U.S., CHINA TRADE: $300 BLN

PLATTS - The US and China agreed Saturday to resume trade negotiations, with the US agreeing to halt further tariff hikes on Chinese goods and China agreeing to immediately start increasing purchases of American goods.

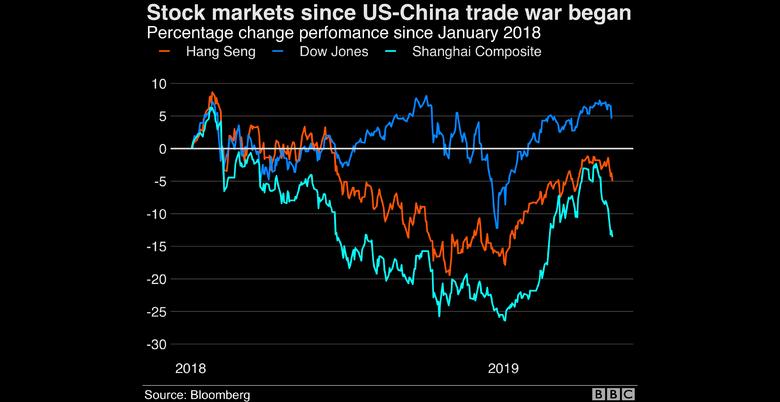

The developments on the sidelines of the G20 summit in Osaka, Japan, are positive for the recovery of commodity trade flows between the two countries, which had declined sharply since the trade conflict began, and US crude oil and agricultural product exports to China are likely to be among the first to benefit.

"With respect to China, basically we agreed today that we will continue the negotiations which I ended a while back," US President Trump said at a press conference.

"And I promised that for at least the time being we're not going to be lifting tariffs on China," he said, referring to the more than $300 billion of Chinese goods that have not yet been tariffed by the US.

"We are not doing that. We are going to work with China where we left off to see if we can make a deal. China is going to be consulting with us and they are going to start spending money even during the negotiation to our farmers," Trump said.

"China is going to be buying a tremendous amount of food and agricultural product and they are going to start that very soon and almost immediately. We are going to give them lists of things that we'd like them to buy," he added.

A White House statement is awaited with further details of the agreement.

The re-opening of trade negotiations between the US and China also opens the door for the easing of trade tensions and potential removal of tariffs on a range of commodities including LNG, LPG, soybeans, metals and petrochemicals.

"Chinese President Xi Jinping and US President Trump have agreed that the two countries should resume economic and trade consultations on the basis of equality and mutual respect," state-run Xinhua News Agency reported Saturday.

"The economic and trade teams of the two countries will discuss specific issues," Xinhua said.

The Trump administration had previously signaled new tariffs on $300 billion of imports from China that would have further impacted commodities trade between the two countries.

With China preparing for a prolonged period of trade conflict, an escalation has been averted for now despite ongoing concerns about the trade dispute slowing global economic growth and commodity demand in the long run.

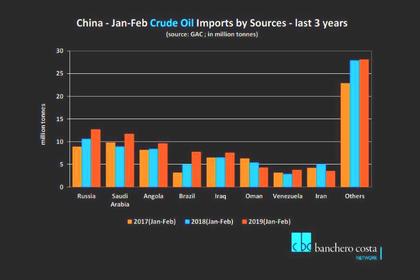

Beijing has not imposed tariffs on US crude imports and the decline in trade flows was due to risk aversion among buyers.

With the current truce, US-China crude flows could recover quickly, according to market participants.There has been renewed buying interest in US crude due to the removal of Iranian and Venezuelan barrels from the market and favorable US-China arbitrage economics.

US crude arrivals in China hit an eight-month high at 799,318 mt (189,000 b/d) in May, while still falling 57.8% year-on-year from 1.86 million mt in May 2018.

State-run Sinopec's refineries have booked US cargoes for delivery in the months between June and September and the refiner's trading arm Unipec has even found an alternative way of shipping barrels that cuts travel time in half by utilizing Panama's Pacific terminal, Platts reported previously.

This suggests that US-China crude trade was sustained despite trade tensions, and are now poised for an uptick with the truce, which a Beijing-based senior official with Sinopec said was expected.

China imported 12.28 million mt (247,000 b/d) of US crude oil in 2018, up 60.5% year-on-year, data from the General Administration of Customs showed.

US crude flows to China hit a record high of 2 million mt in January 2018 and dropped sharply since October when trade tensions began to escalate.

China, the world's largest buyer of soybeans, had retaliated to US tariffs with its own 25% tariffs on US-origin soybeans in July 2018.

It is unclear how China will increase purchases of US soybeans with these tariffs in place, but if the purchases rise they could negatively impact Brazilian and Argentine soybeans markets, which had stepped in to fill the gap.

US soybean exports to China declined sharply in 2018 and rebounded partly this year. The share of US soybeans in the Chinese market slipped below 20% in 2018 from about 34% in 2017, according to China Customs and USDA data.

The latest USDA weekly report shows outstanding sales of US soybeans to China reaching 5.6 million mt in 2018-19, up 388% from the same period a year earlier. Outstanding sales show volumes contracted but not shipped yet.

-----

Earlier: