LNG FOR EUROPE DOWN 28%

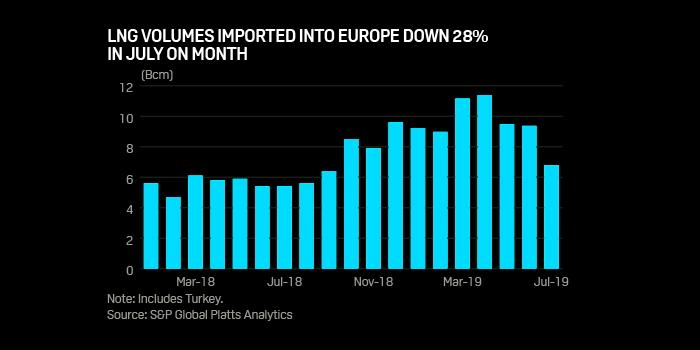

PLATTS - European LNG imports in July fell 27.6% month on month to 6.8 Bcm due to weaker European pricing and a turndown in Qatari production, but a rebound in flows is expected in September, an analysis by S&P Global Platts Analytics show.

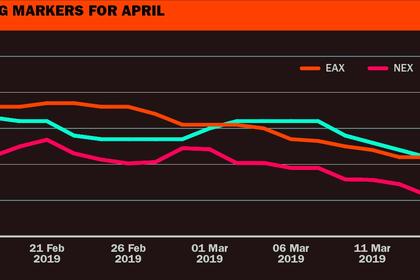

This turndown was a result of a wider JKM-TTF, on the back of weakness in European gas hubs, with stock levels unusually high at 75% full, up 25 percentage points year on year, according to Platts Analytics data.

Although lower on the month, July imports marked a quite significant increase from a year ago, when June and July imports both stood at 5.4 Bcm.

Imports in July from top LNG exporter Qatar plunged 44.6% month on month to 1.8 Bcm.

Capacity utilization of Qatari LNG export facilities fell to 98% in July from 107% a year ago, according to Platts Analytics.

Qatar may have been holding back supplies rather than flooding Europe with excess LNG, Platts Analytics said in its weekly report published Wednesday.

However, the fall in Qatari exports toward Asia was less pronounced than to Europe, with India and Pakistan increasing their imports in July, amid more favorable Asian netbacks.

The Japan-Korea netback to the Middle East for July delivery averaged $3.78/MMBtu, while its Northwest European counterparts averaged only $2.58/MMBtu.

Imports from Russia and the US to Europe also fell in July, down 11.7% and 23.5% month on month to 1.6 Bcm and 0.6 Bcm respectively.

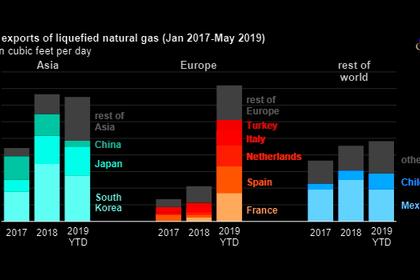

The US sent just one vessel to Northwest Europe in July, its lowest monthly volume since September 2018, while the opening of the North Sea Route has supported the shipment of some Yamal LNG cargoes to Asia, Platts Analytics said.

However, with the current JKM-TTF spread narrowing, Platts Analytics forecasts LNG imports into Northwest Europe will rebound in September, after hitting a bottom in August.

In terms of destinations, France has been Europe's leading importer of LNG in 2019 to date, followed by Spain and the UK, according to Platts Analytics data.

France imported mainly from Russia (5.6 Bcm) and Algeria (2.1 Bcm). The main exporter to Spain this year has been Nigeria (2.6 Bcm), while Qatar has been sending most of its LNG spot cargoes to the UK this year (5.8 Bcm) as demand from other global term contracts shrank.

The top LNG suppliers to Europe so far this year are Qatar (19.1 Bcm), Russia (13 Bcm), Algeria (8.9 Bcm), Nigeria (8.4 Bcm) and the US (7.9 Bcm), Platts Analytics data show.

-----

Earlier: