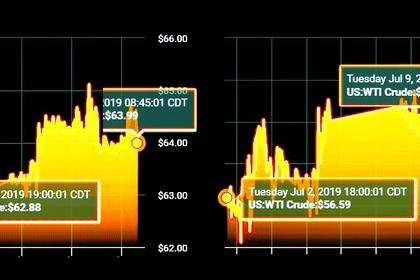

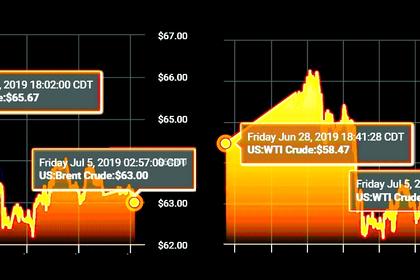

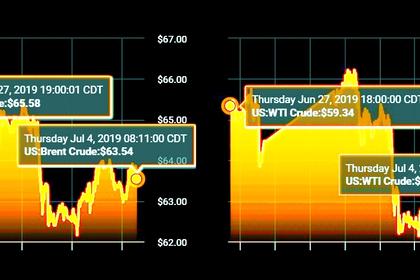

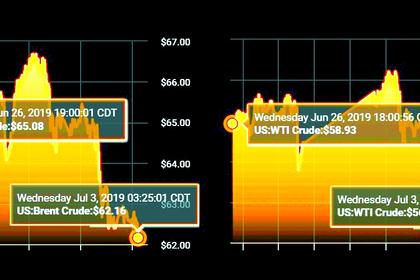

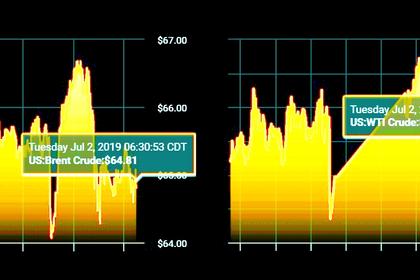

OIL PRICE: NEAR $65 AGAIN

REUTERS - Oil prices rose on Wednesday after industry data showed U.S. stockpiles fell far more than expected, alleviating concerns about oversupply, while major U.S. producers evacuated rigs in the Gulf of Mexico ahead of a brewing storm.

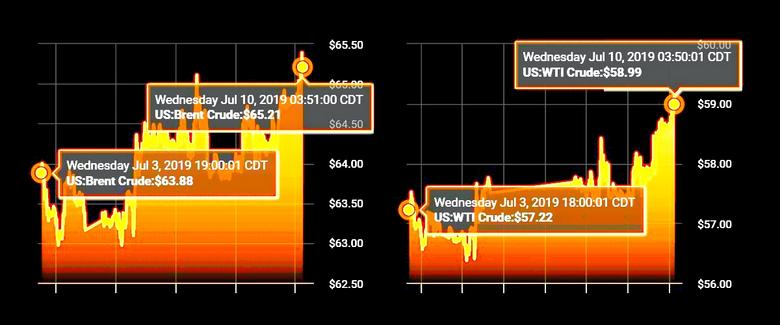

West Texas Intermediate (WTI) crude Clc1 had climbed 93 cents, or 1.6%, to $58.76 by 0652 GMT, having earlier risen to $58.84. Brent LCOc1 was up 70 cents, or 1.1%, at $64.86, after earlier touching $64.95.

The U.S. and global benchmarks have gained this year as the Organization of the Petroleum Exporting Countries (OPEC) and big producers such as Russia have curbed output to bolster prices.

However, ongoing trade tensions have raised fears about weaker demand, and investors have been on the lookout for signs that rapidly increasing U.S. production is being consumed.

U.S. crude stockpiles fell more than forecast last week, while gasoline inventories decreased and distillate stocks built, data from industry group the American Petroleum Institute (API) showed on Tuesday.

Crude inventories dropped by 8.1 million barrels in the week to July 5 to 461.4 million, compared with analyst expectations for a decrease of 3.1 million barrels, according to the data.

Official figures from the government's Energy Information Administration (EIA) are due later on Wednesday.

U.S. oil was also supported as major producers began evacuating and shutting in production in the Gulf of Mexico as a tropical disturbance may become a storm later on Wednesday or Thursday.

Oil prices have been under pressure from concerns about global economic growth amid growing signs of harm from the U.S.-China trade war that has rumbled on over the last year. Lower economic growth typically means reduced demand for commodities such as oil.

Still, U.S. crude oil production is forecast to rise to a record of 12.36 million barrels per day (bpd) in 2019 from the high of 10.96 million bpd last year, the EIA's Short Term Energy Outlook said on Tuesday.

OPEC and allied producers led by Russia agreed last week to extend their supply-cutting deal until March 2020. Brent has risen nearly 20% in 2019, supported by the pact and tensions in the Middle East, especially the row over Iran's nuclear program.

-----

Earlier: