GLOBAL OIL DEMAND GROWTH 2019-20: 1.14 MBD

OPEC - Monthly Oil Market Report 11 July 2019

Oil Market Highlights

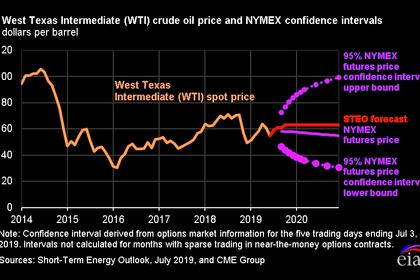

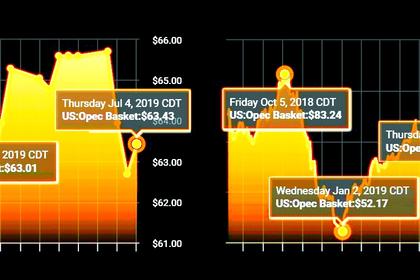

Crude Oil Price Movements

The OPEC Reference Basket (ORB) fell sharply in June by about $7/b, or 10%, month-on-month (m-o-m) to $62.92/b, recording the second consecutive month of decline as all ORB component values dropped significantly, alongside their respective crude oil benchmarks. Crude oil futures prices plunged in June with both ICE Brent and NYMEX WTI falling about 10% m-o-m, posting their biggest monthly drop in six months.

In June, ICE Brent was $7.27, or 10.3%, lower m-o-m at $63.04/b, while NYMEX WTI fell m-o-m by $6.16, or 10.1%, to average $54.71/b. DME Oman crude oil futures also declined in June, dropping by $8.01, or 11.5%, over the previous month to settle at $61.85/b. Both the Brent and Dubai markets continued this steep backwardation, while the WTI price structure remained in contango, specifically in the front months of the curve. Hedge funds and money managers continued more bullish positions, causing net long positions to reach their lowest levels since February for both ICE Brent and NYMEX WTI.

World Economy

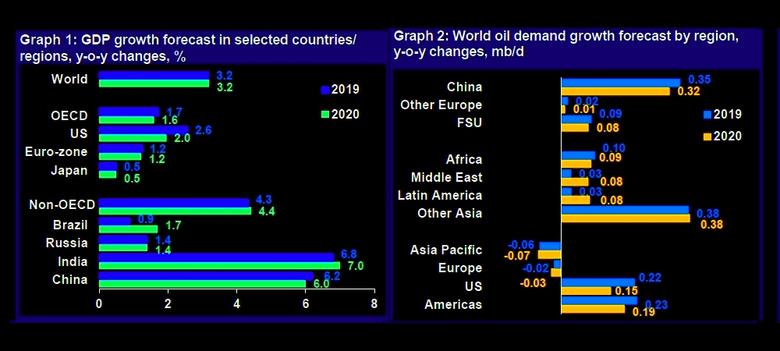

The global GDP growth forecast for 2019 remains at 3.2%, followed by expected growth of 3.2% in 2020. The US economic growth forecast for 2019 remains unchanged at 2.6%, followed by 2.0% in 2020. The Euro-zone's growth estimate for 2019 remains at 1.2% and is also forecast at 1.2% in 2020. Japan's unchanged low growth of 0.5% in 2019 is forecast to continue at the same level in 2020. China's 2019 growth forecast remains at 6.2% and is expected to slow down further to 6.0% in 2020. India's growth forecast remains at 6.8% for 2019, and is anticipated to pick up in 2020 to 7.0%. Brazil's 2019 growth forecast is revised down to 0.9%, and is projected to reach 1.7% in 2020. Russia's growth forecast for 2019 remains unchanged at 1.4%, and is expected to remain at 1.4% in 2020. Although large uncertainties remain, current growth forecasts assume no further down-side risks, and, in particular, that trade-related issues do not escalate further.

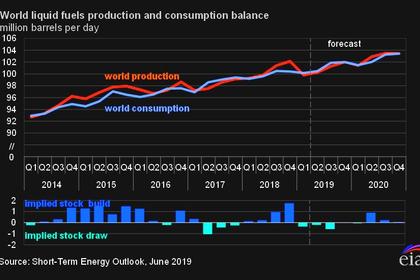

World Oil Demand

In 2019, the global oil demand growth forecast remains at 1.14 mb/d, with expectations for global oil demand to reach 99.87 mb/d. In 2020, the initial forecast indicates growth of around 1.14 mb/d y-o-y, as global oil demand is anticipated to surpass the 100 mb/d threshold on an annual basis, to average 101.01 mb/d for the year. The OECD is forecast to register growth of 0.09 mb/d with the bulk of growth coming from OECD Americas. The non-OECD region is expected to continue leading oil demand growth in 2020 with initial projections indicating an increase of around 1.05 mb/d, most of which is attributed to Other Asia and China, with a combined oil demand growth of 0.68 mb/d.

World Oil Supply

The non-OPEC oil supply growth forecast for 2019 has been revised down by 95 tb/d to reach 2.05 mb/d y-oy, standing at 64.43 mb/d. The downward revisions are mainly due to the extension of the voluntary production adjustments by participating oil producing countries of the Declaration of Cooperation, as well as downward revisions for Brazil and Norway in 2Q19. In 2020, non-OPEC oil supply is projected to grow by 2.4 mb/d, averaging 66.87 mb/d. The US, Brazil, Norway and Canada are forecast to be the main growth drivers, while Mexico, Colombia, the UK, Indonesia and Thailand are expected to see the largest declines.

OPEC NGL production is expected to grow by 0.07 mb/d in 2019 to average 4.84 mb/d, and is forecast to increase by 0.03 mb/d in 2020 to average 4.87 mb/d. In June, OPEC crude oil production decreased by 68 tb/d to average 29.83 mb/d, according to secondary sources.

Product Markets and Refining Operations

Product markets in the Atlantic Basin weakened in June, pressured by strong product outputs, which led to downward pressure on product prices amid lower-than-expected demand. In the US, product markets benefitted from support coming from the middle of the barrel, while the gasoline market received a boost from a supply outage on the East Coast, despite a surge in refinery intakes. In Europe, product markets suffered the most, as the gasoline market plummeted and weakening at the middle of the barrel more than offset the solid positive performance at the bottom of the barrel. Meanwhile, in Asia, product markets received support from large refining capacities being offline, as well as firm jet/kerosene exports and a tighter fuel oil market which led to a shorter balance for these products.

Tanker Market

Average dirty tanker spot freight rates were broadly flat in June, with ample tonnage availability dampening the impact of increased activity as refineries returned from maintenance. In June, VLCCs edged higher, benefiting from the ramp-up in refinery capacity in China. Suezmax spot freight rates firmed in June, reversing the losses seen the month before, supported by gains on the West Africa-to-US East Gulf Coast route. Spot freight rates in the Aframax sector reversed direction from the previous month with declines on most routes. Meanwhile, clean spot tanker freight rates generally moved lower in June, with only the Northwest Europe-to-US East Coast route showing gains. However, with refineries coming out of maintenance, particularly in Asia, the clean market should start to see some improvement into the second half of the year, as preparations for IMO 2020 gather momentum.

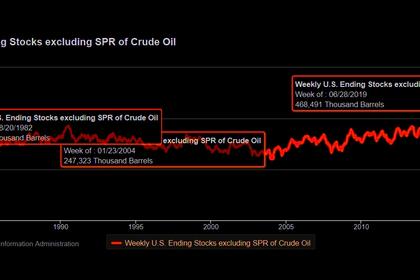

Stock Movements

Preliminary data for May showed that total OECD commercial oil stocks rose by 41.5 mb m-o-m to stand at 2,925 mb, which is 96.8 mb higher than the same time one year ago and 25 mb above the latest five-year average. Within the components, crude stocks indicated a surplus of 35 mb, while product stocks were 10 mb below the latest five-year average. In terms of days of forward cover, OECD commercial stocks rose 0.2 days m-o-m in May to stand at 60.5 days, which was 2.0 days above the same period in 2018, but 0.9 days below the latest five-year average.

Balance of Supply and Demand

Demand for OPEC crude for 2019 was revised up by 0.1 mb/d from the previous report to stand at 30.6 mb/d, 1.0 mb/d lower than the 2018 level. Based on the first forecasts for world oil demand and non-OPEC supply for 2020, demand for OPEC crude for 2020 is projected at 29.3 mb/d, 1.3 mb/d lower than the 2019 level.

-----

Earlier: