GAZPROM'S SHARE IN EUROPE: 32%

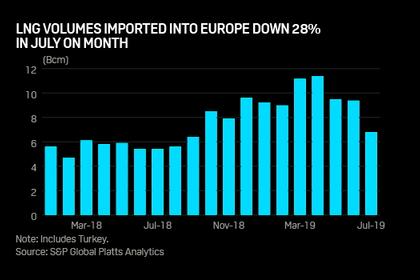

REUTERS - Europe's two biggest suppliers of pipeline gas, Norway's Equinor and Russia's Gazprom, have lost market share for the first time in at least four years amid a tripling in liquefied natural gas (LNG) imports into the region over the past 10 months.

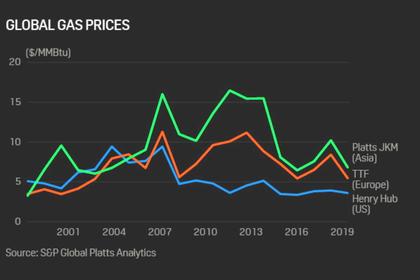

LNG imports into Europe have jumped amid lower than expected spot demand from Asia, which has helped to send European gas prices to 10-year lows and filled European storages to multi-year highs.

Data compiled by Refinitiv showing changes in the market share of gas from Norway, Russia and LNG sources is the latest example of how LNG is transforming Europe's gas market.

The share of LNG in gas supplied to western and central Europe increased to 14% between October 2018 and August 2019 from 5% in the same period of 2017-18.

The share of Norwegian gas dropped to 33% from 38%, a multi-year low, calculations by Refinitiv show.

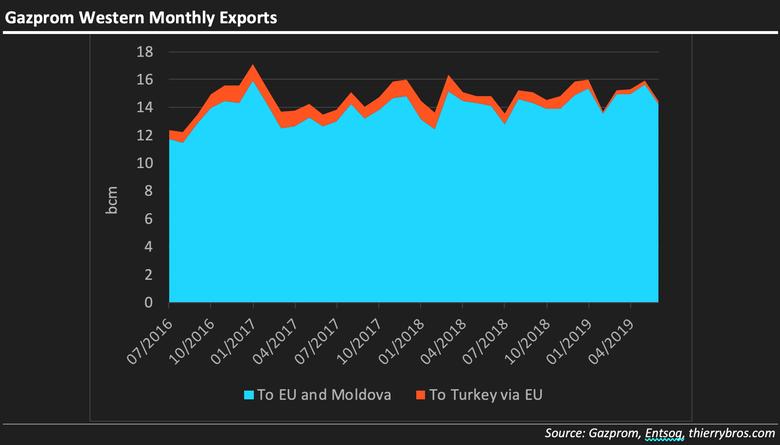

Gazprom's share was around the average of the past three years, edging down by 1% from the previous year to 32%. But it was the first year-on-year drop since 2014-2015, when it was hit by low gas demand in Europe.

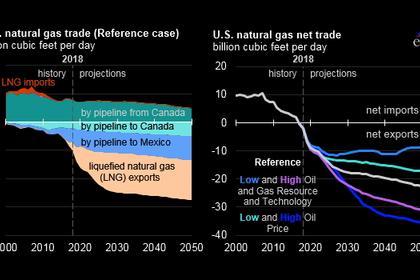

LNG from the United States into northwest Europe accounted for 2% of total gas supply into the region, contributing to the strong increase in LNG in Europe.

Despite its market share loss, Gazprom's total gas exports to Europe rose as the region imported 9% more gas from October to August, compared with the same period in 2017-2018.

"Most of the increase which we see in Russian supply this year came to Slovakia and the Czech Republic - countries which do not have direct access to LNG and which need to prepare their storages in case transit via Ukraine stops from January 2020," said Marina Tsygankova, gas market analyst at Refinitiv.

The gas transit agreement between Russia and Ukraine is due to expire at the end of this year. The lack of progress in talks has spurred Europe to stockpile gas to prevent possible supply disruption in winter.

In countries with LNG terminals, Russian flows have given some ground to LNG volumes, an LNG market source said.

The drop in Norwegian flows, meanwhile, was seller-driven, with Equinor conducting extensive maintenance on its production and also reducing output, probably for commercial reasons.

In contrast, a drop in Russian gas flows to some western European countries, such as Germany, was buyer-driven.

"If I have a long-term contract and some flexibility left, I would run the contract low now and ramp it up again in September or later," a gas trader in Europe said, pointing to current low spot prices.

A drop in Dutch production has also helped to create room for LNG arrivals.

The analysis was based on gas volumes for Germany, France, Austria, the Netherlands, Britain, Belgium, the Czech Republic and Slovakia from October to August over the past six years.

-----

Earlier: