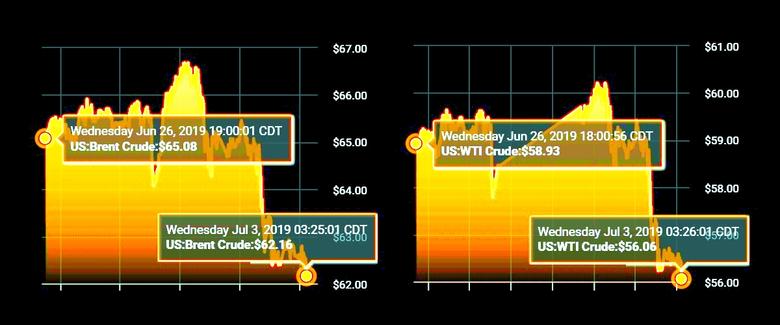

OIL PRICE: NEAR $62

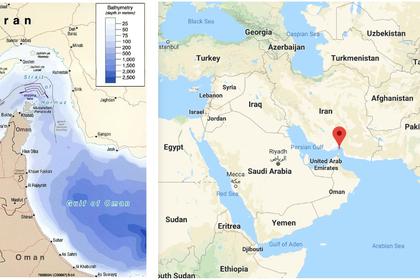

REUTERS - Oil prices were steady on Wednesday after a steep fall in the previous session, supported by extended output cuts by OPEC and its allies despite concerns that a slowing global economy could crimp demand.

Prices were also supported by widely-watched data showing a larger-than-expected drawdown in U.S. crude oil inventories, with government data due later in the day.

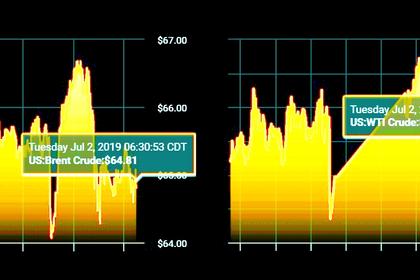

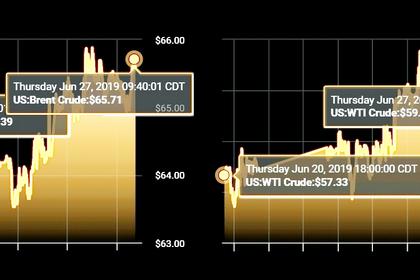

Brent crude futures LCOc1 for September delivery were trading up 12 cents, or 0.2%, at $62.52 a barrel by 0613 GMT.

U.S. crude futures for August CLc1 were up 16 cents, or 0.3%, at $56.41 a barrel. Both benchmarks fell more than 4% on Tuesday as worries about a slowing global economy.

The Organization of the Petroleum Exporting Countries and other producers such as Russia, a group known as OPEC+, agreed on Tuesday to extend oil supply cuts until March 2020 as members overcame differences to try to prop up prices.

"The OPEC+ meeting showed the members sticking together in tough times, characterized by weakening global demand outlook, aiming for a more balanced oil market, despite clear market share implications," Amarpreet Singh, analyst at Barclays Commodities Research, said in a note.

"This is supportive of oil prices, in our view, even as the market remains squarely focused on weak macro signals."

Ahead of government data due later on Wednesday, industry group the American Petroleum Institute (API) said that U.S. crude inventories fell by 5 million barrels last week, more than the expected decrease of 3 million barrels.

The OPEC+ agreement to extend oil output cuts for nine months should draw down oil inventories in the second-half of this year, boosting oil prices, analysts from Citi Research said in a note.

"Keeping cuts through the end of 1Q aims to avoid putting oil into the market during a seasonal low for demand and refinery runs," they said.

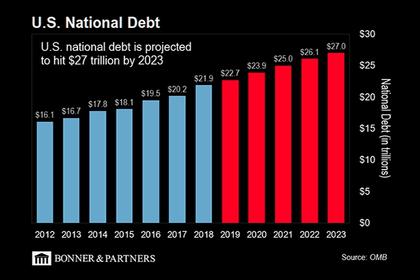

Still, signs of a global economic slowdown hitting oil demand growth worried investors after global manufacturing indicators disappointed and the United States opened another trade front after threatening the EU with more tariffs.

Barclays expects demand to grow at its slowest pace since 2011, gaining less than 1 million barrels per day year-on-year this year.

Morgan Stanley, meanwhile, lowered its long-term Brent price forecast on Tuesday to $60 per barrel from $65 per barrel, and said the oil market is broadly balanced in 2019.

Crude prices were also capped by signs of a recovery in oil exports from Venezuela in June and growth in oil production in Argentina in May.

-----

Earlier: