NORWAY'S FUND INVESTMENT FOR U.S.

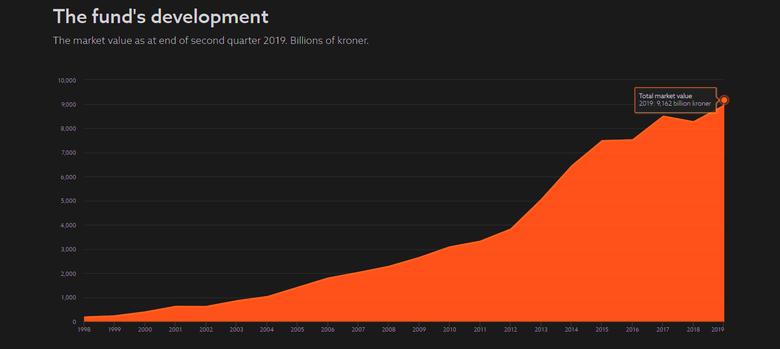

REUTERS - Norway's $1 trillion sovereign wealth fund should shift billions in investments from European stock markets and instead invest more in the United States and other North American markets to seek higher returns, the fund's manager recommended on Tuesday.

The world's largest sovereign wealth fund has historically given higher weighting to European stocks, focusing on countries that Norway does the most trade with, and a lower weighting to those of North America.

But the Norwegian central bank, which manages the Government Pension Fund Global, said this was no longer necessary, and it wanted the fund's portfolio to better reflect the available pool of investments.

"We can all see that both return and the common measure of risk has been better in North America in the past years than it has been in the rest of the world," Egil Matsen, the deputy central bank governor in charge of the fund, told Reuters.

He declined to say how much of the value of the fund could potentially shift further to North American equities.

"We are not specific on that, and that is a conscious decision," he said, stressing that it would be up to the finance ministry, and parliament, to decide whether to take up the central bank's advice.

If they do, it would mean potentially billions of euros, pounds and other European currencies of investments would shift from Europe to the United States and other North American markets.

As it stands, Norway's rainy day fund, which invests the proceeds of the country's oil and gas production, owns more European stocks and fewer U.S. shares than the size of those markets would dictate.

But the fund eased the policy of directing investment to Norway's most important trading partners in 2012, the last time it reviewed its regional weighting.

The fund has since reduced its exposure to European shares from 50% of the total equity holdings to about 34% by the end of 2018. Some 43.0% of the fund's investments were in North America at the end of last year and 17% in Asia.

The advice is not based on any particular view on future return in individual markets or regions, the fund added.

The finance ministry said separately that it would give its assessment next spring. "Implementation of any changes in the benchmark index will be gradually over time," it said.

-----

Earlier: