JAPAN'S OIL, GAS 29%

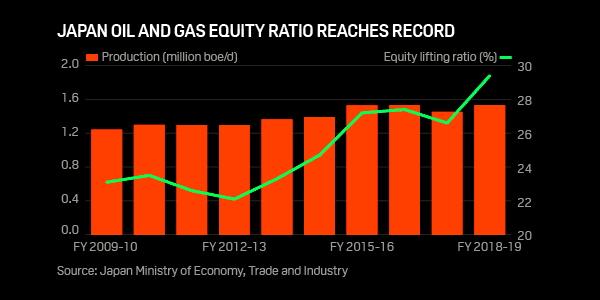

PLATTS - Japan's oil and gas equity ratio rose to a record 29.4% of total imports and domestic output in fiscal 2018-2019 (April-March), the Ministry of Economy, Trade and Industry said Monday, signaling increased supply security.

The fiscal 2018-2019 equity lifting ratio rose from 26.6% in the previous fiscal year due to the startup of an LNG project in Australia, coupled with increased production at numerous oil and gas fields, METI said in a statement.

The equity lifting ratio was also at the highest since the government started collecting such data in fiscal 1973-74. By 2030, Japan aims to boost its oil and gas equity ratio to more than 40%.

During fiscal 2018-19, Japan's Inpex started up its operated Ichthys project that involves piping gas from the Ichthys field in the Browse Basin, in northwestern Australia, over 889 km (551 miles) to the onshore 8.9 million mt/year LNG plant near Darwin. It also has a production capacity of 100,000 boe/d of condensate and 1.6 million mt/year of LPG.

Itochu has also started selling small amounts of Iraqi crude oil from its equity participation in the giant West Qurna 1 oil field after it had acquired Shell's 19.6% stake in March 2018. Located in southern Iraq 50 km (31 miles) northwest of Basra, the ExxonMobil-operated West Qurna 1 field produces around 500,000 b/d.

Inpex North Caspian Sea, or INCS, has a 7.56% stake in Kazahstan's giant Kashagan oil field, where production was rising. The Kashagan field, in the Kazakhstan's sector of the Caspian Sea, was producing at around 340,000 b/d prior to its over a month-long maintenance starting in mid-April, according to Inpex.

Japan's increased oil and gas equity ratio comes at a time when the nation is trying to step up efforts to ensure energy security amid rising tensions in the Strait of Hormuz.

Japan's oil supply security came under the spotlight in the wake of the June 13 oil tanker attacks, when two vessels, including one operated by a Japanese shipping company, were attacked just outside of the Strait of Hormuz.

"The Strait of Hormuz is extremely important for Japan's crude oil and natural gas procurements," Ryo Minami, METI's director-general of oil, gas and mineral resources, told S&P Global Platts.

"We are closely monitoring situations, including on Hormuz," said Minami, adding that more than 80% of Japan's imported crude oil and about 20% of LNG transited through the Strait of Hormuz in 2018.

Japanese companies, which are under equity finance or liability guarantee from the state-owned Japan Oil, Gas and Metals National Corporation for their participation in upstream development projects, are obliged to bring back all of their equity volumes to Japan in the event of an emergency involving supply disruptions.

Jogmec's financial support accounts for roughly half of Japan's oil and gas equity lifting volumes but Tokyo has never enforced this emergency contractual obligation.

-----

Earlier: