MODERATE STEPS OF RUSSIA'S BANK

REUTERS - The Russian central bank plans to lower the key interest rate in small steps, taking into account the risk the government's spending plans may strengthen the rouble, Governor Elvira Nabiullina said.

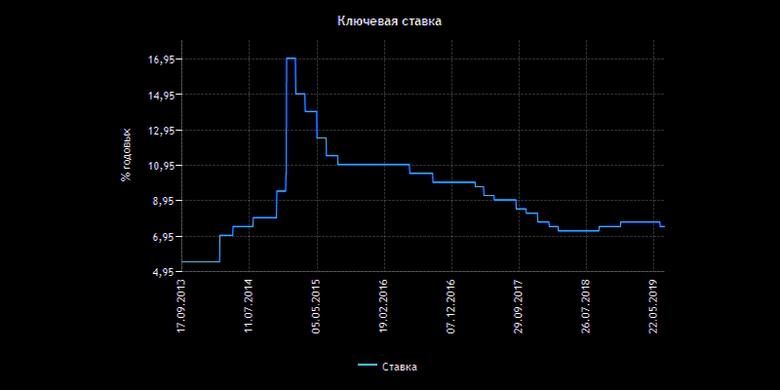

The central bank embarked on a monetary easing cycle last month, lowering the cost of lending amid sluggish economic growth and abating inflationary risks. Analysts expect further rate cuts but there is no consensus on their scale and timing.

At its last board meeting in June, the central bank considered holding the key rate and cutting it by 50 basis points but eventually trimmed it by 25 basis points to 7.50%, Nabiullina said.

"Other things being equal, we are trying to move in moderate steps for the economy to adapt to our new decisions," she said in an interview with Reuters cleared for publication on Wednesday.

Under its baseline scenario, the central bank, which aims to keep consumer inflation at its 4% target, plans to complete its monetary easing cycle by mid-2020, Nabiullina said.

Russia's monetary policy will become neutral once the key rate reaches a range of 6% to 7%, she added.

Expectations of further rate cuts have boosted demand for Russian OFZ treasury bonds this year. Rate cuts drive bonds' yields down, which inversely send their prices higher.

Nabiullina said inflows of foreign funds into OFZ bonds have not caused the market to overheat, while volatility in capital flows do not constitute a risk because of Russia's low state debt. Russia's debt currently stands at less than 15% of gross domestic product (GDP).

"We have tools to mitigate the implications of spikes in volatility for financial markets and the economy," she said.

RISK SCENARIO

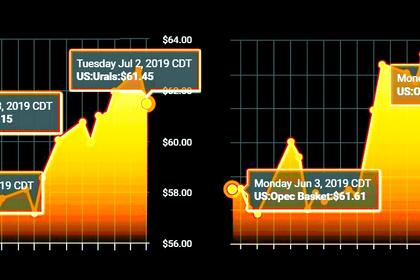

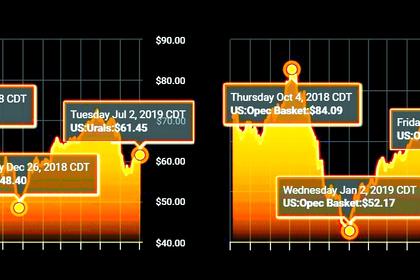

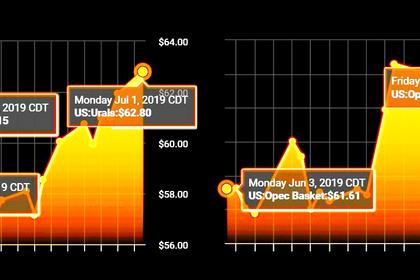

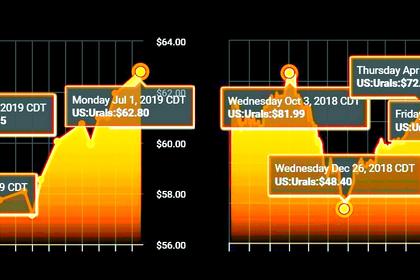

In its latest monetary policy report published last month, the central bank added to its risk scenario a probability of a drop in prices for oil, Russia's key export, to just $20 per barrel.

"In order to bring the risk scenario closer to real situations, we have priced in an option in which oil prices fall sharply for a short time before increasing to some extent and stabilizing," Nabiullina said.

Seeking to avoid such a scenario and prop up the price of crude, OPEC and its allies led by Russia agreed to extend oil output cuts until March 2020 on Tuesday.

"The main factor behind the oil prices drop in this scenario is the slowdown of the global economy," she said, adding that such a scenario was unlikely.

Asked about the trade war between China and the United States that has been fuelling concerns about the global economy for months and rattling emerging market currencies, Nabiullina said she did not expect the dispute to be resolved soon.

STRONGER ROUBLE

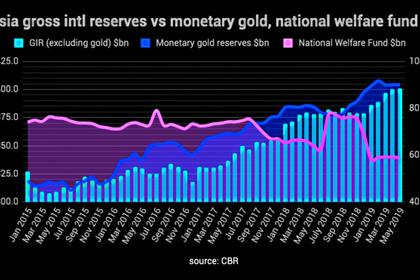

The Russian rouble could firm if the government proceeds with its plan to uncork the National Wealth Fund, now at around $60 billion, and start using it once it reaches 7% of GDP, a level it is expected to reach next year, Nabiullina said.

"This could lead, for example, to the rouble firming in a structural manner and to its stabilization at a new level," Nabiullina said without elaborating on the rouble exchange rate.

Nabiullina said the fund's spending should be economically feasible, reiterating her call for the 7% threshold to be re-examined and possibly raised.

BANKING SECTOR WATCH

The central bank has shut dozens of commercial banks in the past few years as part of a program to clean-up the banking sector, helping increase its sustainability.

Russian banks are on track to post a higher net profit this year than the 1.3 trillion rubles ($20.6 billion) they made in 2018, Nabiullina said.

"We have largely solved the issue of laundering of illegal incomes through the banking system. But now we need to constantly be vigilant for this operation not to come back."

In addition to shutting smaller lenders, the central bank has bailed out a handful of major banks, including Otkritie, B&N and Promsvyazbank.

Nabiullina said the central bank now needs to prepare the rescued lenders to be sold on the market and to be converted into banks with a large free float of shares.

-----

Earlier: