INDIA'S RENEWABLE INVESTMENT: $500-$700 BLN

IEEFA - 16 August 2019 (IEEFA India) - India will require US$500 – 700 billion in renewable energy and supporting grid investment over the coming decade in order to meet its renewable energy targets, finds a new IEEFA briefing note out today.

Entitled International Capital Awaits Robust Policy Environment in India’s Renewables Infrastructure Sector, the note reviews India’s energy market and finds some recent policy changes favourable for renewable energy investors, but also notes with caution some sovereign risk issues that need to be resolved quickly.

Author Tim Buckley, Director of Energy Finance Studies with the Institute for Energy Economics and Financial Analysis (IEEFA), says the world is looking to invest in India’s renewable energy sector.

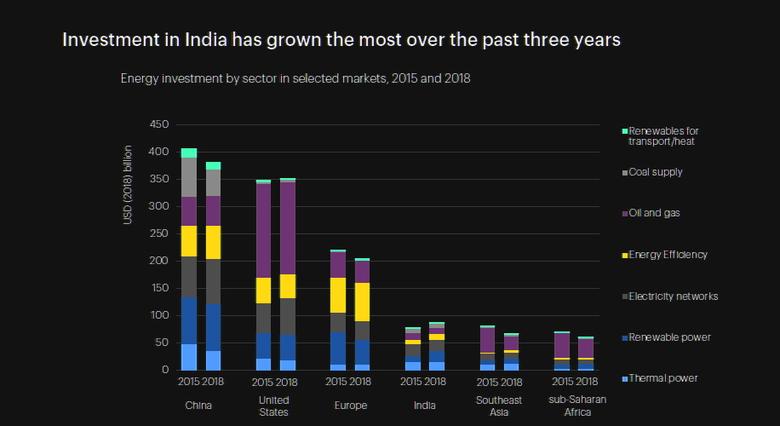

“There has been clear momentum in India’s renewable energy capacity building in the last 24 months, leveraging the expanding opportunities in deflationary sustainable domestic projects,” says Buckley.

“India is set to reach 144 gigawatts of renewable energy by the end of financial year 2021/22.

“The country has a clear ambition to transition to a cheaper lower emission electricity system, and that ambition is attracting healthy global investment.

“Global capital flows will into India will accelerate as long as the Indian government provides a clear policy framework and puts in place measures to lower risks and protect investor confidence.”

The briefing note highlights multiple examples of international investment in India’s renewable energy projects, while also noting recent obstacles to India’s renewable ambitions, including a slow-down in the tendering process, grid integration constraints, and issues with excessively aggressive tariff caps on reverse auctions.

As a result, during FY2018/19 India failed to capitalise on the momentum built over the previous two years through record low solar and wind tariffs. Only 10.3GW of renewable generation capacity was added in FY2018/19.

Co-author Kashish Shah says the slowdown masks some very positive policy announcements recently, which accelerated tendering activity in June 2019 post the Central election.

“The proposed tariff policy revision and the payment security mechanism enhancements are both significant regulatory reforms, while removing the priority lending limit for the renewable energy sector will accelerate private bank lending to renewable energy infrastructure projects,” says Shah.

“There is however a need for better coordination between central and state governments to ensure ambitious renewable targets can be met state by state and across the country as a whole.”

The briefing note concludes the Indian government is successfully paving the way for increased renewables investment that will enhance India’s energy security and drive investment and employment opportunities.

For global public and private debt and equity capital seeking steady long-term returns, there is a huge investment opportunity in India’s electricity and transportation sectors to support the development of new generating capacity and grid development by 2030.

“India wants to meet its renewable targets while showing global leadership in setting a policy framework consistent with the Paris Agreement,” says Buckley.

“Investors are showing a strong appetite to support India’s infrastructure goals, if the government can stay on track. IEEFA believes they can.”

-----

Earlier: