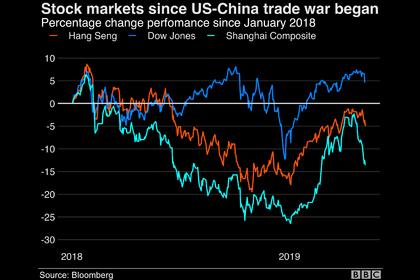

U.S., CHINA TENSIONS

PLATTS - President Trump's decision to postpone the levying of additional tariffs on Chinese imports marks a positive development for the US oil and gas industry, but more needs to be done to resolve the adverse impacts that have already occurred as a result of the ongoing trade war, industry advocates said.

"We are encouraged to see progress in US-China trade negotiations," Aaron Padilla, American Petroleum Institute's senior advisor for international policy, said in a statement.

In a signal that he might be open to renewed trade talks with China, Trump announced on the sidelines of the G20 meeting of world leaders in Japan Saturday that he would hold off on the imposition of additional tariffs on Chinese imports.

Tariffs, imposed by the US under Section 301 of the Trade Act of 1974, as well as retaliatory tariffs imposed by China on US imports, have already harmed the US oil and gas industry, according to testimony Padilla recently gave to the US Trade Representative's Section 301 committee.

"Section 301 tariffs have been levied on more than 100 products -- including bearings, drill collars, electronic circuits, fluids, lithium batteries, meters, motors, pumps, pump parts, rotors/stators, steel, turbines, and valves -- are hurting the natural gas and oil industry," he testified.

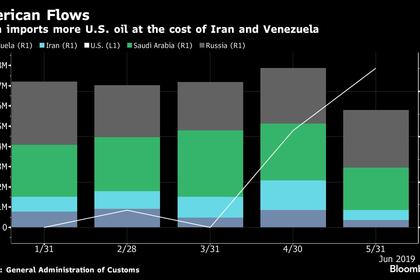

Padilla reported that the trade dispute with China has diminished US exports of crude oil and refined products to that country. In the nine months from October 2017 to June 2018, before the US first imposed Section 301 tariffs on imports from China in July 2018, China received 22% of total US crude oil exports and 4% of total US refined products exports. In the nine subsequent months, from July 2018 to March 2019, China received only 3% of total US crude oil exports and 2% of total US refined products exports, he said.

An easing of trade tensions with China also could have a positive impact on the level of US exports of LNG to that country, Katie Ehly, senior policy advisor for the Center for Liquefied Natural Gas, said in an interview Tuesday.

"We've seen less cargos of LNG going to China versus last year and China is certainly a large market that we hope to be exporting to," she said.

Ehly said Trump's announcement Saturday eased trading tensions, but did not end the dispute between the two countries.

GETTING NEGOTIATIONS BACK ON TRACK

"We were certainly glad that no more tariffs will be imposed and it seems like they're trying to get negotiations back on track. We would have loved to have seen some kind of an agreement happen this weekend, but at least we did not see an escalation," she said.

"I see it as a good step in the right direction," Ehly said. "The sooner that we can resolve these tariffs, the better."

Ed Longanecker, president of Texas Independent Producers & Royalty Owners Association, also called for an end to the trade war, which he said could be harmful to the growth of the state's oil and gas industry.

"As negotiations resume regarding trade matters, TIPRO remains hopeful that leaders of the two countries will agree to a suitable deal officially bringing an end to the ongoing trade war," he said in a statement Tuesday.

As a result of the 18-month trade war, the Chinese have imposed retaliatory tariffs against numerous American-made products, "including energy resources produced in the United States," he said. "TIPRO hopes the Trump administration will achieve a fair deal with China bringing a resolution to the trade war and terminating tariffs against US energy products."

----

Earlier: