OIL PRICE: NEAR $60 STILL

REUTERS - Oil gave back some of its recent gains on Friday, but was still headed for the biggest weekly increase since early July, boosted by a decline in U.S stocks, a looming hurricane in Florida and an easing of Sino-U.S. trade rhetoric.

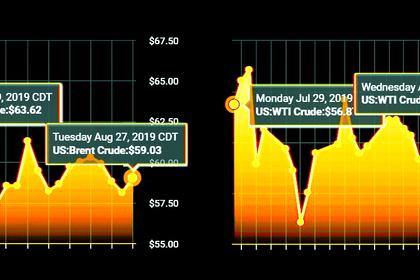

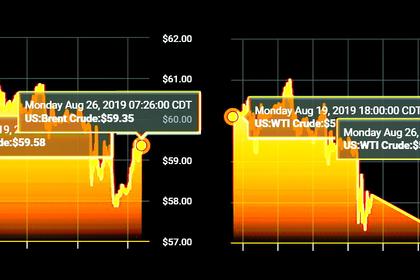

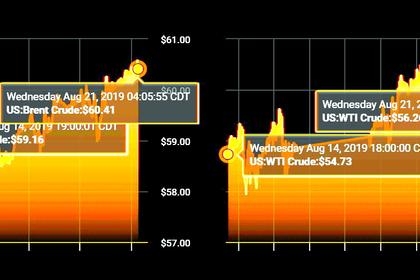

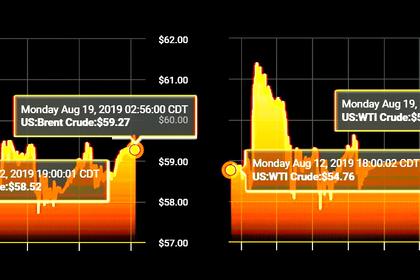

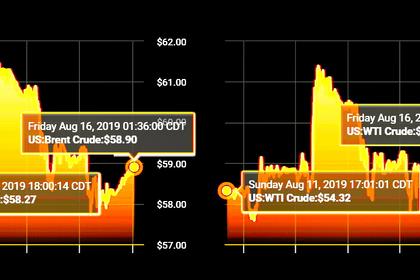

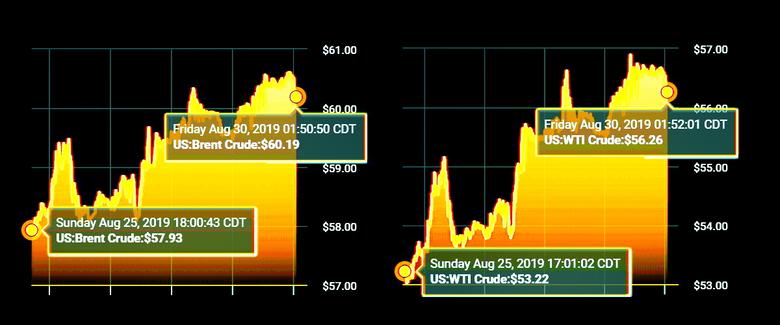

Brent crude LCOc1 was down by 23 cents, or 0.4%, at $60.85 a barrel, by 0711 GMT, but was heading for a gain of more than 2% for the week.

U.S. West Texas Intermediate (WTI) crude futures CLc1 fell 40 cents, or 0.7%, to $56.31 a barrel. The contract is still set for a gain of nearly 4% this week.

"Oil prices remain elevated and we are in the middle of trading range here for both Brent and West Texas," said Michael McCarthy, chief market strategist at CMC Markets in Sydney.

Worries about a slowdown in economic growth and the impact on oil demand due to the trade war between the world's two biggest oil consumers kept a lid on price gains this week, even as falling inventories indicate a balancing market.

On Thursday, the United States and China gave signs that they will resume trade talks, discussing the next round of in-person negotiations in September ahead of a looming deadline for additional U.S. tariffs.

"It is very difficult to predict the sudden twist and turns in the Sino-US trade backdrop," said Samuel Siew, investment analyst at Phillip Futures in Singapore.

The approach of Hurricane Dorian toward Florida earlier raised fears that offshore U.S. crude producers may shutter output if the storm passes into the Gulf of Mexico over the weekend.

Dorian is heading toward landfall on the Atlantic coast of Florida over the weekend and may enter into the eastern Gulf of Mexico next week. It is forecast to strengthen and become a highly dangerous Category 4 hurricane on Sunday, the National Hurricane Center said.

Chevron Corp's (CVX.N) 356,440 barrel-per-day Pascagoula, Mississippi, oil refinery is closely monitoring the progress of Hurricane Dorian, a company spokesman said on Thursday.

Last month, Hurricane Barry prompted offshore oil companies to shut as much as 74% of production, lifting U.S. crude prices, before it weakened to a tropical storm.

Government data on Wednesday showed U.S. crude stocks dropped last week by 10 million barrels to their lowest since October as imports slowed, while gasoline and distillate stocks each fell by over 2 million barrels.

But the EIA data also showed that U.S. production rebounded to a weekly record of 12.5 million barrels per day, suggesting there is still plenty of supply available.

-----

Earlier: