U.S. LNG DEMAND UP

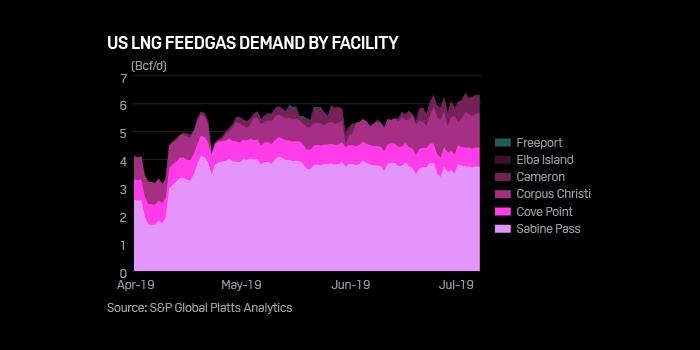

PLATTS - US LNG feedgas demand is trending near record-high levels this month as newly minted liquefaction facilities along the Gulf Coast continue to ramp up, despite narrow margins for export profit.

In July, gas demand from the six operational US export facilities has averaged nearly 6.2 Bcf/d.

Demand hit a single-day record high just below 6.4 Bcf/d on July 4 and was estimated at just under that level Monday, data compiled by S&P Global Platts Analytics shows.

The more-than-600 MMcf/d increase in feedgas demand since last month comes principally from an uptick in liquefaction at Cameron LNG Train 1 and Cheniere Energy's Corpus Christi Train 2.

Cameron exported it's first cargo -- the 3.9 Bcf Marvel Crane delivered to Spain -- on May 31 and continues to move closer to commercial service at Train 1, expected later this month or possibly in August.

At Corpus Christi, the startup of LNG production at Train 2 in early June has seen feedgas demand there climb sharply over the past several weeks. In July, flows to the two-train facility have averaged nearly 1.2 Bcf/d, or at about 85% of its current nameplate capacity.

While feedgas flows to Freeport LNG's Train 1 have remained at zero in recent weeks, steady demand from Sabine Pass, Cove Point and Elba Island has lifted total US LNG export demand to record highs recently, despite historically narrow margins for profit.

NETBACKS

As incremental supplies of US LNG continue filtering onto the global market, exporters are facing narrow margin for profit amid a sustained rout in global gas prices.

In Northeast Asia, the prompt-month Platts JKM is now hovering just above a three-year low -- the index was assessed Monday at $4.26/MMBtu. Forward-market valuations show weaker prices continuing.

Physical supply for September is now trading in the low-$4s/MMBtu, while swaps for October and November are still priced below $5/MMBtu and $6/MMBtu, respectively, S&P Global Platts data shows.

In Europe, prompt supply at the UK National Balancing Point and at the Dutch TTF is also trading near multi-year lows in the upper $3/MMBtu area.

According to Platts Analytics, the weighted-average netback value on a US LNG export cargo shipped to the highest-priced global import market is averaging just 14 cents/MMBtu this month. The netback, or profit calculation, includes the cost of feedstock gas, onshore transport, shipping and related fees but excludes sunk costs associated with liquefaction.

From Sabine Pass, the margin on cargoes shipped to the JKM market actually turned negative last month. On Monday, the netback was estimated at just 38 cents/MMBtu.

-----

Earlier: