2019-07-31 13:35:00

KUWAIT'S OIL REVENUE $60.7 BLN

MEOG - Kuwait reported oil revenue of $60.7bn for the 2018 fiscal year ending March 31, 2019, according to state news agency KUNA. This is a 24% increase from the previous year. Its non-oil revenue also grew 24% to hit $6.9bn.

"For the second year in a row, the State of Kuwait's non-oil revenues continued to grow by 24% year on year, capital expenditure remains a healthy proportion of the total expenses at 14%," said Kuwait's finance minister, Nayef Al-Hajraf.

He estimated that capex would reach 17% of total expenditure in 2019, attributing the expected increase to initiatives to "stimulate economic growth and to serve Kuwait's 2035 vision, New Kuwait."

-----

Earlier:

2019, April, 22, 08:25:00

KUWAIT OIL PRODUCTION: +370 TBD

Boosting heavy crude output is a major part of the country's 2040 oil production strategy. Kuwait plans to increase overall oil production capacity to 4.75mbpd by 2040, up from its current capacity of 3.15mbpd.

|

2019, April, 5, 09:45:00

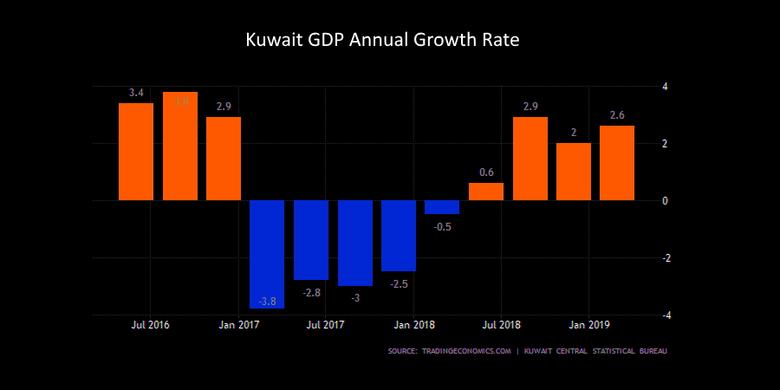

KUWAIT'S GDP UP 1.7%

Kuwait's growth has resumed, and the current account rebounded thanks to higher oil prices. Hydrocarbon output rose by 1.2 percent in 2018 after contracting a year earlier. Buoyed by a rebound in confidence and government spending, non-oil growth has accelerated to 2.5 percent.

|

2019, January, 30, 11:00:00

KUWAIT'S GDP GROWTH 2.5-2.9%

IMF - Kuwait's growth is expected to strengthen. The mission has assumed an average oil price of US$57 per barrel in 2019–20, increasing to US$60 per barrel over the medium term. As capital project implementation accelerates, non-oil growth is projected to increase to about 3.5 percent in 2020. The recent OPEC decision to cut production is expected to hold oil output to 2 percent growth in 2019, which could rebound to 2.5 percent in 2020 given the spare capacity. Inflation is expected to rise in 2019–20 to about 2.5 percent as the deflationary factors in 2018 unwind.

|