CHINA'S COAL IMPORTS UP

CHINA'S COAL IMPORTS UP

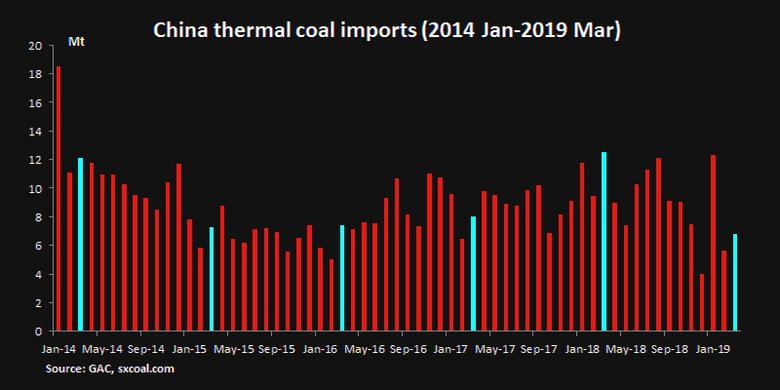

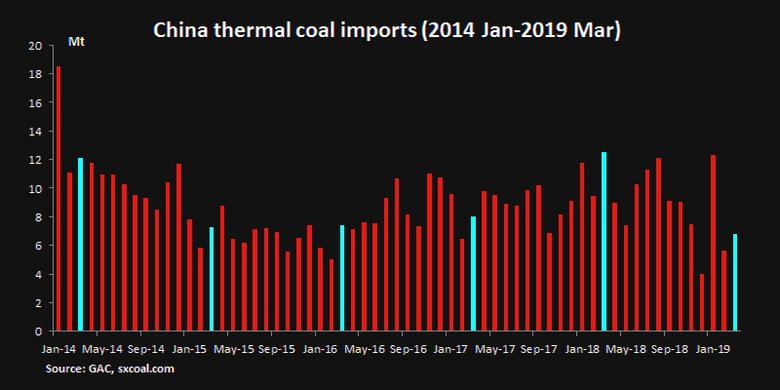

PLATTS - China's July thermal coal imports, including lignite, jumped 20% from 20.44 million mt a year ago to 24.42 million mt, according to China customs data released Sunday.

Month-on-month, China's thermal coal import volume was up by about 23% from 19.84 million mt in June, the data showed.

In July, volume of coking coal import stood at 7.75 million mt, up 18% month on month.

Market sources said that Chinese power utilities have been calling for tenders amid tightening import curbs.

"It might be even more difficult to import in Q4 as quota might be used up by then, so buyers are procuring earlier to avoid that situation," an East China-based trader said.

China imported 187 million mt of coal over January-July, including thermal and coking coal, up 7% year on year, the GAC data showed.

It imported a total of around 281 million mt of coal last year and market participants are expecting the country's custom authorities to keep this year's imports at similar levels.

-----

Earlier:

2019, August, 23, 11:00:00

CHINA'S COAL DEMAND UPDOWN

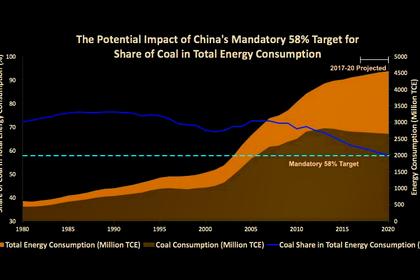

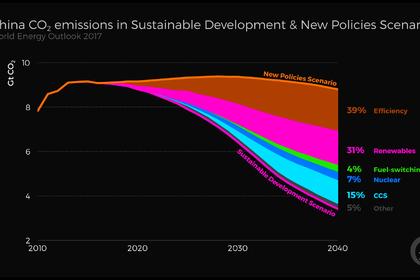

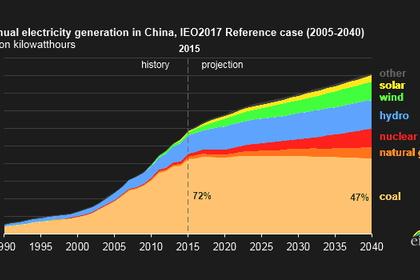

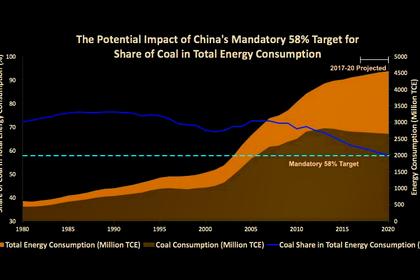

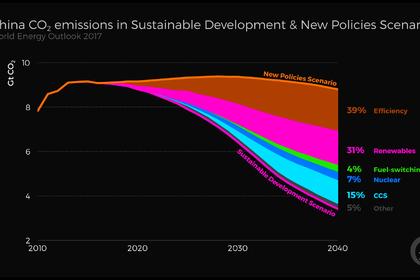

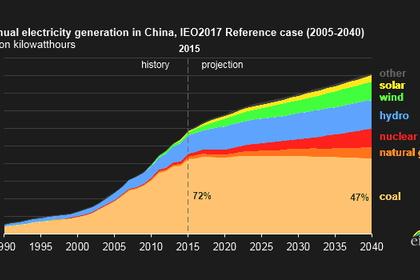

Though the share of coal in the China’s total energy mix fell to 59% last year from 68.5% in 2012, overall consumption in 2018 rose 3% from a year earlier to 3.82 billion tonnes,

2019, August, 19, 11:20:00

CHINA'S GREEN INVESTMENT $1 BLN

Chinese financial institutions provided at least $1 billion in “green” financing to coal-related projects in the first half of this year, a review of financial data showed, with fossil fuels still playing a major role in Beijing’s energy strategy.

2019, August, 12, 13:00:00

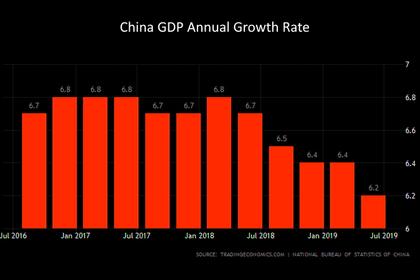

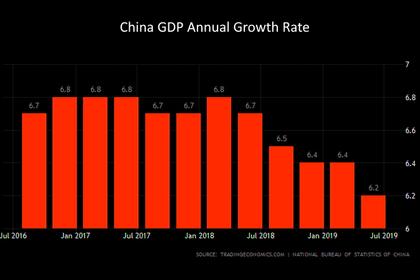

CHINA'S GDP UP 6.2%

The Chinese economy is facing external headwinds and an uncertain environment. GDP growth slowed to 6.6 percent in 2018, driven by necessary financial regulatory reforms and softening external demand. Growth is projected to moderate to 6.2 percent in 2019 as the planned policy stimulus partially offsets the negative impact from the US tariff hike on US$ 200 billion of Chinese exports. Headline inflation rose due to rising food prices and is expected to remain around 2½ percent.

2019, August, 7, 12:05:00

CHINA'S COAL UP

Long-term cuts in coal consumption are a key part of China’s energy, environment and climate goals, but the fivefold increase in new mine approvals in the first-half of 2019 suggests China’s targets still provide ample room for shorter-term growth.

All Publications »

Tags:

CHINA,

COAL,