LATIN AMERICA, CARRIBEAN GDP UP 0.6%

IMF - Economic activity in Latin America and the Caribbean remains sluggish. Real GDP is expected to grow by 0.6 percent in 2019—the slowest rate since 2016—before rising to 2.3 percent in 2020.

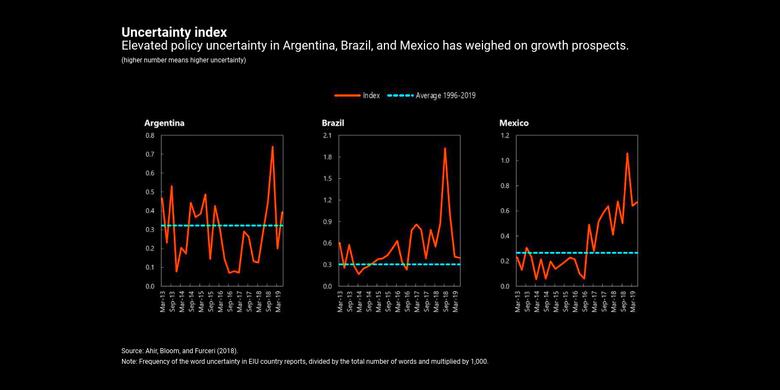

The weak momentum reflects negative surprises in the first half of 2019, elevated domestic policy uncertainty in some large economies, heightened US-China trade tensions, and somewhat lower global growth.

Slower growth

Sluggish activity in the first half of this year largely reflects temporary factors, including adverse weather conditions that reduced mining output in Chile and agricultural output in Paraguay. Mining activity in Brazil moderated following the Brumadinho Dam disaster, while growth in Mexico weakened due to an under execution of the budget, labor strikes, and fuel shortages.

Elevated policy uncertainty in some large economies of the region has also contributed to the weak growth momentum. In Brazil, concerns about the timing and scope of much-needed pension reforms—with a draft bill currently being discussed by Congress—has kept policy uncertainty above historical averages.

Similarly, in Mexico, uncertainty remains high due to certain policy reversals, notably pertaining to energy and education reforms. There are also continuing concerns about the financial health and prospects of Pemex. In Argentina, uncertainty has moderated, and more recently inflation has started to decline while economic activity rebounds.

Weaker global growth and lingering US-China trade tensions have also hurt the Latin America region through their impact on commodity prices and exports.

Risks: global and domestic

Risks to the outlook remain tilted to the downside, including from a further escalation of US-China trade tensions, a slowdown in major economies, and tighter global financial conditions.

The main domestic risks include a further rise in policy uncertainty, reversal of reforms, and natural disasters. Although portfolio flows were strong early this year, they declined in May-June and could decline further if downside risks were to materialize.

Given weak growth prospects and significant downside risks, economic policies will need to strike a balance between supporting growth and rebuilding buffers.

Policies: a balanced approach

Fiscal consolidation remains a priority in many countries in the region given high public debt levels. This will likely lower growth, but its contractionary effects can be mitigated by protecting public investment and well-targeted social expenditures, while raising revenue and cutting non-priority expenditure.

In light of lower global growth and an easing bias across major advanced economy central banks, monetary policy can remain supportive of growth in the region, especially given well-anchored inflation expectations, negative output gaps, and generally subdued inflationary pressures in most countries. But efforts should continue to monitor corporate and household leverage to safeguard financial stability.

Beyond policies to support a cyclical recovery, structural reforms remain an imperative and need to be accelerated to boost potential growth. Such reforms should include opening the economies further to trade and foreign direct investment, an easing of regulations in product and labor markets, enhancing competition, and improving the quality of human and physical capital.

South America:

In Argentina, the economy is gradually recovering from last year's recession. GDP growth is projected to increase to -1.3 percent in 2019 and 1.1 percent in 2020 due to a recovery in agricultural production and a gradual rebuilding of consumer purchasing power, following the sharp compression of real wages last year. Inflation is expected to continue to fall. However, with inflation proving to be more persistent, real interest rates will need to remain higher for longer, resulting in a downward revision to GDP growth in 2020.

In Brazil, growth is expected to stay subdued at 0.8 percent in 2019 and to accelerate to 2.4 percent in 2020, assuming a robust pension reform is approved, confidence returns, investment recovers, and monetary policy remains accommodative. In addition to the successful approval of pension reform, a continued reduction in the budget deficit over the coming years remains crucial to ensure public debt sustainability. To boost potential growth, Brazil needs decisive structural reforms, including tax reform, privatization, trade liberalization, and measures to enhance the efficiency of financial intermediation.

In Chile, growth is projected to remain robust at 3.2 percent in 2019 and 3.4 percent in 2020, helped by an expansionary monetary policy stance and the announced acceleration of investment projects. However, the balance of risks remains tilted to the downside, especially in light of the recent weak data on economic activity and export performance. The gradual convergence of inflation toward the central bank's target should be facilitated by the recent monetary policy easing, while fiscal policy is expected to remain guided by the authorities' structural balance target. Considering high global uncertainty, reaching a broad agreement over the pending policy reforms will be crucial to support domestic confidence.

In Colombia, the recovery is projected to continue in 2019 despite external headwinds. Accommodative monetary policy, election-year spending by subnational governments, migration from Venezuela, continued implementation of 4G infrastructure projects and a positive impact of recent tax reforms on investment will support domestic demand and lift growth to around 3.5 percent in 2019-20. Headline inflation should remain near target despite temporary supply shocks. The government's recently announced headline deficit target for 2019 is expected to be met. But, lower corporate taxes from 2020 onwards, while boosting investment and growth may result in lower revenues.

In Peru, growth was revised down, albeit modestly, to 3.7 percent in 2019 due to a weak outturn in the first quarter. Downside risks remain prominent, including lower commodity prices, continued trade tensions, and low implementation of public investment. Growth is projected to stabilize at around 4.0 percent in the medium term, with robust private domestic demand offsetting a gradual fiscal consolidation. Headline inflation is expected to remain within the central bank's target range of 1-3 percent.

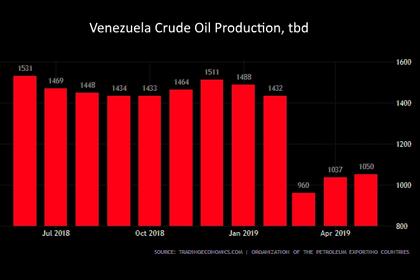

In Venezuela, the economic and humanitarian crisis continues to worsen. Real GDP is projected to fall by 35 percent in 2019, bringing the estimated cumulative decline since 2013 to over 60 percent. Hyperinflation is also projected to continue, and outward migration to intensify, with the total number of migrants from Venezuela expected to surpass 5 million by end-2019. This exodus is having sizable spillovers to other countries in the region.

Mexico, Central America, and the Caribbean

In Mexico, growth was revised down to 0.9 percent in 2019 due to a weaker momentum and elevated policy uncertainty but is expected to edge up to 1.9 percent in 2020 as conditions normalize. Adherence to the fiscal deficit target in 2019—and the approval of a prudent 2020 budget—will be important to prove the government's commitment to fiscal responsibility and a non-increasing public debt-to-GDP ratio. Advancing productivity-enhancing structural reforms remains crucial to boost Mexico's medium-term potential growth.

In Central America, Panama, and the Dominican Republic, growth is projected to continue in 2019−20 despite downward revisions. External conditions have improved marginally with the decline in global interest rates. However, the terms of trade have not recovered from last year's slump. Growth prospects in Costa Rica and Panama have been curtailed for 2019, reflecting weaker than expected activity so far this year.

Guatemala is benefiting from a fiscal impulse, while Honduras is still enduring unfavorable terms of trade. In El Salvador, growth continues to be boosted by investment, while continuing political tensions in Nicaragua are creating a significant headwind to activity there. A sharp tightening of external financial conditions and a further escalation in global trade tensions still stand out as prominent downside risks.

In the Caribbean, economic prospects are generally improving, but with substantial variation across countries. Growth in tourism-dependent economies is expected to strengthen to around 2 percent in 2019-20, supported by still strong U.S. growth—the main market for tourism in the region—and continued reconstruction from the 2017 hurricanes.

With improved energy production and higher commodity prices, commodity exporting countries are expected to see some modest recovery in growth, except in Guyana, where the start of oil production in 2020 will provide a substantial boost to growth.

More generally, regional growth continues to be impeded by lingering structural problems including high public debt, poor access to finance, high unemployment and vulnerability to commodity and climate-related shocks.

-----

Earlier: