OIL PRICES 2019-20: $64-65

U.S. EIA - SHORT-TERM ENERGY OUTLOOK

Forecast Highlights

Global liquid fuels

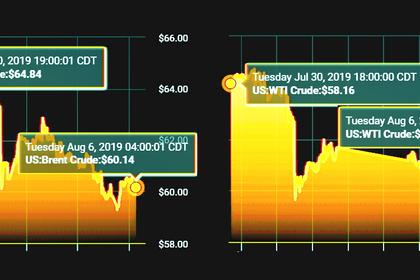

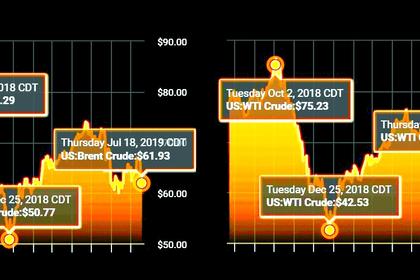

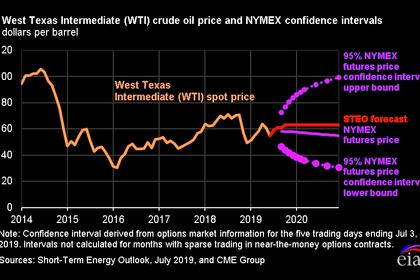

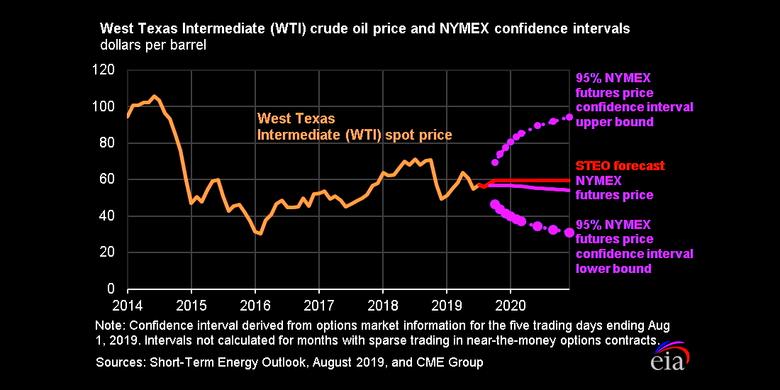

Brent crude oil spot prices averaged $64 per barrel (b) in July, almost unchanged from the average in June 2019 but $10/b lower than the price in July of last year. EIA forecasts Brent spot prices will average $64/b in the second half of 2019 and $65/b in 2020. The forecast of stable crude oil prices is the result of EIA's expectations of a relatively balanced global oil market. EIA forecasts global oil inventories will increase by 0.1 million barrels per day (b/d) in 2019 and 0.3 million b/d in 2020.

EIA expects West Texas Intermediate (WTI) crude oil prices will average $5.50/b less than Brent prices during the fourth quarter of 2019 and in 2020, narrowing from the $6.60/b spread during July. The narrowing spread reflects EIA's assumption that crude oil pipeline transportation constraints from the Permian Basin to refineries and export terminals on the U.S. Gulf Coast will ease in the coming months. In the July STEO, EIA forecast the Brent-WTI spread to average $4.00/b in 2020. The updated differential forecast reflects EIA's revised assumptions about the marginal cost of moving crude oil via pipeline from Cushing, Oklahoma, to the Gulf Coast.

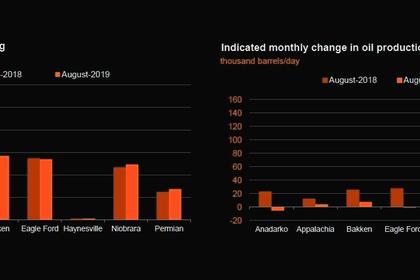

EIA estimates that U.S. crude oil production averaged 11.7 million b/d in July, down by 0.3 million b/d from the June level. The declines were mostly in the Federal Gulf of Mexico (GOM), where operators shut platforms for several days in mid-July because of Hurricane Barry. EIA estimates that GOM crude oil production fell by more than 0.3 million b/d in July. Those declines were partially offset by the Lower 48 States onshore region, which is mostly tight oil production, where supply rose by more than 0.1 million b/d. EIA expects monthly growth in Lower 48 onshore production to slow during the rest of the forecast period, averaging 50,000 b/d per month from the fourth quarter of 2019 through the end of 2020, down from an average of 110,000 b/d per month from August 2018 through July 2019. EIA forecasts U.S. crude oil production will average 12.3 million b/d in 2019 and 13.3 million b/d in 2020, both of which would be record levels.

U.S. regular gasoline retail prices averaged $2.74 gallon (gal) in July, up 2 cents/gal from June but 11 cents/gal lower than the average in July of last year. EIA expects that monthly average gasoline prices peaked for the year in May at an average of $2.86/gal and will fall to an average of $2.64/gal in September. EIA expects regular gasoline retail prices to average $2.62/gal in 2019 and $2.71/gal in 2020.

Natural gas

The Henry Hub natural gas spot price averaged $2.37/million British thermal units (MMBtu) in July, down 3 cents/MMBtu from June. However, by the end of the month, spot prices had fallen below $2.30/MMBtu. Based on this price movement and EIA's forecast of continued strong growth in natural gas production, EIA lowered its Henry Hub spot price forecast for the second half of 2019 to an average of $2.36/MMBtu. In the July STEO, EIA expected prices to average $2.50/MMBtu during this period. EIA expects natural gas prices in 2020 will increase to an average of $2.75/MMBtu. EIA's natural gas production models indicate that rising prices are required in the coming quarters to bring supply into balance with rising domestic and export demand in 2020.

EIA forecasts that U.S. dry natural gas production will average 91.0 billion cubic feet per day (Bcf/d) in 2019, up 7.6 Bcf/d from 2018. EIA expects monthly average natural gas production to grow in late 2019 and then decline slightly during the first quarter of 2020 as the lagged effect of low prices in the second half of 2019 reduces natural gas-directed drilling. However, EIA forecasts that growth will resume in the second quarter of 2020, and natural gas production in 2020 will average 92.5 Bcf/d.

EIA estimates that natural gas inventories ended July at 2.7 trillion cubic feet (Tcf), 13% higher than levels from a year earlier and 4% lower than the five-year (2014–18) average. EIA forecasts that natural gas storage injections during the 2019 April-through-October injection season will outpace the previous five-year average and that inventories will rise to more than 3.7 Tcf at the end of October, which would be 16% higher than October 2018 levels and slightly above to the five-year average.

Electricity, coal, renewables, and emissions

EIA has expanded its forecasts for electricity supply in the United States and has introduced new forecasts for wholesale electricity prices. A STEO Supplement provides more information about the changes.

Lower costs for natural gas drive EIA's forecast that annual average wholesale electricity prices will be lower in 2019 than last year in all areas of the United States. The forecast year-over-year declines range from -0.2% in the Southwest Power Pool (SPP) to -28% in the Electric Reliability Council of Texas (ERCOT) market.

EIA expects the share of U.S. total utility-scale electricity generation from natural gas-fired power plants will rise from 34% in 2018 to 37% in 2019 and then decline slightly in 2020. EIA forecasts that the share of U.S. generation from coal will average 24% in 2019 and in 2020, down from 28% in 2018. The forecast nuclear share of U.S. generation remains at about 20% in 2019 and in 2020. Hydropower averages a 7% share of total U.S. generation in the forecast for 2019 and 2020, similar to 2018. Wind, solar, and other nonhydropower renewables together provided 10% of U.S. total utility-scale generation in 2018. EIA expects they will provide 10% in 2019 and 12% in 2020.

EIA expects electric power sector demand for coal to fall by 2% in 2020, compared with an expected decline of 15% in 2019. However, planned coal plant retirements will continue to put downward pressure on overall electricity demand for the fuel. Almost 13 gigawatts of coal-fired electricity generation capacity has retired this year or is scheduled to retire by the end of 2020, accounting for 5% of the capacity existing at the end of 2018.

EIA forecasts that renewable fuels, including wind, solar, and hydropower, will collectively produce 18% of U.S. electricity in 2019 and 19% in 2020. EIA expects that annual generation from wind will surpass hydropower generation for the first time in 2019 to become the leading source of renewable electricity generation and maintain that position in 2020.

EIA is improving its regional-level trend analysis by inserting a generator-level production cost model that simulates hourly generation at individual power plants. This improves our insight into generation, especially from fast-growing renewable sources like wind and solar.

This additional granularity and the assumption that wind will return to more normal levels in 2019, after a windy first half of 2018, results in an EIA forecast that electricity generation from wind power will average 295 billion kilowatthours (kWh) in 2019 and 335 billion kWh in 2020, estimates that are 4% and 7% lower, respectively, than forecast in the July STEO. In addition, the application of hourly dispatch that better models solar incidence lowers the solar electric production forecast by 1.1% in 2019 and by 2.8% in 2020.

EIA forecasts that, after rising by 2.7% in 2018, U.S. energy-related carbon dioxide (CO2) emissions will decline by 2.3% in 2019 and by 0.5% in 2020. In 2019, EIA forecasts that space cooling demand (as measured in cooling degree days) will be lower than in 2018, when it was 13% higher than the previous 10-year (2008–17) average. In addition, in 2019, EIA expects U.S. CO2 emissions to decline because the forecast share of electricity generated from natural gas and renewables is increasing while the forecast share generated from coal, which is a more carbon-intensive energy source, is decreasing. EIA's projected emissions decline is lower in 2020 than in 2019 because it forecasts that both heating and cooling requirements will be slightly lower than normal. At the same time, the forecast coal share of generation will remain about the same as in 2019 while the natural gas share declines. Although EIA forecasts that generation from renewables will continue to increase in 2020, a forecast decrease in nuclear power offsets 24% of the renewables' gain.

-----

Earlier: