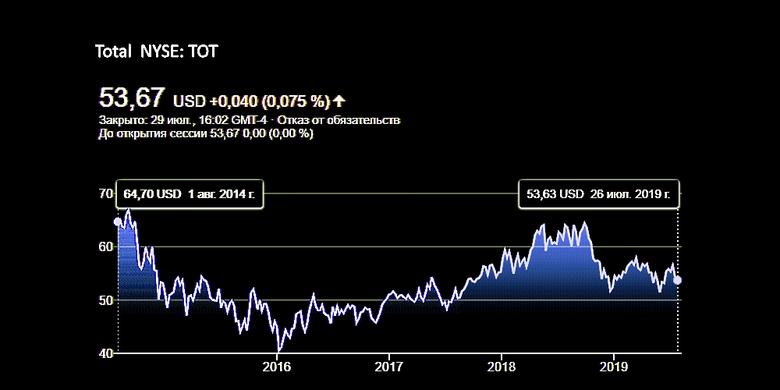

TOTAL NET INCOME $2.8 BLN

TOTAL - Second quarter and first half 2019 results

- Net income (Group share) of 2.8 B$ in 2Q19, a 26% decrease compared to 2Q18

- Net-debt-to-capital ratio of 20.6% at June 30, 2019

- Hydrocarbon production of 2,957 kboe/d in 2Q19, an increase of 9% compared to 2Q18

- Ex-dividend date for second 2019 interim dividend of 0.66 €/share on January 06, 2020

Paris, July 25, 2019 - Total's Board of Directors met on July 24, 2019, to approve the Group's second quarter 2019 financial statements. Commenting on the results, Chairman and CEO Patrick Pouyanne said:

"Markets remained volatile with Brent averaging $69/b in the second quarter, an increase of 9% compared to the previous quarter, but natural gas prices were down 36% in Europe and 26% in Asia. In this context, with a slight increase in production to 2.96 Mboe/d, adjusted net income increased by 5% compared to the previous quarter to 2.9 8$, and the return on equity remained above 11%.

Fueled by the ramp up of cash flow accretive projects, like Egina in Nigeria, lchthys in Australia and Kaombo Norte in Angola, plus the second-quarter start-ups of Kaombo Sul in Angola and Culzean in the UK North Sea, debt-adjusted cash flow (DACF) increased by 10% compared to the previous quarter to 7.2 8$. Cash flow after organic investments increased to 3.7 8$, up 13% from the previous quarter. Thus, the organic pre-dividend breakeven is below $25/b and the organic post-dividend breakeven is below $50/b.

Exploration & Production benefited from the higher Brent with a 15% increase in operating cash flow before working capital changes.

Although gas prices fell sharply, iGRP increased its operating cash flow before working capital changes by 42% thanks to 8% production growth and a 10% increase in LNG sales. Compared to the second quarter 2018, operating cash flow before working capital changes increased by 77%, driven by a doubling of LNG sales.

In signing an agreement with Occidental to acquire Anadarko's assets in Africa, the Group is preparing for its future and capitalizing on its strengths. In Mozambique, it leverages its expertise in LNG, in Ghana, the deep offshore and, in Algeria, its historic presence. The Group continues to grow in LNG with the signing of a sales contract with the Chinese company Guanghui, the takeover of Toshiba's LNG portfolio and the start-up of Cameron LNG in the United States. This strategy is complemented by the divestment of high-breakeven assets, such as the recent sale of mature assets in the UK North Sea. This active portfolio management policy will continue with the sale of 5 B$ of assets over the 2019-20 period, the majority coming from Exploration & Production.

In the Downstream, adjusted net operating income was 1.1 8$, up 4% compared to the previous quarter, in an environment where refining margins fell by 16%. In addition, the Group strengthened its presence in biofuels with the start-up of the La MOde bio-refinery.

Total maintains a solid financial position with gearing of 20.6%, after taking into account the payment of two interim dividends in the quarter and the impact of the new IFRS 16 standard (2.7%). Consistent with its shareholder return policy, the Group increased the second interim dividend by 3.1% compared to last year to €0.66 per share and bought back 0.76 8$ as part of its target to buy back 1.5 8$ of share in 2019 with Brent at $60/b. The cash returned to shareholders, expressed in dollars, stands at 37% of operating cash flow before working capital changes for the first half 2019."

-----

Earlier:

2019, June, 3, 12:20:00

TOTAL BUYS U.S. LNG

The transaction, among other things, will give Total control over 2.2 million mt/year of LNG to be produced by the third train at the Freeport LNG export terminal in Texas. The facility is currently preparing to begin production from its first train, after several construction- and weather-related delays hampered the project.

|

2019, May, 30, 17:20:00

TOTAL, ALGERIA PARTNERSHIP

Algeria’s energy minister said on Monday he would seek a “good compromise” when asked about his earlier comments that Algiers would block Total’s plan.

|

2019, April, 29, 11:00:00

TOTAL NET INCOME $2.8 BLN

“Markets remained volatile with Brent averaging $63/b in the first quarter, down 6% from last year, while natural gas prices were down 11% in Europe and 30% in Asia. Adjusted net income was $2.8 billion this quarter, down 4%, and return on equity held steady at 12% this quarter.

|