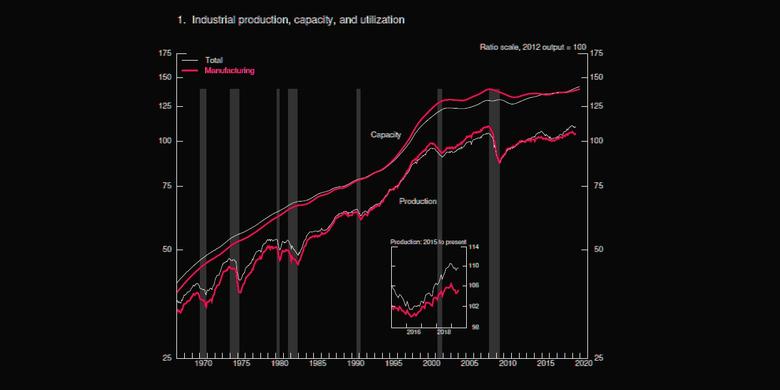

U.S. INDUSTRIAL PRODUCTION DOWN 1.2%

U.S. FRB - Industrial production was unchanged in June, as increases for both manufacturing and mining offset a decline for utilities. For the second quarter as a whole, industrial production declined at an annual rate of 1.2 percent, its second consecutive quarterly decrease. In June, manufacturing output advanced 0.4 percent. An increase of nearly 3 percent for motor vehicles and parts contributed significantly to the gain in factory production; excluding motor vehicles and parts, manufacturing output moved up 0.2 percent. The output of utilities fell 3.6 percent as milder-than-usual temperatures in June reduced the demand for air conditioning. The index for mining rose 0.2 percent. At 109.6 percent of its 2012 average, total industrial production was 1.3 percent higher in June than it was a year earlier. Capacity utilization for the industrial sector decreased 0.2 percentage point in June to 77.9 percent, a rate that is 1.9 percentage points below its long-run (1972–2018) average.

Market Groups

The major market groups recorded mixed results in June. The drop in utilities contributed notably to small declines for nondurable consumer goods, materials, and business supplies through their energy components, but almost all of the major non-energy market groups posted increases. The largest gain was recorded by consumer durables, as decreases for most of its categories were outweighed by a substantial increase for automotive products.

Industry Groups

Manufacturing output increased 0.4 percent in June after moving up 0.2 percent in May. Despite the gains in the past two months, factory production declined at an annual rate of 2.2 percent in the second quarter, about the same pace as in the first quarter. In June, the indexes for durables and for nondurables advanced 0.4 percent and 0.5 percent, respectively. The output for other manufacturing (publishing and logging) declined 0.5 percent. Among durables, an increase of nearly 3 percent in the output of motor vehicles and parts was accompanied by gains of around 1 percent in the indexes for nonmetallic mineral products and for computer and electronic products. Among nondurables, the index for petroleum and coal products recorded the largest advance—2.5 percent—and most other categories also posted gains; the indexes for printing and support activities and for chemicals registered the only declines.

In June, electric utilities and natural gas utilities posted drops of 3.9 percent and 2.0 percent, respectively. Mining output rose 0.2 percent, as a gain in oil and gas extraction was partly offset by declines in coal mining and in support activities for mining. Mining production advanced 8.9 percent at an annual rate for the second quarter, its 11th consecutive quarterly increase.

Capacity utilization for manufacturing rose 0.3 percentage point in June, with increases for both durables and nondurables and a decrease for other manufacturing (publishing and logging). The overall manufacturing operating rate of 75.9 percent is 2.4 percentage points below its long-run average. The utilization rate for mining moved down to 91.5 percent, which is still more than 4 percentage points higher than its long-run average. The operating rate for utilities dropped 3.0 percentage points and remained well below its long-run average.

Note: Revised Estimates of Industrial Capacity

The estimates for industrial capacity for 2019 were revised for this release. The revisions reflect updated measures of physical capacity from various government and private sources as well as updated estimates of capital spending by industry. Measured from the fourth quarter of 2018 to the fourth quarter of 2019, capacity for the industrial sector is now expected to increase 2.1 percent, a rate that is 0.1 percentage point higher than previously estimated. Capacity for manufacturing is now expected to grow 1.4 percent, a rate that is also 0.1 percentage point higher than previously estimated. Mining capacity is now expected to rise 5.8 percent. This increase is 0.5 percentage point higher than previously estimated, primarily reflecting faster capacity growth for oil and gas extraction. The gain in capacity for utilities, at 2.5 percent, is 0.1 percentage point lower than previously estimated.

-----

Earlier: