German terminals, theoretically helps to some extent in mitigating the risks as long as such additional capacity does not result in the closure of existing capacity," Stefaan Adriaens, commercial manager at the Dutch Gate LNG terminal told Platts.

In March, Dutch operator Gasunie put on sale 2 Bcm/year of new send-out capacity at its Gate terminal after 2021. Other terminals in France and in the UK also offered additional capacity this year.

"The LNG market grows and EU needs more imports while flexibility decreases (e.g. storages closures, Groningen reduction). The recent changes in utilization rates show how quick markets can change," Adriaens said.

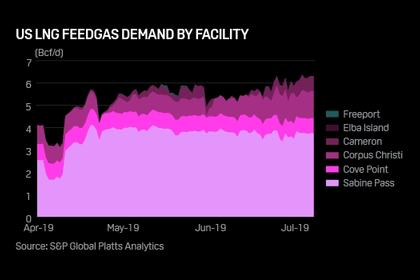

Europe has been absorbing most of US and Russian LNG since last winter on the back of low demand in Asia associated with higher global supply.

As a result, Northwest European capacity terminals have been used at more than 50% capacity since last winter, compared with 30% before.

Market signals

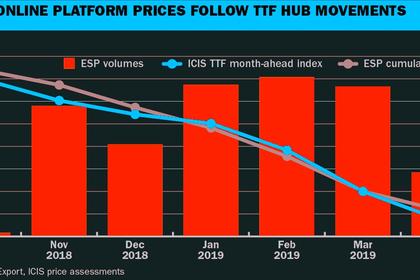

But there is the risk that the Platts JKM price premium to the Dutch gas TTF hub will have recovered by the time the terminals become operational.

"Next year we will see more LNG coming into Europe keeping a high rate of [regasification capacity] utilization, but this will decrease from 2022 to 2025," RWE's chief commercial officer Andree Stracke said at the EU-US Energy Council in May.

Some market participants take the view that Northwest Europe already has enough regasification capacity.

"There is too much physical proximity with other existing terminals in North West Europe," said a German gas trader, pointing to Dutch Gate, UK Grain, French Dunkirk, and Belgium Zeebrugge LNG terminals. "Why would you need an additional one? The capacity at those NWE terminals are underused anyway. It's easier, cheaper to regas there and then flow via pipelines," he said.

And the construction of the LNG terminals represents a considerable investment. The FSRU for instance, the cheapest facility, will require about €400 million ($500 million) to build.

Additional investments would be needed to connect the facility to the grid. The Brunsbuettel connection pipeline project would cost about €60 million, according to a source close to the matter. Last December, the project was rejected by German regulator Bundesnetzagentur from the network development plan budget (NEP Gas 2018-2028). The pipeline project is now in stand-by.

"It takes two years for the application to be considered by the gas transport network, then the implementation would take about three years," the same source said, adding that there is no sign of interest from the market.

"The only potential for LNG in Germany would be marine fuels but it depends on how EU legislation on transport change," he added referring to IMO 2020.

"I guess the lack of a real need for LNG into Germany proves that the push is more of a favour to Trump," said the lawyer, suggesting it may be a small concession by the German government to keep the trade peace between Germany, the EU and the US.

The economy minister Peter Altmaier himself said last year that the plan is "a gesture to our American friends". And politics between countries is unpredictable.

"There is no guarantee that LNG will land to Germany anyway even if they have a terminal. Also if a terminal is built, the irony would be that LNG from the Yamal peninsula is sent to Germany," said the German trader.

In the end politics, not economics, might be the driving factor for the construction of at least one terminal in Germany. However, LNG is now more than ever seen as a vital option to bolster Europe's security of supply.

-----

Earlier: